- Spain

- /

- Capital Markets

- /

- BME:YCPS

Uncovering Undiscovered Gems on None in December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rate cuts from the ECB and SNB, alongside expectations of a Federal Reserve cut, small-cap stocks have faced challenges with the Russell 2000 Index underperforming against larger indices like the S&P 500. Amidst this backdrop of shifting monetary policies and cooling labor markets, investors are increasingly on the lookout for unique opportunities that might be overlooked in broader market trends. In such an environment, identifying undiscovered gems requires focusing on companies with strong fundamentals and growth potential that can thrive despite economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Prima Andalan Mandiri | 0.94% | 20.24% | 15.28% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| CTCI Advanced Systems | 30.56% | 24.10% | 29.97% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Castellana Properties Socimi (BME:YCPS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Castellana Properties Socimi, S.A. is a real estate investment company focused on acquiring and managing retail and office properties, with a market cap of €801.78 million as of December 20, 2016.

Operations: The company generates revenue primarily from retail and office segments, with retail contributing €64.73 million and offices €22.88 million.

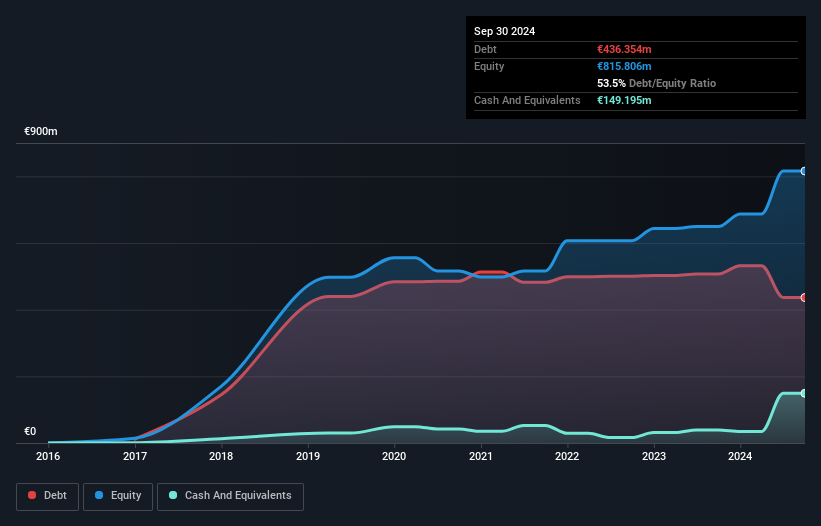

Castellana Properties Socimi, a small player in the real estate sector, showcases a robust financial standing with a net debt to equity ratio of 35.2%, deemed satisfactory. Although its earnings growth of 7.7% last year lagged behind the industry average of 12.9%, it has achieved an impressive annual earnings growth rate of 22% over the past five years. Recent results highlight significant progress, with net income reaching €32.99 million for the half-year ending September 2024, doubling from €16.22 million previously, and basic earnings per share increasing from €0.16 to €0.31 during this period.

- Click here and access our complete health analysis report to understand the dynamics of Castellana Properties Socimi.

Learn about Castellana Properties Socimi's historical performance.

Zambal Spain Socimi (BME:YZBL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Zambal Spain Socimi, S.A., a subsidiary of IBA Capital Partners, focuses on real estate investment and management with a market capitalization of approximately €603.57 million.

Operations: The company generates revenue primarily through the lease of real properties, amounting to €50.53 million, and the lease of parking spaces, contributing €1.37 million.

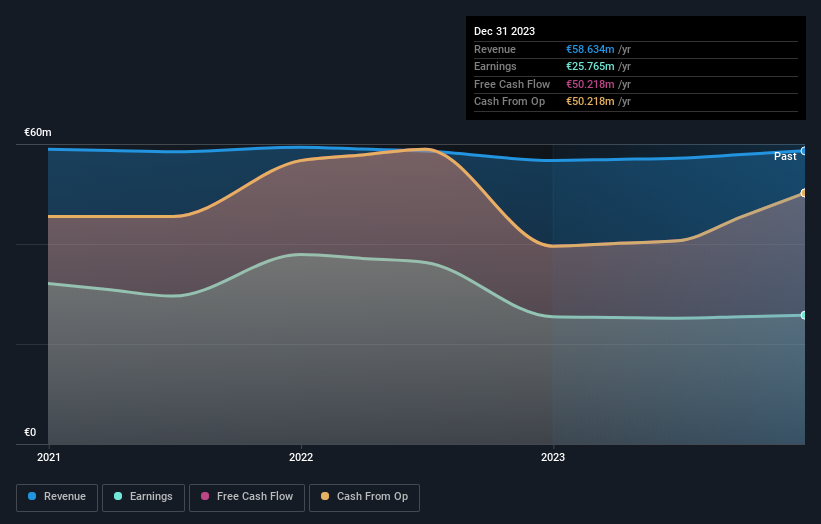

Zambal Spain Socimi, a relatively small player in the office REITs sector, has shown resilience with earnings growth of 1.3% over the past year, outpacing the industry average decline of 11.7%. The company's debt management appears prudent; its debt to equity ratio has impressively decreased from 24.2% to 9.7% over five years, while maintaining a satisfactory net debt to equity ratio at 7.3%. Trading at nearly 30% below estimated fair value suggests potential undervaluation. High-quality past earnings and robust interest coverage (24.5x EBIT) further bolster its financial health and appeal for further exploration in investment circles.

- Click here to discover the nuances of Zambal Spain Socimi with our detailed analytical health report.

Assess Zambal Spain Socimi's past performance with our detailed historical performance reports.

AblePrint Technology (TPEX:7734)

Simply Wall St Value Rating: ★★★★★☆

Overview: AblePrint Technology Co., Ltd. is a process solution provider addressing process issues across various industries both in Taiwan and internationally, with a market cap of NT$34.45 billion.

Operations: AblePrint Technology generates revenue primarily from Automation System Solutions and Pneumatic and Thermal Process Solutions, with the latter contributing significantly more at NT$1.24 billion. The company's gross profit margin is a key financial metric to watch, reflecting its ability to manage production costs relative to sales.

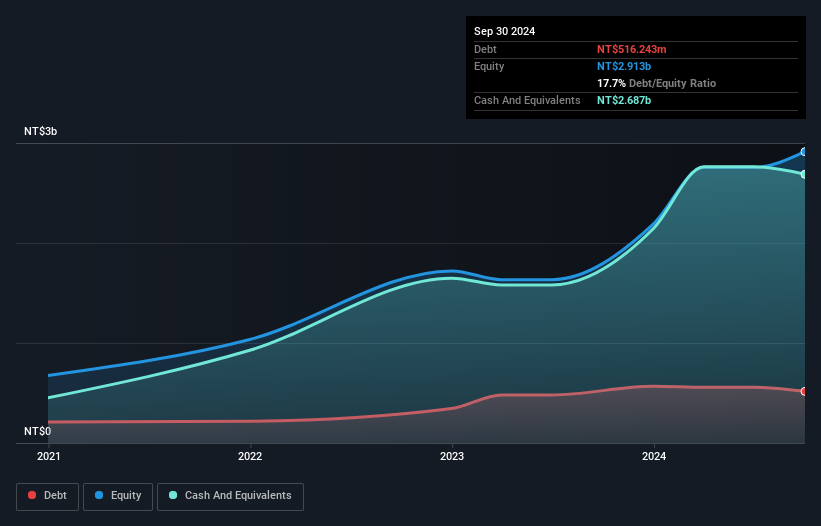

AblePrint Technology, a nimble player in the tech sector, has shown mixed results. Recent earnings reveal third-quarter sales of TWD 394.15 million, up from TWD 225.21 million last year, yet net income dipped to TWD 97.88 million from TWD 123.92 million. Despite this earnings drop, the company remains financially robust with more cash than debt and positive free cash flow of US$553 million as of September 2024. Notably added to the S&P Global BMI Index recently, it faces challenges with negative earnings growth against industry averages but boasts high-quality past earnings and solid interest coverage capabilities.

Where To Now?

- Click through to start exploring the rest of the 597 Undiscovered Gems With Strong Fundamentals now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:YCPS

Castellana Properties Socimi

As of December 20, 2016, Castellana Properties Socimi, S.A.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives