Those who invested in Laboratorios Farmaceuticos Rovi (BME:ROVI) five years ago are up 176%

While Laboratorios Farmaceuticos Rovi, S.A. (BME:ROVI) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 16% in the last quarter. But that scarcely detracts from the really solid long term returns generated by the company over five years. In fact, the share price is 161% higher today. Generally speaking the long term returns will give you a better idea of business quality than short periods can. The more important question is whether the stock is too cheap or too expensive today.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for Laboratorios Farmaceuticos Rovi

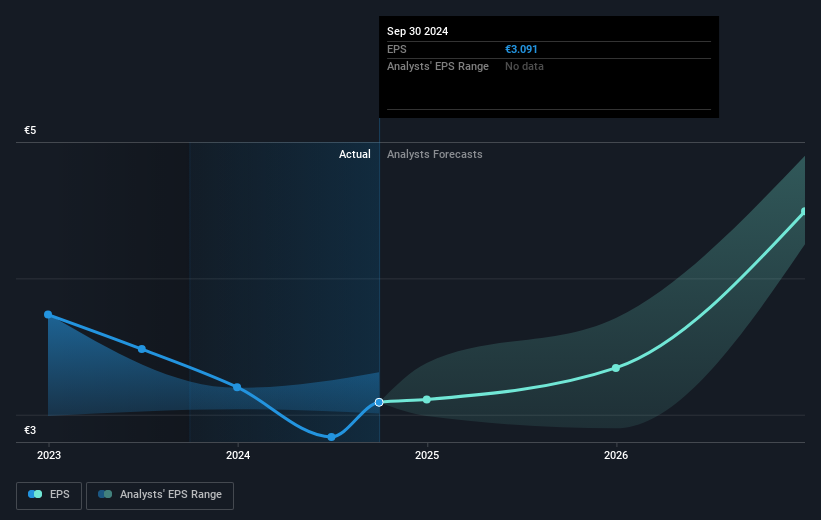

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, Laboratorios Farmaceuticos Rovi became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Laboratorios Farmaceuticos Rovi's key metrics by checking this interactive graph of Laboratorios Farmaceuticos Rovi's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Laboratorios Farmaceuticos Rovi, it has a TSR of 176% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Laboratorios Farmaceuticos Rovi shareholders are up 9.2% for the year (even including dividends). But that return falls short of the market. If we look back over five years, the returns are even better, coming in at 23% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. It's always interesting to track share price performance over the longer term. But to understand Laboratorios Farmaceuticos Rovi better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Laboratorios Farmaceuticos Rovi you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Spanish exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:ROVI

Laboratorios Farmaceuticos Rovi

Engages in the research, development, manufacture, and marketing of pharmaceutical products in Spain and internationally.

Very undervalued with excellent balance sheet.

Market Insights

Community Narratives