Línea Directa Aseguradora, S.A., Compañía de Seguros y Reaseguros (BME:LDA) Investors Are Less Pessimistic Than Expected

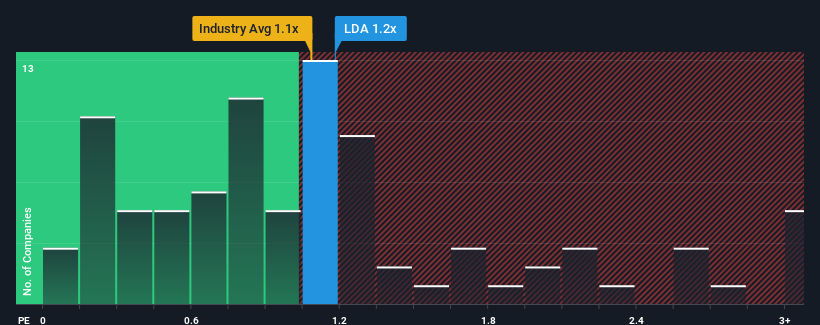

With a median price-to-sales (or "P/S") ratio of close to 1.1x in the Insurance industry in Spain, you could be forgiven for feeling indifferent about Línea Directa Aseguradora, S.A., Compañía de Seguros y Reaseguros' (BME:LDA) P/S ratio of 1.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Línea Directa Aseguradora Compañía de Seguros y Reaseguros

What Does Línea Directa Aseguradora Compañía de Seguros y Reaseguros' P/S Mean For Shareholders?

Recent times haven't been great for Línea Directa Aseguradora Compañía de Seguros y Reaseguros as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Línea Directa Aseguradora Compañía de Seguros y Reaseguros' future stacks up against the industry? In that case, our free report is a great place to start.How Is Línea Directa Aseguradora Compañía de Seguros y Reaseguros' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Línea Directa Aseguradora Compañía de Seguros y Reaseguros' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 4.0%. Revenue has also lifted 13% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 4.1% per year during the coming three years according to the five analysts following the company. That's shaping up to be materially lower than the 9.3% per year growth forecast for the broader industry.

In light of this, it's curious that Línea Directa Aseguradora Compañía de Seguros y Reaseguros' P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

When you consider that Línea Directa Aseguradora Compañía de Seguros y Reaseguros' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Before you settle on your opinion, we've discovered 1 warning sign for Línea Directa Aseguradora Compañía de Seguros y Reaseguros that you should be aware of.

If these risks are making you reconsider your opinion on Línea Directa Aseguradora Compañía de Seguros y Reaseguros, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:LDA

Línea Directa Aseguradora Compañía de Seguros y Reaseguros

Engages in insurance and reinsurance business in Spain and Portugal.

Solid track record and good value.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

A high-quality defensive business with limited growth but strong cash generation.

The Infrastructure AI Cannot Be Built Without

ASML: Durable Advantage, Limited Margin for Error

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks