3 Stocks Estimated To Be Trading Up To 47% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a period of mixed performance, with the Nasdaq reaching new heights while other major indexes face declines, investors are keenly observing the economic indicators such as inflation rates and central bank policies. Amidst this complex environment, identifying undervalued stocks becomes increasingly appealing for those looking to capitalize on potential discrepancies between market prices and intrinsic values. A good stock in this context is one that demonstrates strong fundamentals yet trades below its estimated worth, offering potential value opportunities in an uncertain market landscape.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Strike CompanyLimited (TSE:6196) | ¥3645.00 | ¥7281.65 | 49.9% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1129.35 | ₹2250.95 | 49.8% |

| Wuhan Keqian BiologyLtd (SHSE:688526) | CN¥14.62 | CN¥29.09 | 49.7% |

| Lindab International (OM:LIAB) | SEK225.40 | SEK450.75 | 50% |

| Decisive Dividend (TSXV:DE) | CA$5.93 | CA$11.84 | 49.9% |

| GlobalData (AIM:DATA) | £1.875 | £3.75 | 50% |

| Western Alliance Bancorporation (NYSE:WAL) | US$82.86 | US$165.30 | 49.9% |

| HealthEquity (NasdaqGS:HQY) | US$94.76 | US$189.22 | 49.9% |

| Charter Hall Group (ASX:CHC) | A$14.37 | A$28.58 | 49.7% |

| Hanall Biopharma (KOSE:A009420) | ₩32650.00 | ₩65043.15 | 49.8% |

Let's uncover some gems from our specialized screener.

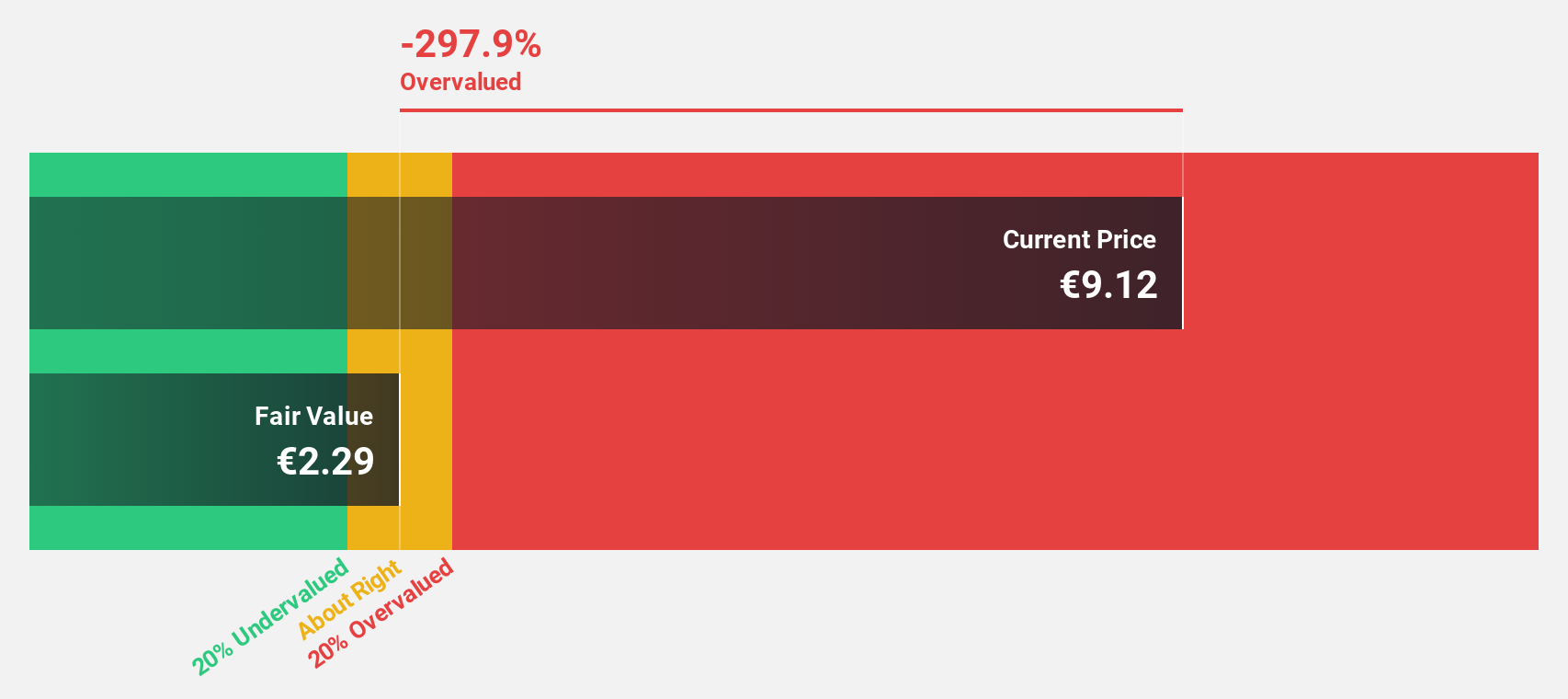

Ercros (BME:ECR)

Overview: Ercros, S.A. is a Spanish company that manufactures and sells basic chemicals, intermediate chemicals, and pharmaceuticals, with a market cap of €324.60 million.

Operations: The company generates revenue from three main segments: Pharmaceuticals (€63.57 million), Chlorine Derivatives (€375.76 million), and Intermediate Chemicals (€193.57 million).

Estimated Discount To Fair Value: 14.4%

Ercros, S.A. is trading at €3.55, below its estimated fair value of €4.15, indicating it may be undervalued based on cash flows. Despite a net loss of €7.8 million for the first nine months of 2024 and a decline in revenue to €533.61 million, earnings are forecast to grow significantly at 48.52% annually over the next three years, outpacing the Spanish market's growth rate. However, return on equity remains low and dividends are unstable.

- Our expertly prepared growth report on Ercros implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Ercros with our detailed financial health report.

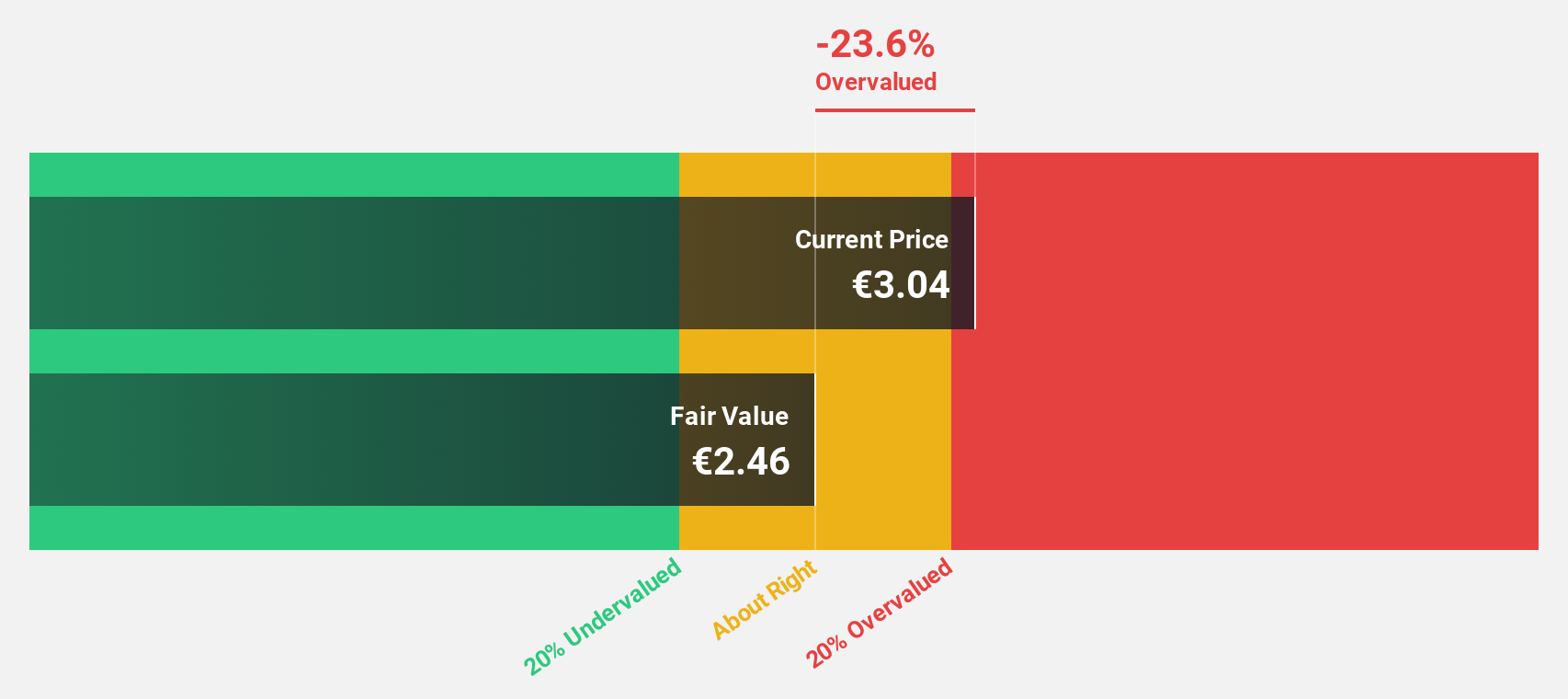

izertis (BME:IZER)

Overview: Izertis, S.A. offers technological consultancy services both in Spain and internationally, with a market cap of €263.63 million.

Operations: The company's revenue is primarily generated from its Technologies and Information (IT) segment, amounting to €124.33 million.

Estimated Discount To Fair Value: 11.8%

Izertis, S.A. is trading at €9.82, slightly below its estimated fair value of €11.14, suggesting it is undervalued based on cash flows. Despite a decline in net income to €1.32 million for the first half of 2024, earnings are expected to grow significantly at 40.86% annually over the next three years, surpassing the Spanish market's growth rate. However, interest payments are not well covered by earnings and shareholders have faced dilution recently.

- According our earnings growth report, there's an indication that izertis might be ready to expand.

- Take a closer look at izertis' balance sheet health here in our report.

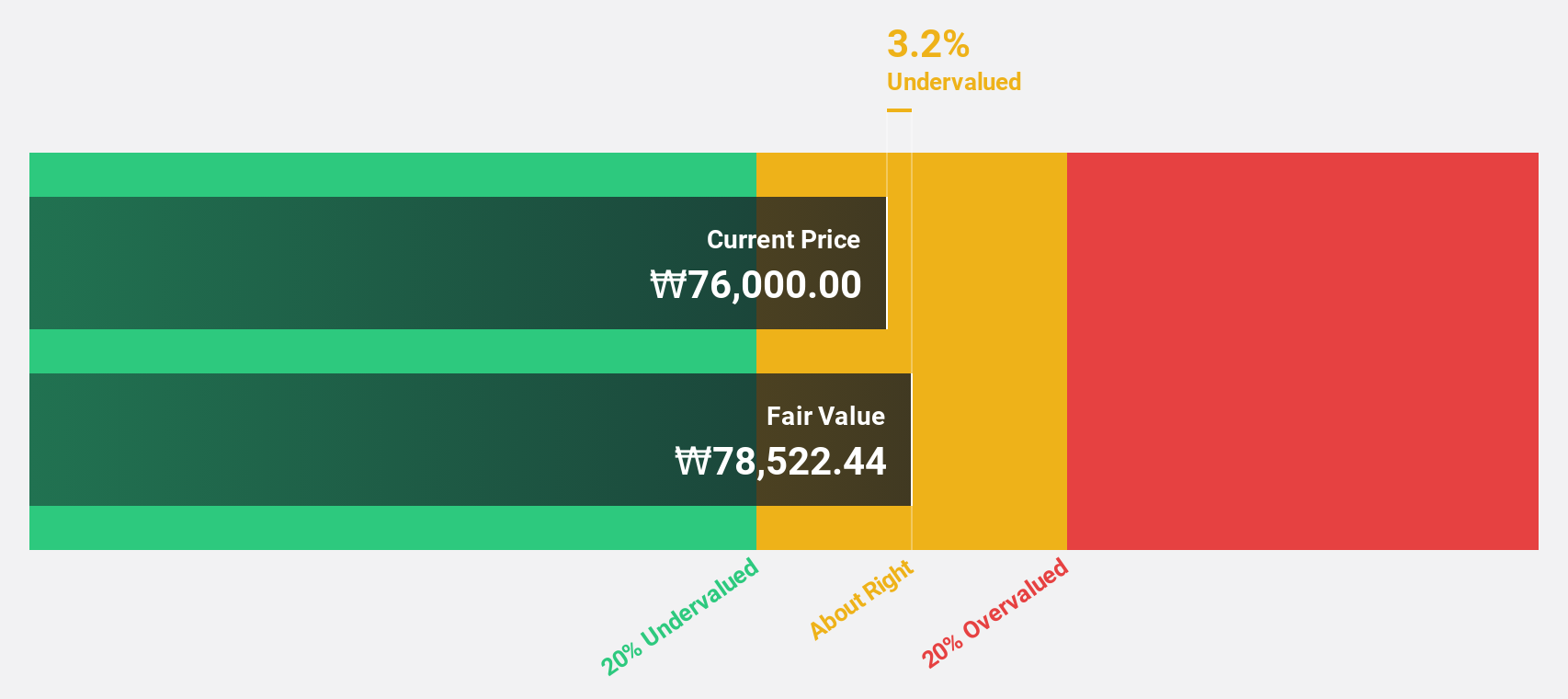

JYP Entertainment (KOSDAQ:A035900)

Overview: JYP Entertainment Corporation is a South Korean entertainment company with international operations, and it has a market cap of approximately ₩2.40 trillion.

Operations: The company's revenue is primarily derived from Entertainment at ₩470.40 billion, followed by Distribution and Sales at ₩78.85 billion, and Music Publishing at ₩10.51 billion.

Estimated Discount To Fair Value: 47%

JYP Entertainment is trading at ₩72,300, significantly below its estimated fair value of ₩136,385.16, highlighting potential undervaluation based on cash flows. Despite a decrease in net profit margin from 21.9% to 13.5%, the company's earnings and revenue are forecasted to grow annually by 19% and 11.2%, respectively—outpacing the Korean market averages. However, revenue growth remains moderate compared to high-growth benchmarks.

- Insights from our recent growth report point to a promising forecast for JYP Entertainment's business outlook.

- Get an in-depth perspective on JYP Entertainment's balance sheet by reading our health report here.

Key Takeaways

- Investigate our full lineup of 911 Undervalued Stocks Based On Cash Flows right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if izertis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:IZER

izertis

Provides technological consultancy services in Spain, Portugal, and Mexico.

High growth potential with proven track record.

Market Insights

Community Narratives