- Spain

- /

- Construction

- /

- BME:GSJ

Discovering Undiscovered Gems on None in December 2024

Reviewed by Simply Wall St

In December 2024, global markets are navigating a landscape marked by interest rate cuts from the ECB and SNB, while the U.S. Federal Reserve is anticipated to follow suit amid cooling labor markets and stalled inflation progress. As major indexes like the Russell 2000 underperform larger-cap peers, investors are increasingly focused on identifying small-cap stocks with strong fundamentals that can weather economic shifts and capitalize on potential opportunities for growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Boursa Kuwait Securities Company K.P.S.C | NA | 14.28% | 2.26% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Al-Enma'a Real Estate Company K.S.C.P | 16.44% | -13.00% | 21.11% | ★★★★★☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Grupo Empresarial San José (BME:GSJ)

Simply Wall St Value Rating: ★★★★★★

Overview: Grupo Empresarial San José, S.A. operates in the construction industry both in Spain and internationally, with a market capitalization of €318.63 million.

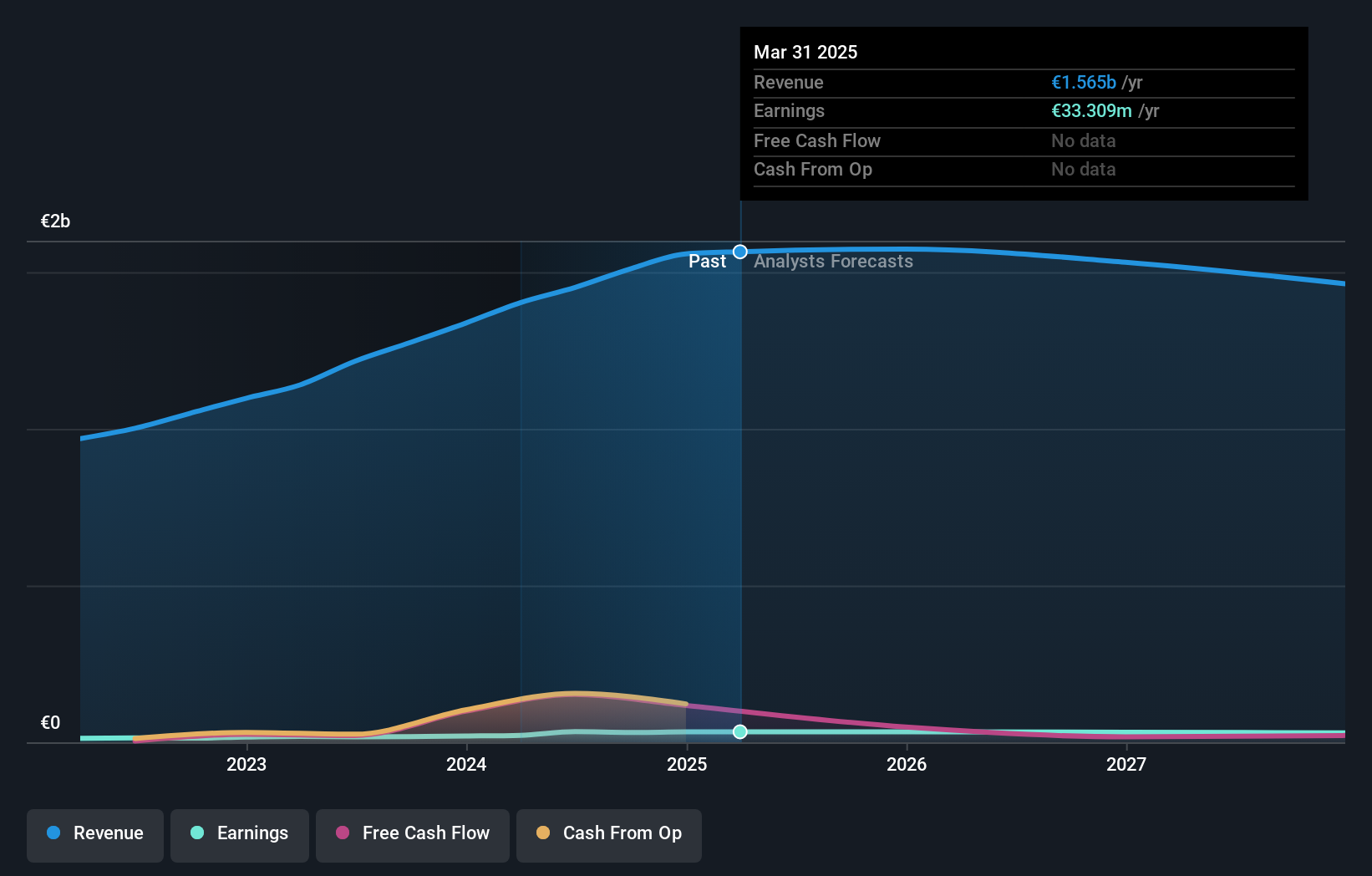

Operations: San José generates revenue primarily from its construction segment, which accounts for €1.39 billion. Other significant contributions come from concessions and services (€74.68 million), while energy and real estate segments add smaller amounts to the total revenue.

Grupo Empresarial San José has shown impressive growth, with earnings surging 70.9% over the past year, outpacing the construction industry's 19.7%. The firm's price-to-earnings ratio of 10.6x is notably lower than the Spanish market average of 19x, suggesting potential undervaluation. Over five years, its debt-to-equity ratio has improved significantly from 208.2% to 49.5%, indicating better financial health and reduced leverage risks. Recent earnings reports highlight a net income increase to €23.17 million for nine months ending September 2024 from €11.81 million a year prior, reflecting strong operational performance despite forecasted declines in future earnings growth rates.

- Click to explore a detailed breakdown of our findings in Grupo Empresarial San José's health report.

Shanghai Laimu ElectronicsLtd (SHSE:603633)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shanghai Laimu Electronics Co., Ltd. focuses on the research, development, production, and sale of precision electronic components in China with a market cap of CN¥3.58 billion.

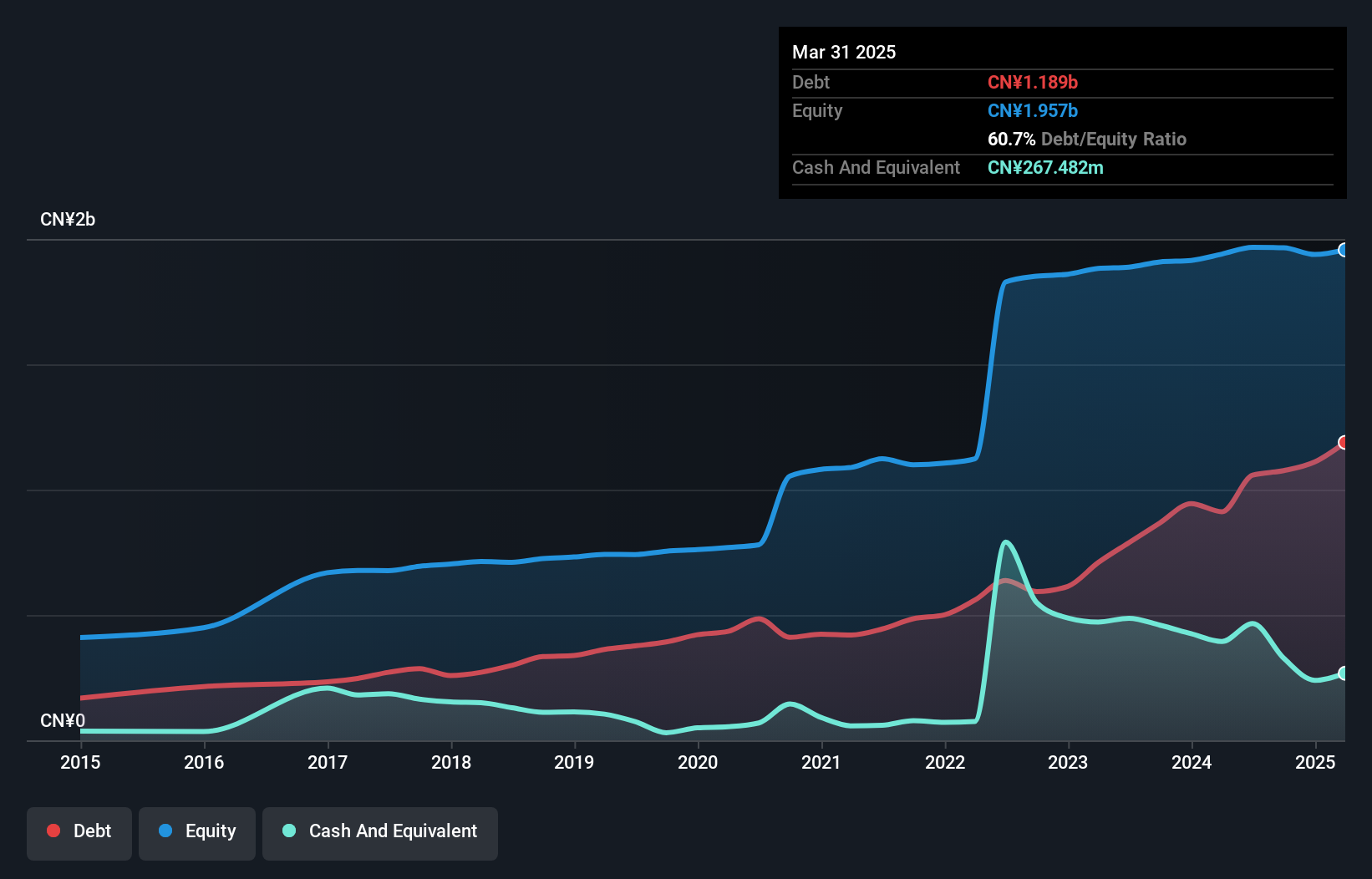

Operations: Laimu Electronics generates revenue primarily through the sale of precision electronic components. The company has experienced fluctuations in its net profit margin, which reflects the variability in its cost structure and operational efficiency over time.

Shanghai Laimu Electronics, a smaller player in the electronics sector, has shown modest growth with earnings increasing by 1.1% over the past year, surpassing industry averages. The company's net debt to equity ratio stands at a satisfactory 38.1%, indicating manageable leverage levels. Interest coverage is strong with EBIT covering interest payments 3.9 times over, reflecting solid financial health despite negative free cash flow trends. Recent reports highlight a rise in sales to CNY 1,050 million from CNY 778 million last year and net income of CNY 70 million up from CNY 66 million previously, suggesting steady operational performance amidst industry challenges.

- Click here and access our complete health analysis report to understand the dynamics of Shanghai Laimu ElectronicsLtd.

Gain insights into Shanghai Laimu ElectronicsLtd's past trends and performance with our Past report.

Rainbow Tours (WSE:RBW)

Simply Wall St Value Rating: ★★★★★★

Overview: Rainbow Tours S.A. is a tour operator active in Poland and several international markets, including the Czech Republic, Greece, Spain, Turkey, Slovakia, and Lithuania; it has a market capitalization of PLN 1.92 billion.

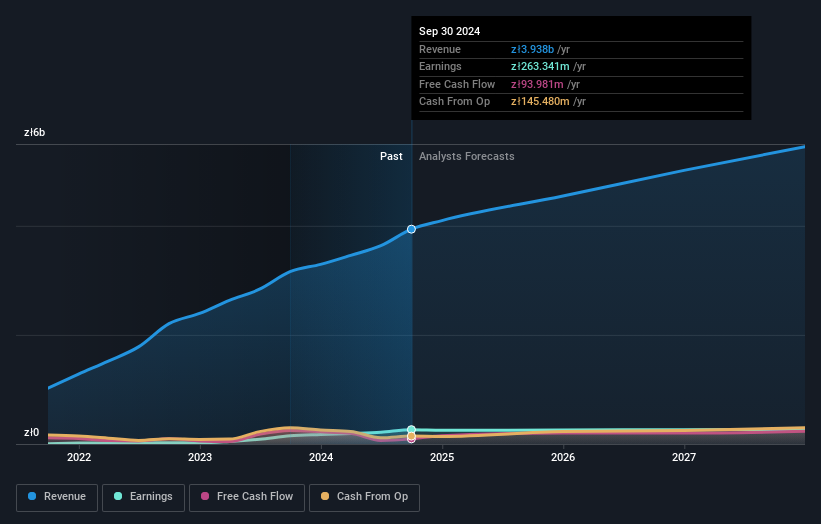

Operations: Rainbow Tours S.A. generates its revenue primarily from tour operator activities in Poland, accounting for PLN 3.86 billion, with additional contributions from foreign tour operations at PLN 142.57 million and a smaller hotel segment abroad at PLN 52.91 million.

Rainbow Tours, a dynamic player in the travel industry, has shown impressive financial performance with earnings growth of 76.5% over the past year, outpacing the hospitality sector's 4%. The company reported third-quarter sales of PLN 1.74 billion and net income of PLN 159.8 million, up from PLN 1.43 billion and PLN 110.83 million respectively a year ago. Over five years, its debt-to-equity ratio decreased from 43.4% to just 7.2%, highlighting strong financial management. With high-quality earnings and trading at nearly half its estimated fair value, Rainbow Tours seems poised for continued robust performance in a competitive market landscape.

- Take a closer look at Rainbow Tours' potential here in our health report.

Evaluate Rainbow Tours' historical performance by accessing our past performance report.

Make It Happen

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4615 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:GSJ

Grupo Empresarial San José

Engages in construction business in Spain and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives