Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Libertas 7 (BDM:LIB). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Libertas 7 with the means to add long-term value to shareholders.

See our latest analysis for Libertas 7

How Fast Is Libertas 7 Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So EPS growth can certainly encourage an investor to take note of a stock. To the delight of shareholders, Libertas 7's EPS soared from €0.071 to €0.11, over the last year. That's a commendable gain of 54%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Libertas 7's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Libertas 7 shareholders can take confidence from the fact that EBIT margins are up from 13% to 23%, and revenue is growing. That's great to see, on both counts.

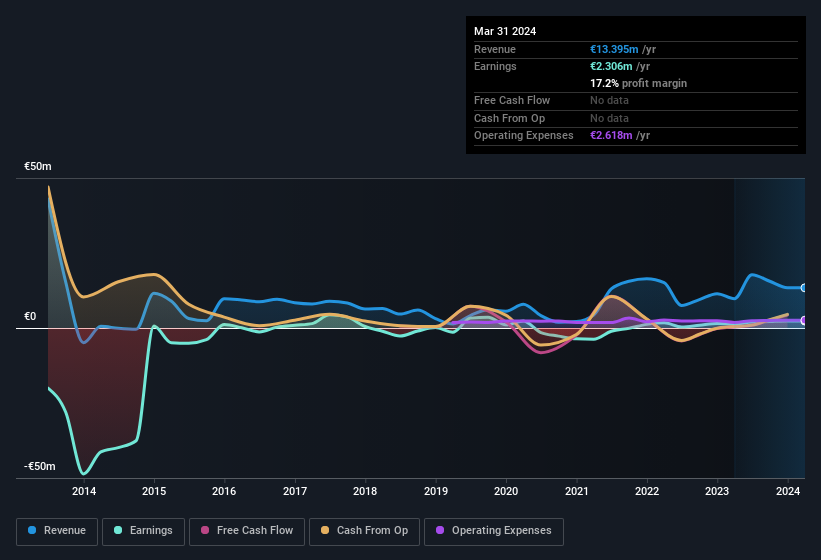

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Libertas 7 isn't a huge company, given its market capitalisation of €34m. That makes it extra important to check on its balance sheet strength.

Are Libertas 7 Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. Our analysis has discovered that the median total compensation for the CEOs of companies like Libertas 7 with market caps under €185m is about €242k.

Libertas 7's CEO took home a total compensation package worth €209k in the year leading up to December 2023. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Libertas 7 Worth Keeping An Eye On?

You can't deny that Libertas 7 has grown its earnings per share at a very impressive rate. That's attractive. With swiftly growing earnings, the best days may still be to come, and the modest CEO pay suggests the company is careful with cash. We think that based on its merits alone, this stock is worth watching into the future. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Libertas 7 that you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in ES with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:LIB

Libertas 7

Engages in the real estate and investment businesses in Spain.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026