Grifols And 2 Other Stocks That Might Be Trading Below Estimated Value

Reviewed by Simply Wall St

As global markets grapple with rising Treasury yields and tepid economic growth, investors are increasingly focused on identifying stocks that may be trading below their intrinsic value. In this environment, a good stock is often characterized by strong fundamentals and the potential for future growth, making it an attractive option for those seeking value amidst market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trimegah Bangun Persada (IDX:NCKL) | IDR890.00 | IDR1777.58 | 49.9% |

| Provident Financial Services (NYSE:PFS) | US$19.03 | US$37.92 | 49.8% |

| Western Alliance Bancorporation (NYSE:WAL) | US$84.27 | US$168.24 | 49.9% |

| California Resources (NYSE:CRC) | US$52.32 | US$104.35 | 49.9% |

| Geovis TechnologyLtd (SHSE:688568) | CN¥40.77 | CN¥81.16 | 49.8% |

| Beyout Investment Group Holding Company - K.S.C. (Holding) (KWSE:BEYOUT) | KWD0.395 | KWD0.79 | 49.9% |

| Acerinox (BME:ACX) | €8.52 | €16.98 | 49.8% |

| Enento Group Oyj (HLSE:ENENTO) | €18.40 | €36.57 | 49.7% |

| ChromaDex (NasdaqCM:CDXC) | US$3.58 | US$7.15 | 49.9% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.36 | €16.70 | 49.9% |

Let's explore several standout options from the results in the screener.

Grifols (BME:GRF)

Overview: Grifols, S.A. is a plasma therapeutic company operating in Spain, the United States, Canada, and internationally with a market cap of approximately €6.40 billion.

Operations: Grifols generates revenue primarily from its Biopharma segment (€5.78 billion), followed by the Diagnostic segment (€651.33 million) and Bio Supplies segment (€186.91 million).

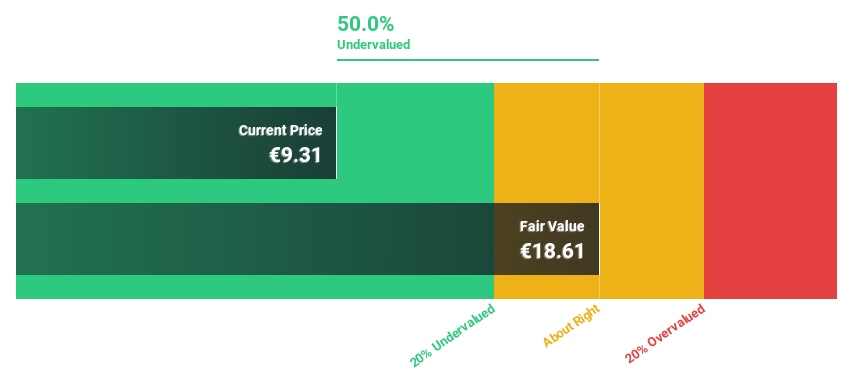

Estimated Discount To Fair Value: 47.2%

Grifols appears undervalued, trading at €10.32, significantly below its estimated fair value of €19.55. Despite recent volatility, the company has become profitable this year and is expected to see substantial earnings growth of 28.6% annually over the next three years, outpacing the Spanish market's average growth rate. However, interest payments are not well covered by earnings, which could pose financial challenges despite promising revenue forecasts and strategic product developments like VISTASEAL™ in pediatric surgery.

- Upon reviewing our latest growth report, Grifols' projected financial performance appears quite optimistic.

- Click here to discover the nuances of Grifols with our detailed financial health report.

IKD (SHSE:600933)

Overview: IKD Co., Ltd. specializes in the research, development, production, and sale of automotive aluminum alloy precision die castings across the United States, Europe, and Asia with a market cap of CN¥15.13 billion.

Operations: Revenue Segments (in millions of CN¥): The company generates revenue primarily from the sale of automotive aluminum alloy precision die castings in the United States, Europe, and Asia.

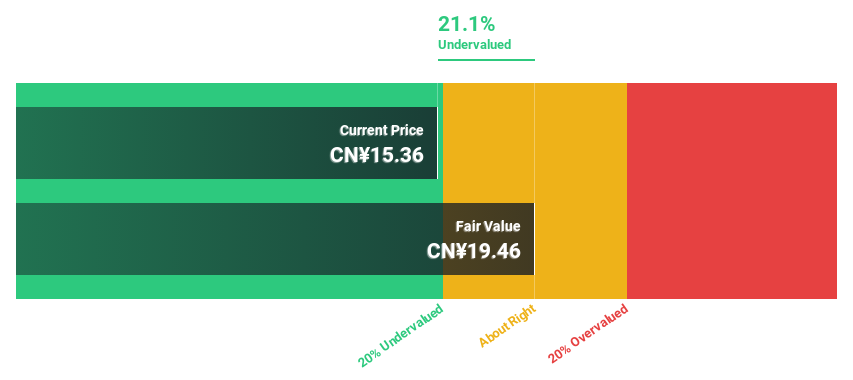

Estimated Discount To Fair Value: 13.4%

IKD Co., Ltd. is trading at CN¥15.48, below its estimated fair value of CN¥17.87, with analysts predicting a 51.7% price increase. Recent earnings show a net income rise to CNY 741.79 million for the first nine months of 2024 from CNY 597.61 million last year, reflecting strong revenue growth potential at 23% annually, surpassing the Chinese market average of 13.7%. However, shareholder dilution and low dividend coverage by cash flows present concerns.

- In light of our recent growth report, it seems possible that IKD's financial performance will exceed current levels.

- Dive into the specifics of IKD here with our thorough financial health report.

Shanghai Commercial & Savings Bank (TWSE:5876)

Overview: The Shanghai Commercial & Savings Bank, Ltd. operates as a financial institution providing banking services and has a market cap of NT$194.25 billion.

Operations: The company's revenue is primarily derived from its banking segment, amounting to NT$33.16 billion.

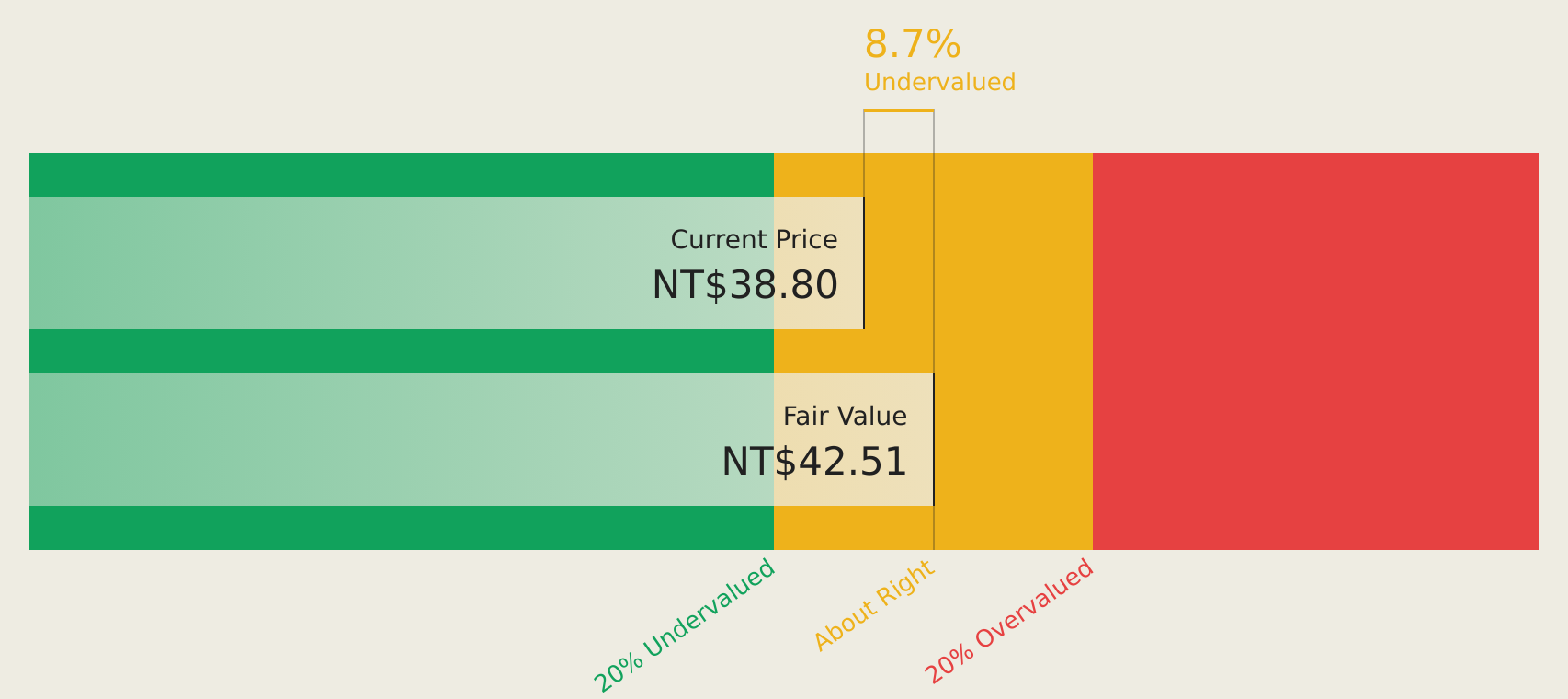

Estimated Discount To Fair Value: 17.6%

Shanghai Commercial & Savings Bank is trading at NT$40.05, below its estimated fair value of NT$48.58, indicating potential undervaluation based on cash flows. Despite a drop in recent earnings, with net income for Q2 2024 at TWD 1,468.33 million compared to TWD 5,509.57 million a year ago, the bank's earnings are forecast to grow significantly over the next three years at 32.5% annually—faster than the Taiwanese market average of 19%.

- The analysis detailed in our Shanghai Commercial & Savings Bank growth report hints at robust future financial performance.

- Navigate through the intricacies of Shanghai Commercial & Savings Bank with our comprehensive financial health report here.

Make It Happen

- Get an in-depth perspective on all 959 Undervalued Stocks Based On Cash Flows by using our screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Grifols, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:GRF

Grifols

Operates as a plasma therapeutic company in Spain, the United States, Canada, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives