Exploring 3 Undiscovered European Gems with Strong Potential

Reviewed by Simply Wall St

Despite recent uncertainty around U.S. trade policy and mixed performance in major European stock indices, the pan-European STOXX Europe 600 Index has shown resilience, with investor sentiment buoyed by potential increases in defense and infrastructure spending across the continent. In this environment of cautious optimism, identifying stocks with strong fundamentals and growth potential can provide valuable opportunities for investors seeking to navigate the complexities of the European market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Bahnhof | NA | 8.39% | 14.20% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Altia Consultores (BME:ALC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Altia Consultores, S.A. is engaged in the information and communication technologies sector, providing services both in Spain and internationally, with a market capitalization of €329.46 million.

Operations: Altia generates revenue primarily through its segments: Altia (€122.39 million), Noesis (€72.98 million), and Bilbomatics (€57.48 million). The company also reports revenue from Exis (€8.98 million) and Chile (€1.43 million).

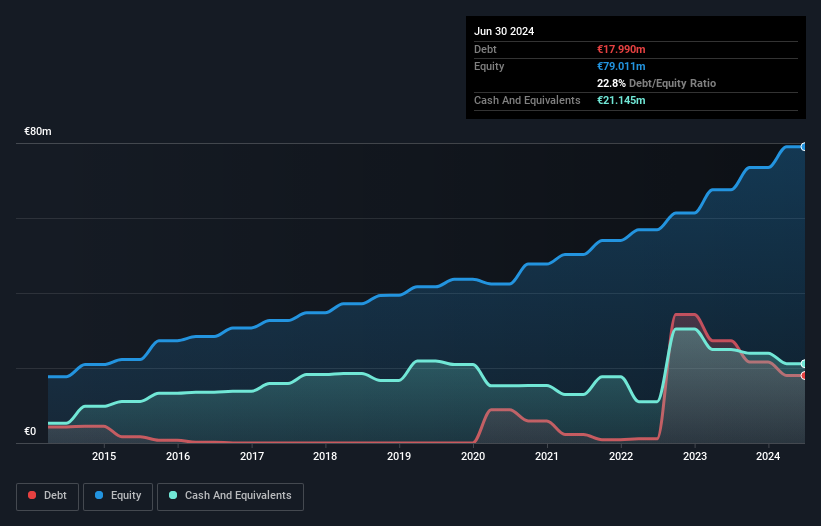

Altia Consultores, a nimble player in the IT sector, shows promising attributes with its earnings growth of 9.9% over the past year surpassing the industry average of 9.5%. The company's interest payments are comfortably covered by EBIT at 17.9 times, indicating strong financial health. Despite an increase in its debt to equity ratio from 0.01% to 22.8% over five years, Altia still holds more cash than total debt, underscoring prudent financial management. With a price-to-earnings ratio of 21.8x below the industry average of 23x and high-quality earnings reported, Altia seems poised for potential growth within its market niche.

BW Offshore (OB:BWO)

Simply Wall St Value Rating: ★★★★★☆

Overview: BW Offshore Limited specializes in engineering offshore production solutions across various global regions, with a market cap of NOK5.04 billion.

Operations: BW Offshore generates revenue primarily through its offshore production solutions. The company's net profit margin shows variability, reflecting changes in operational efficiency and market conditions.

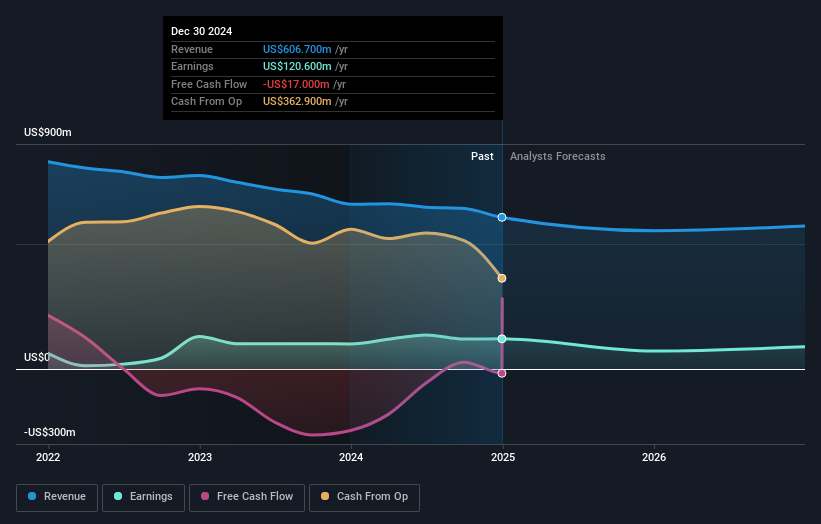

BW Offshore, a nimble player in the energy services sector, has demonstrated impressive earnings growth of 20.1% over the past year, outpacing the industry average of 9.6%. The company's debt to equity ratio has significantly improved from 85.5% to 18.6% over five years, indicating effective debt management. Despite being profitable and having high-quality earnings, BW Offshore faces challenges with negative free cash flow and projected earnings declines averaging 17% annually for the next three years. Recently, they signed an agreement to sell FPSO BW Pioneer for US$125 million while securing a five-year operations contract with Phy Oil Corporation.

- Get an in-depth perspective on BW Offshore's performance by reading our health report here.

Explore historical data to track BW Offshore's performance over time in our Past section.

Logwin (XTRA:TGHN)

Simply Wall St Value Rating: ★★★★★★

Overview: Logwin AG is a logistics and transport solutions provider operating in Germany, Austria, other European countries, Asia/Pacific, and internationally with a market capitalization of €673.74 million.

Operations: Logwin generates revenue primarily from its Air + Ocean segment, contributing €954.25 million, and its Solutions segment, which adds €275.78 million. The company's financial performance is significantly influenced by these segments' contributions to overall revenue.

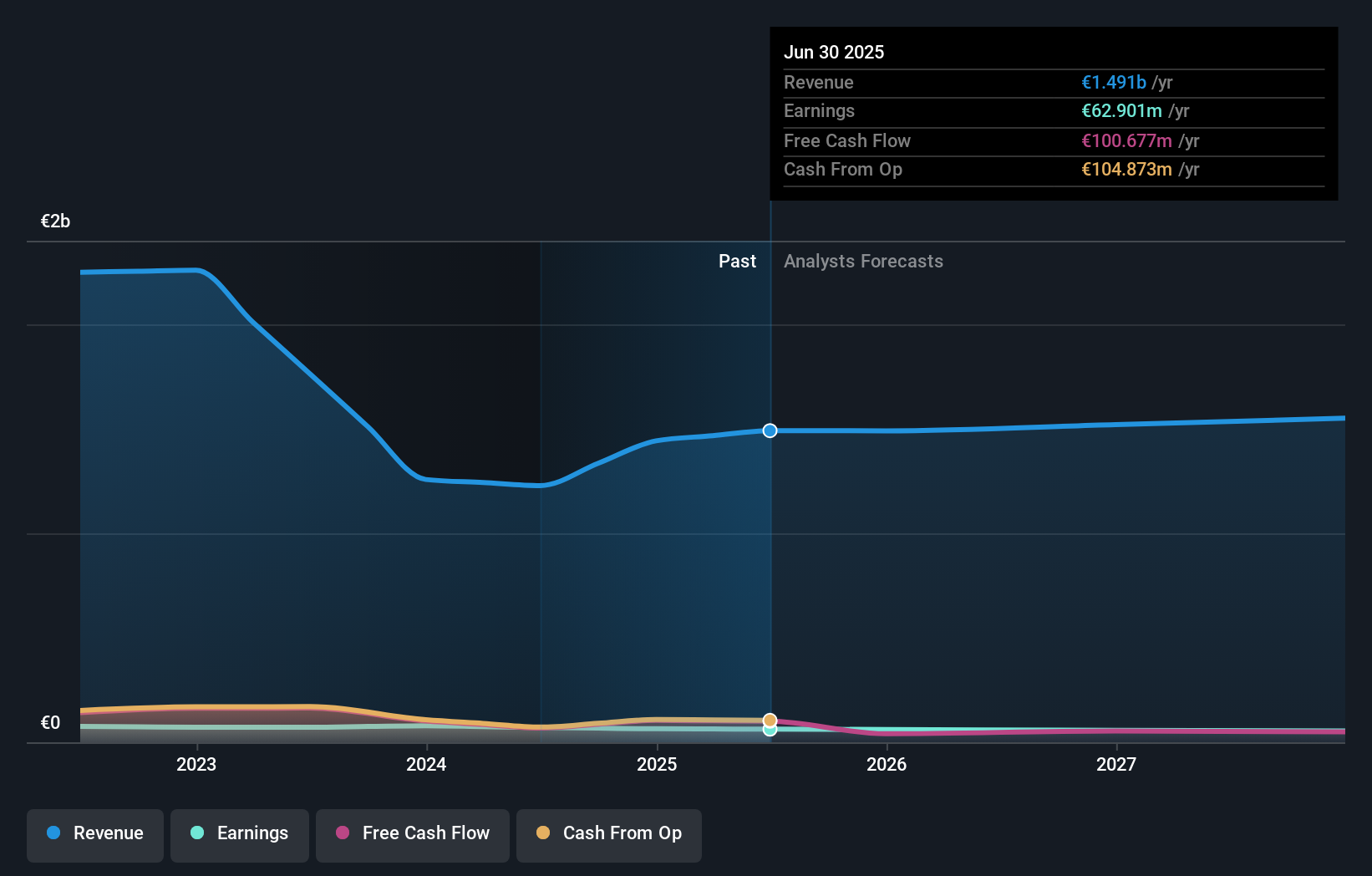

Logwin, a small logistics player in Europe, presents an intriguing mix of financial metrics. With its debt-to-equity ratio dropping from 0.04% to 0.03% over five years and cash exceeding total debt, the company seems financially stable. Despite negative earnings growth of -2.2% last year compared to the industry average of 0.7%, Logwin trades at a significant discount of 37.8% below estimated fair value, indicating potential undervaluation opportunities for investors. However, with earnings expected to fall by an average of 7.4% annually over the next three years, future growth prospects appear challenging amidst industry competition and market dynamics.

- Click to explore a detailed breakdown of our findings in Logwin's health report.

Evaluate Logwin's historical performance by accessing our past performance report.

Seize The Opportunity

- Discover the full array of 363 European Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ALC

Altia Consultores

Operates in the information and communication technologies (ICT) sector in Spain and internationally.

Excellent balance sheet with questionable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)