- Portugal

- /

- Food and Staples Retail

- /

- ENXTLS:JMT

Arteche Lantegi Elkartea And 2 More European Stocks That Might Be Priced Below Estimated Value

Reviewed by Simply Wall St

As European markets experience a rebound, driven by the European Central Bank's rate cuts and improved investor sentiment following delayed tariff impositions, opportunities for discerning investors may arise in identifying stocks that are priced below their estimated value. In this environment, stocks like Arteche Lantegi Elkartea and others can be appealing if they demonstrate strong fundamentals and resilience amid economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Cenergy Holdings (ENXTBR:CENER) | €8.42 | €16.49 | 48.9% |

| Mips (OM:MIPS) | SEK354.00 | SEK690.38 | 48.7% |

| LPP (WSE:LPP) | PLN15500.00 | PLN30684.54 | 49.5% |

| Lindab International (OM:LIAB) | SEK187.40 | SEK372.28 | 49.7% |

| Verbio (XTRA:VBK) | €9.435 | €18.33 | 48.5% |

| Jerónimo Martins SGPS (ENXTLS:JMT) | €21.90 | €42.52 | 48.5% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.52 | €7.04 | 50% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.38 | €6.73 | 49.7% |

| Expert.ai (BIT:EXAI) | €1.328 | €2.63 | 49.4% |

| MedinCell (ENXTPA:MEDCL) | €14.47 | €28.62 | 49.4% |

We're going to check out a few of the best picks from our screener tool.

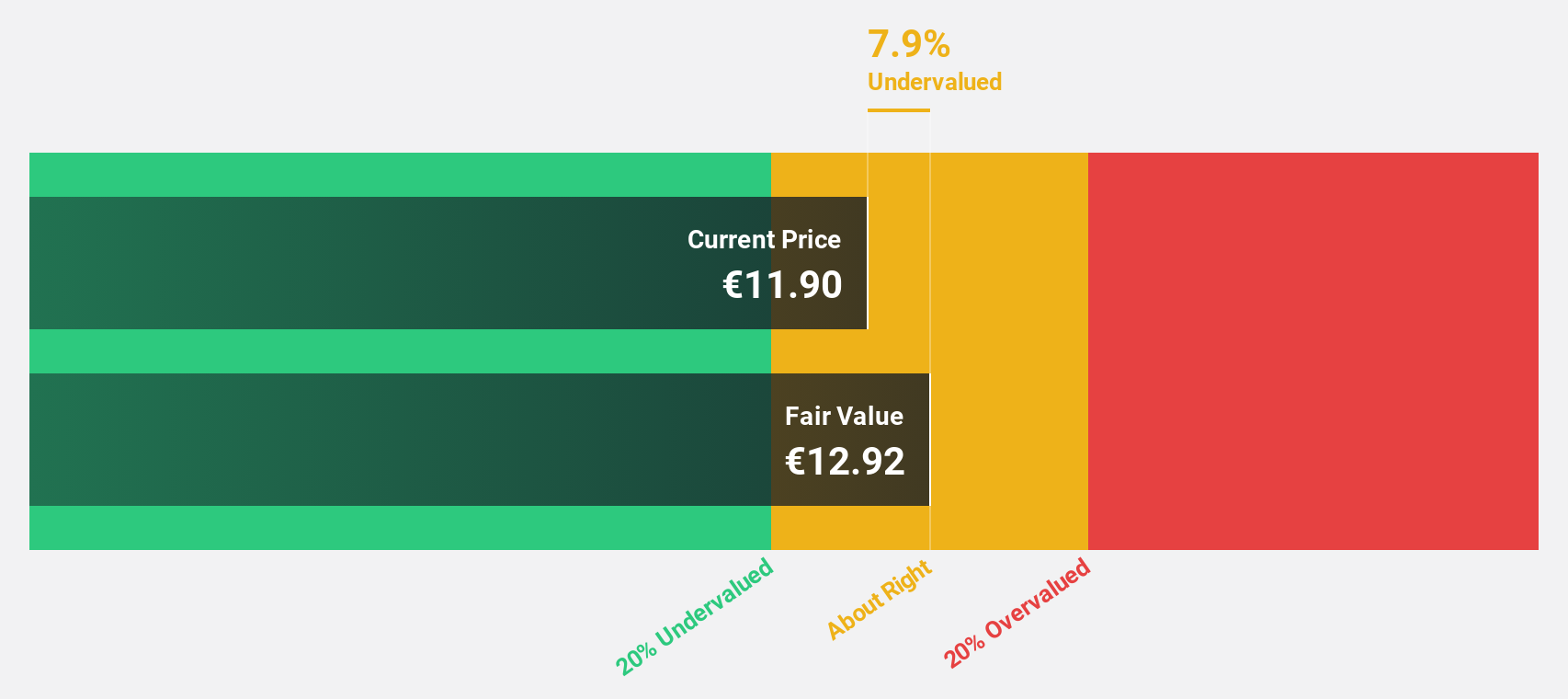

Arteche Lantegi Elkartea (BME:ART)

Overview: Arteche Lantegi Elkartea, S.A. specializes in designing, manufacturing, integrating, and supplying electrical equipment and solutions with a focus on renewable energies and smart grids both in Spain and internationally, with a market cap of €453.02 million.

Operations: The company's revenue is derived from three main segments: Network Reliability (€45.92 million), Systems Measurement and Monitoring (€321.55 million), and Automation of Transmission and Distribution Networks (€79.94 million).

Estimated Discount To Fair Value: 35.5%

Arteche Lantegi Elkartea is trading at €7.95, significantly below its estimated fair value of €12.33, indicating it might be undervalued based on cash flows. The company reported a substantial increase in net income to €18.9 million for 2024, with earnings per share rising to €0.33 from the previous year’s €0.21. Additionally, earnings are forecasted to grow at 22.62% annually over the next three years, outpacing the broader Spanish market growth rate of 5.9%.

- According our earnings growth report, there's an indication that Arteche Lantegi Elkartea might be ready to expand.

- Take a closer look at Arteche Lantegi Elkartea's balance sheet health here in our report.

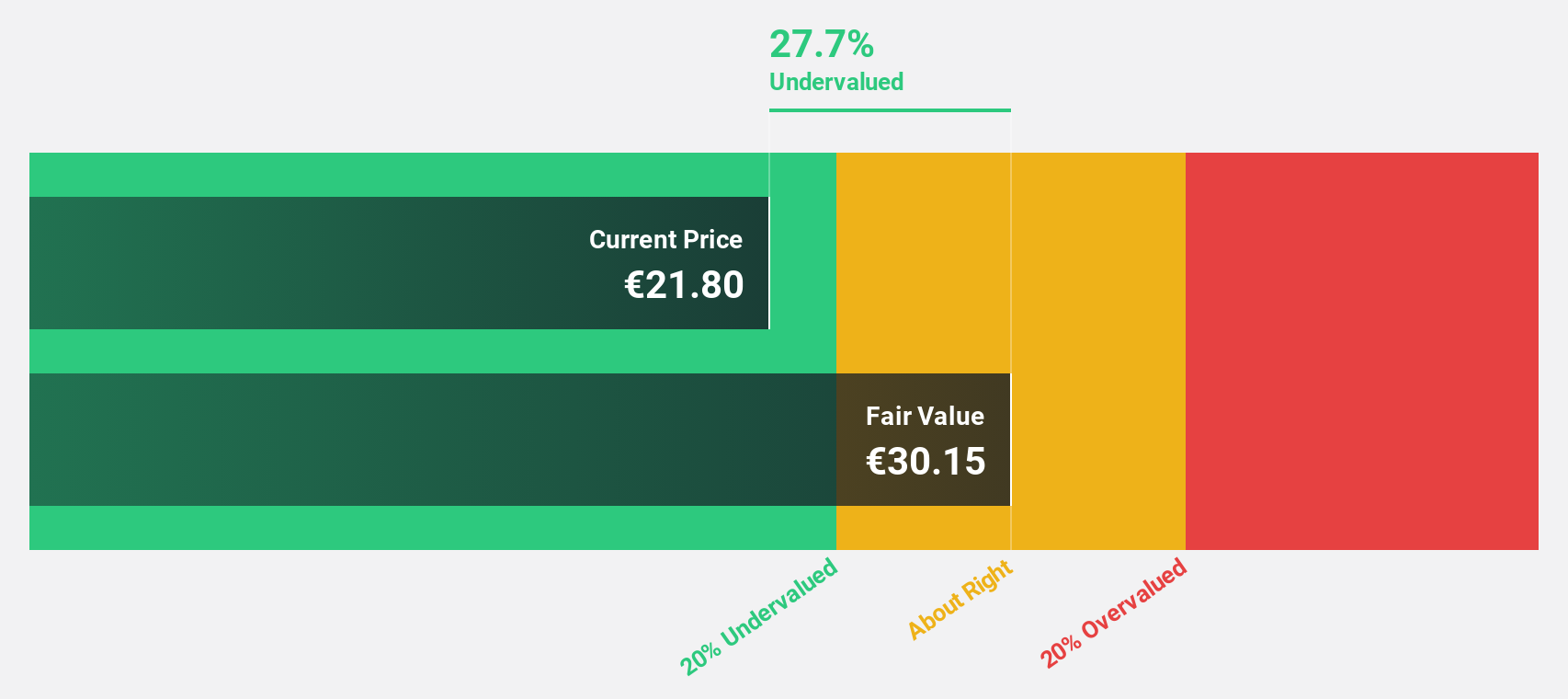

Jerónimo Martins SGPS (ENXTLS:JMT)

Overview: Jerónimo Martins SGPS operates in the food distribution and specialized retail sectors across Portugal, Poland, Colombia, and internationally with a market cap of €13.76 billion.

Operations: The company generates revenue from several segments, including €23.57 billion from Poland Retail, €2.85 billion from Colombia Retail, €5.71 billion from Portugal Retail, €1.36 billion from Portugal Cash & Carry, and €583 million from Poland Health and Beauty.

Estimated Discount To Fair Value: 48.5%

Jerónimo Martins SGPS is trading at €21.9, well below its estimated fair value of €42.52, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow 13.38% annually, surpassing the Portuguese market's 10.8%. Revenue growth is expected at 6% per year, faster than the local market's 3.6%. With a forecasted return on equity of 23.9%, Jerónimo Martins shows promising financial health despite slower revenue expansion compared to high-growth benchmarks.

- Our growth report here indicates Jerónimo Martins SGPS may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Jerónimo Martins SGPS stock in this financial health report.

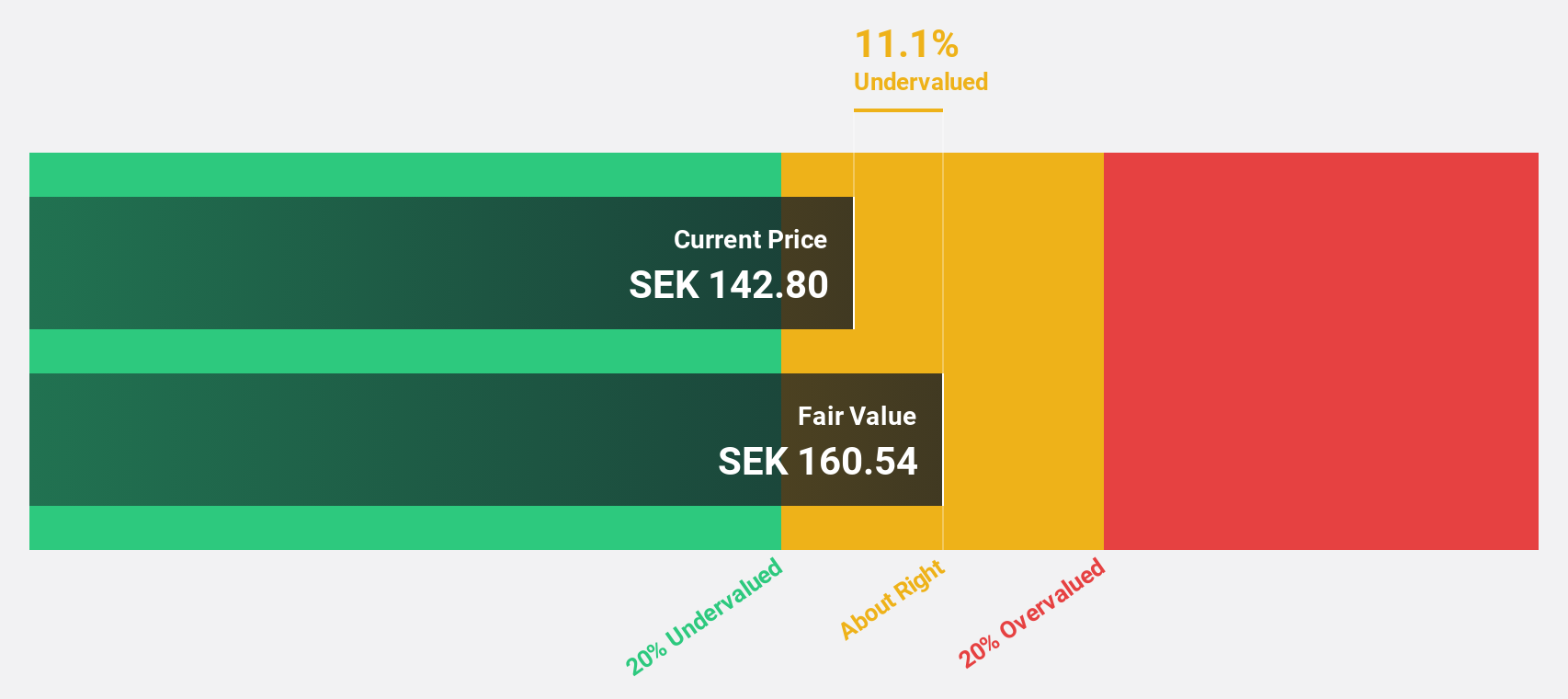

Biotage (OM:BIOT)

Overview: Biotage AB (publ) offers solutions and products for drug discovery and development, analytical testing, and water and environmental testing, with a market cap of approximately SEK11.29 billion.

Operations: Biotage's revenue segments encompass drug discovery and development, analytical testing, and water and environmental testing.

Estimated Discount To Fair Value: 19.3%

Biotage AB is trading at SEK 141, slightly below its estimated fair value of SEK 174.67, suggesting it may be undervalued based on cash flows despite a recent earnings decline. Earnings are expected to grow significantly at 20.7% annually, outpacing the Swedish market's growth rate of 13.1%. However, recent first-quarter results showed a decrease in sales and net income compared to the previous year, reflecting volatility amidst acquisition interest from Kohlberg Kravis Roberts & Co.

- Insights from our recent growth report point to a promising forecast for Biotage's business outlook.

- Dive into the specifics of Biotage here with our thorough financial health report.

Next Steps

- Click through to start exploring the rest of the 176 Undervalued European Stocks Based On Cash Flows now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTLS:JMT

Jerónimo Martins SGPS

Operates in the food distribution and specialized retail sectors in Portugal, Poland, Colombia, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives