- Spain

- /

- Paper and Forestry Products

- /

- BME:ENC

If EPS Growth Is Important To You, ENCE Energía y Celulosa (BME:ENC) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in ENCE Energía y Celulosa (BME:ENC). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for ENCE Energía y Celulosa

ENCE Energía y Celulosa's Improving Profits

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. Which is why EPS growth is looked upon so favourably. Commendations have to be given in seeing that ENCE Energía y Celulosa grew its EPS from €0.20 to €0.82, in one short year. Even though that growth rate may not be repeated, that looks like a breakout improvement.

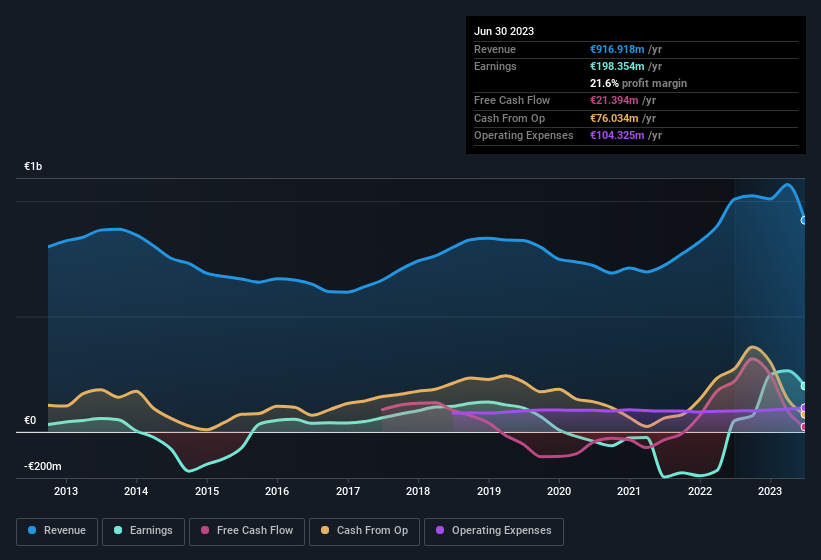

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. ENCE Energía y Celulosa's EBIT margins are flat but, worryingly, its revenue is actually down. While this may raise concerns, investors should investigate the reasoning behind this.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for ENCE Energía y Celulosa's future EPS 100% free.

Are ENCE Energía y Celulosa Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. The median total compensation for CEOs of companies similar in size to ENCE Energía y Celulosa, with market caps between €366m and €1.5b, is around €994k.

The CEO of ENCE Energía y Celulosa only received €135k in total compensation for the year ending December 2022. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is ENCE Energía y Celulosa Worth Keeping An Eye On?

ENCE Energía y Celulosa's earnings have taken off in quite an impressive fashion. This appreciable increase in earnings could be a sign of an upward trajectory for the company. At the same time the reasonable CEO compensation reflects well on the board of directors. It will definitely require further research to be sure, but it does seem that ENCE Energía y Celulosa has the hallmarks of a quality business; and that would make it well worth watching. It is worth noting though that we have found 3 warning signs for ENCE Energía y Celulosa (2 are significant!) that you need to take into consideration.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if ENCE Energía y Celulosa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:ENC

ENCE Energía y Celulosa

Produces and sells eucalyptus hardwood pulp and renewable energy in Spain, Germany, Poland, Italy, the Netherlands, the United Kingdom, Greece, Turkey, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives