The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Global Dominion Access, S.A. (BME:DOM) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Global Dominion Access

How Much Debt Does Global Dominion Access Carry?

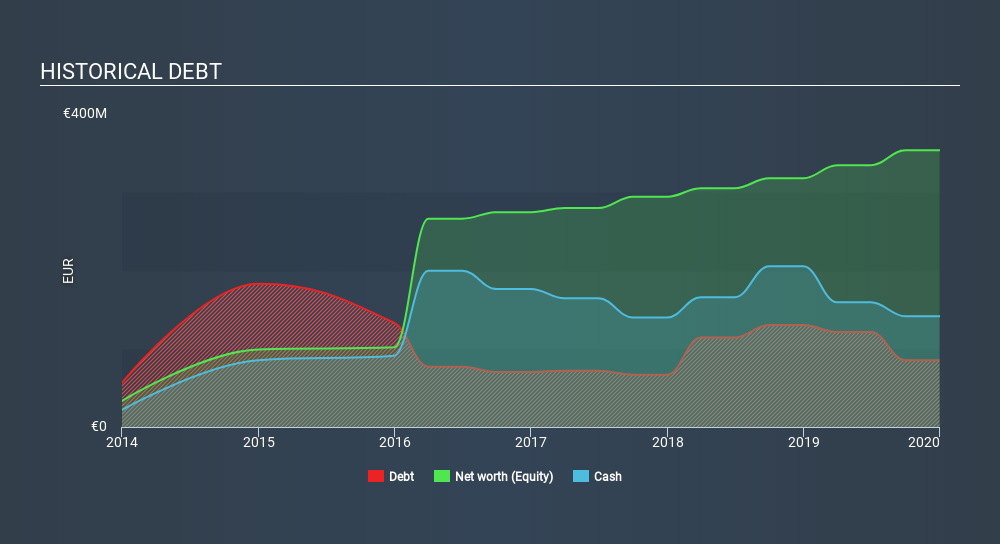

You can click the graphic below for the historical numbers, but it shows that Global Dominion Access had €85.4m of debt in December 2019, down from €130.4m, one year before. However, its balance sheet shows it holds €141.5m in cash, so it actually has €56.2m net cash.

How Strong Is Global Dominion Access's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Global Dominion Access had liabilities of €627.7m due within 12 months and liabilities of €168.8m due beyond that. On the other hand, it had cash of €141.5m and €404.5m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €250.4m.

While this might seem like a lot, it is not so bad since Global Dominion Access has a market capitalization of €631.9m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. Despite its noteworthy liabilities, Global Dominion Access boasts net cash, so it's fair to say it does not have a heavy debt load!

One way Global Dominion Access could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 16%, as it did over the last year. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Global Dominion Access can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Global Dominion Access may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Global Dominion Access recorded free cash flow worth a fulsome 88% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Summing up

Although Global Dominion Access's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of €56.2m. The cherry on top was that in converted 88% of that EBIT to free cash flow, bringing in €49m. So we don't have any problem with Global Dominion Access's use of debt. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Global Dominion Access insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About BME:DOM

Global Dominion Access

Provides integral services for business process efficiency and sustainability worldwide.

Very undervalued with moderate growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)