How Does Regulatory Uncertainty in UK Auto Finance Shape Santander’s (BME:SAN) Risk Management Narrative?

Reviewed by Sasha Jovanovic

- Banco Santander recently delayed the release of its quarterly results due to uncertainty surrounding a proposed UK car finance compensation scheme, with bank leaders openly criticizing the initiative's scope and warning of potential impacts on jobs and the wider economy.

- This unusual pause in financial reporting shines a spotlight on the complex regulatory and legal risks facing European banks as new compensation programs create operational and economic challenges.

- We'll examine how the ongoing uncertainty around UK regulatory actions adds a new dimension to Banco Santander's investment narrative.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Banco Santander Investment Narrative Recap

For long-term shareholders, belief in Banco Santander’s diversified footprint and digital transformation is key, as these underpin resilience across varied economic cycles. The recent delay in reporting, due to the uncertain UK car finance compensation scheme, brings regulatory risk sharply into focus and temporarily overshadows what otherwise remains a story defined by operational execution. In the near term, this regulatory issue acts as the central risk and short-term catalyst, while core earnings momentum may be less material until clarity emerges.

The bank’s latest earnings announcement stands out: net income rose to EUR 3,504 million in Q3 and EUR 10,337 million over nine months, marking year-on-year improvement. These figures highlight strong underlying performance even as compliance challenges loom, underscoring how regulatory outcomes, not only operating trends, now influence investor sentiment and may shape near-term share price movement.

By contrast, the potential for further regulatory intervention, especially in the UK’s car finance market, is a risk every Santander investor should keep watching...

Read the full narrative on Banco Santander (it's free!)

Banco Santander's narrative projects €63.8 billion revenue and €13.2 billion earnings by 2028. This requires 8.4% yearly revenue growth and a €0.6 billion earnings increase from €12.6 billion today.

Uncover how Banco Santander's forecasts yield a €8.83 fair value, in line with its current price.

Exploring Other Perspectives

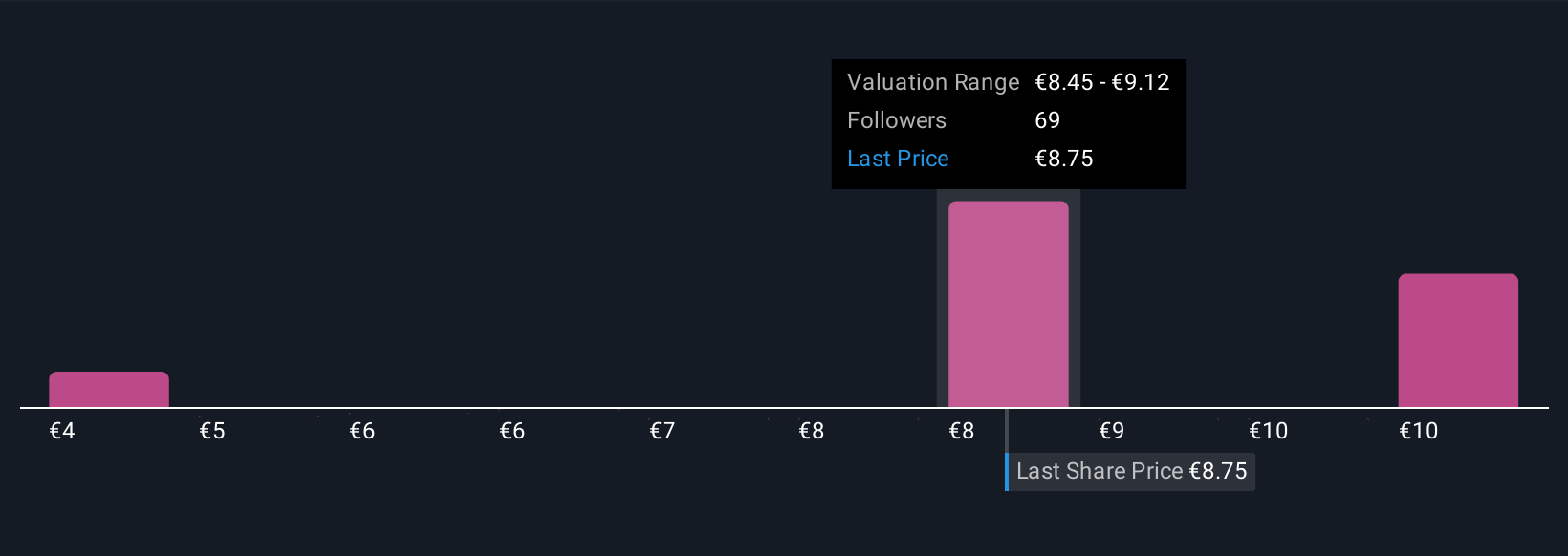

Simply Wall St Community members have published 11 fair value opinions for Santander, ranging from €4.43 to €11.56 per share. As broader regulatory challenges affect earnings visibility, investor sentiment and assumptions can shift quickly, explore how others view the risk-reward balance.

Explore 11 other fair value estimates on Banco Santander - why the stock might be worth as much as 29% more than the current price!

Build Your Own Banco Santander Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Banco Santander research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Banco Santander research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Banco Santander's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco Santander might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:SAN

Banco Santander

Provides various financial products and services to individuals, small and medium-sized enterprises, large corporations, and public entities worldwide.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives