We Take A Look At Why Laboratorios Farmaceuticos Rovi, S.A.'s (BME:ROVI) CEO Has Earned Their Pay Packet

Key Insights

- Laboratorios Farmaceuticos Rovi will host its Annual General Meeting on 24th of June

- Salary of €743.0k is part of CEO Juan Lopez-Belmonte Encina's total remuneration

- The overall pay is comparable to the industry average

- Laboratorios Farmaceuticos Rovi's EPS grew by 12% over the past three years while total shareholder return over the past three years was 64%

We have been pretty impressed with the performance at Laboratorios Farmaceuticos Rovi, S.A. (BME:ROVI) recently and CEO Juan Lopez-Belmonte Encina deserves a mention for their role in it. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 24th of June. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

Check out our latest analysis for Laboratorios Farmaceuticos Rovi

Comparing Laboratorios Farmaceuticos Rovi, S.A.'s CEO Compensation With The Industry

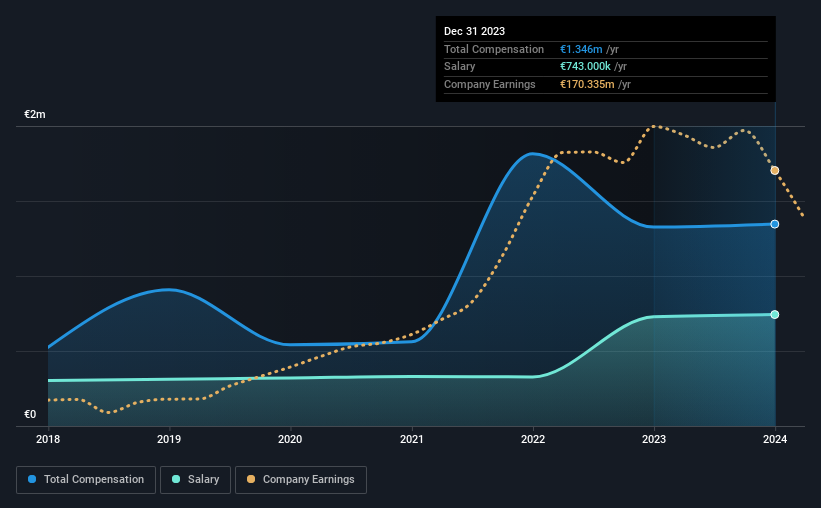

Our data indicates that Laboratorios Farmaceuticos Rovi, S.A. has a market capitalization of €4.5b, and total annual CEO compensation was reported as €1.3m for the year to December 2023. This means that the compensation hasn't changed much from last year. In particular, the salary of €743.0k, makes up a fairly large portion of the total compensation being paid to the CEO.

On examining similar-sized companies in the Spain Pharmaceuticals industry with market capitalizations between €3.7b and €11b, we discovered that the median CEO total compensation of that group was €1.4m. So it looks like Laboratorios Farmaceuticos Rovi compensates Juan Lopez-Belmonte Encina in line with the median for the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €743k | €728k | 55% |

| Other | €603k | €598k | 45% |

| Total Compensation | €1.3m | €1.3m | 100% |

On an industry level, roughly 59% of total compensation represents salary and 41% is other remuneration. There isn't a significant difference between Laboratorios Farmaceuticos Rovi and the broader market, in terms of salary allocation in the overall compensation package. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Laboratorios Farmaceuticos Rovi, S.A.'s Growth Numbers

Laboratorios Farmaceuticos Rovi, S.A. has seen its earnings per share (EPS) increase by 12% a year over the past three years. In the last year, its revenue is down 4.3%.

Shareholders would be glad to know that the company has improved itself over the last few years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Laboratorios Farmaceuticos Rovi, S.A. Been A Good Investment?

Boasting a total shareholder return of 64% over three years, Laboratorios Farmaceuticos Rovi, S.A. has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Laboratorios Farmaceuticos Rovi (free visualization of insider trades).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ROVI

Laboratorios Farmaceuticos Rovi

Engages in the research, development, manufacture, and marketing of pharmaceutical products in Spain and internationally.

Very undervalued with excellent balance sheet.