Does the Recent Price Drop Signal Opportunity in Sabadell After Five Years of Strong Gains?

Reviewed by Bailey Pemberton

Trying to decide what to do with Banco de Sabadell stock? You are not alone. With the share price surging by an incredible 1159.2% over the past five years, and up nearly 70% in the last year, Sabadell has been on quite a run. But as any seasoned investor will remind you, past performance does not guarantee future returns, and those double-digit negative moves in the last month and week (down -5.5% and -5.0% respectively) show just how quickly sentiment can shift, especially amidst broader market volatility and shifting risk perceptions for European banks.

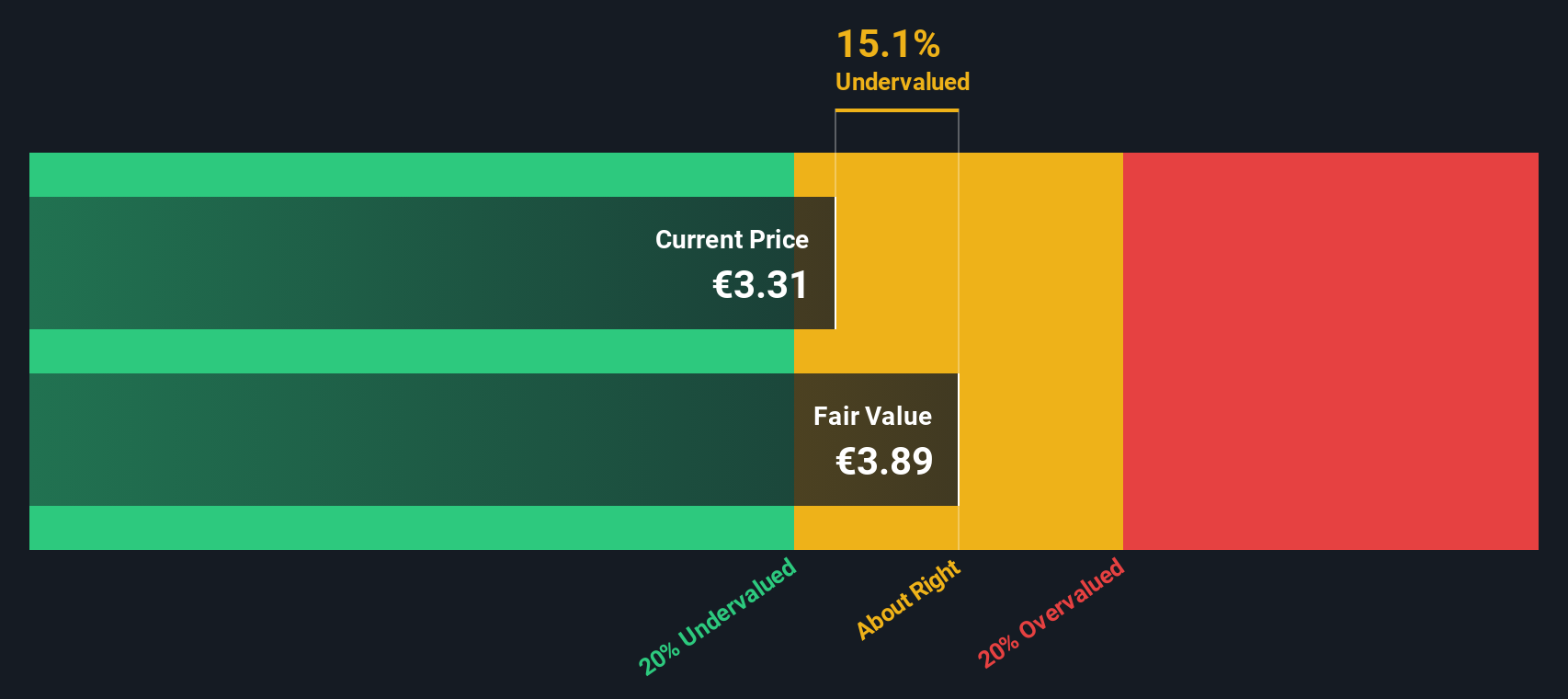

So, is this recent dip an opportunity, or a warning sign? At Friday’s close of €3.01, Sabadell still boasts a year-to-date return of 61.8%, outpacing most of its peers, despite some short-term turbulence. What really stands out, though, is its value score: a solid 5 out of 6, meaning the company screens as undervalued in five different valuation checks. That kind of consistency typically signals a stock with untapped potential, or at the very least, one worth another look.

Let’s dive into what those valuation methods are really telling us. We will break down the results for each approach, and if you stick around until the end, introduce a perspective that might just change how you look at stock valuation altogether.

Why Banco de Sabadell is lagging behind its peers

Approach 1: Banco de Sabadell Excess Returns Analysis

The Excess Returns approach offers insight by examining Banco de Sabadell's ability to generate returns on shareholders' equity beyond its cost of equity. This method focuses on how efficiently the bank can convert its invested capital into profit after accounting for the basic cost of funding that capital.

Looking at the latest estimates, Banco de Sabadell's book value stands at €2.73 per share, with projections for a stable book value of €2.77 per share according to weighted future book value forecasts from seven analysts. The bank's stable earnings per share are projected at €0.35, sourced from the collective view of nine analysts forecasting future return on equity. Notably, the cost of equity per share is €0.26, which means Sabadell is generating an excess return of €0.08 per share above this threshold. The average return on equity is also a healthy 12.58%, signaling ongoing profitability and solid banking fundamentals.

This methodology estimates an intrinsic value for Sabadell shares that is 23.4% above the latest market price, indicating the stock is considerably undervalued based on its ability to deliver consistent excess returns on its capital base. For investors focusing on core bank performance, this is a promising sign. Banco de Sabadell's underlying economics seem to be more robust than its market price implies.

Result: UNDERVALUED

Our Excess Returns analysis suggests Banco de Sabadell is undervalued by 23.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Banco de Sabadell Price vs Earnings

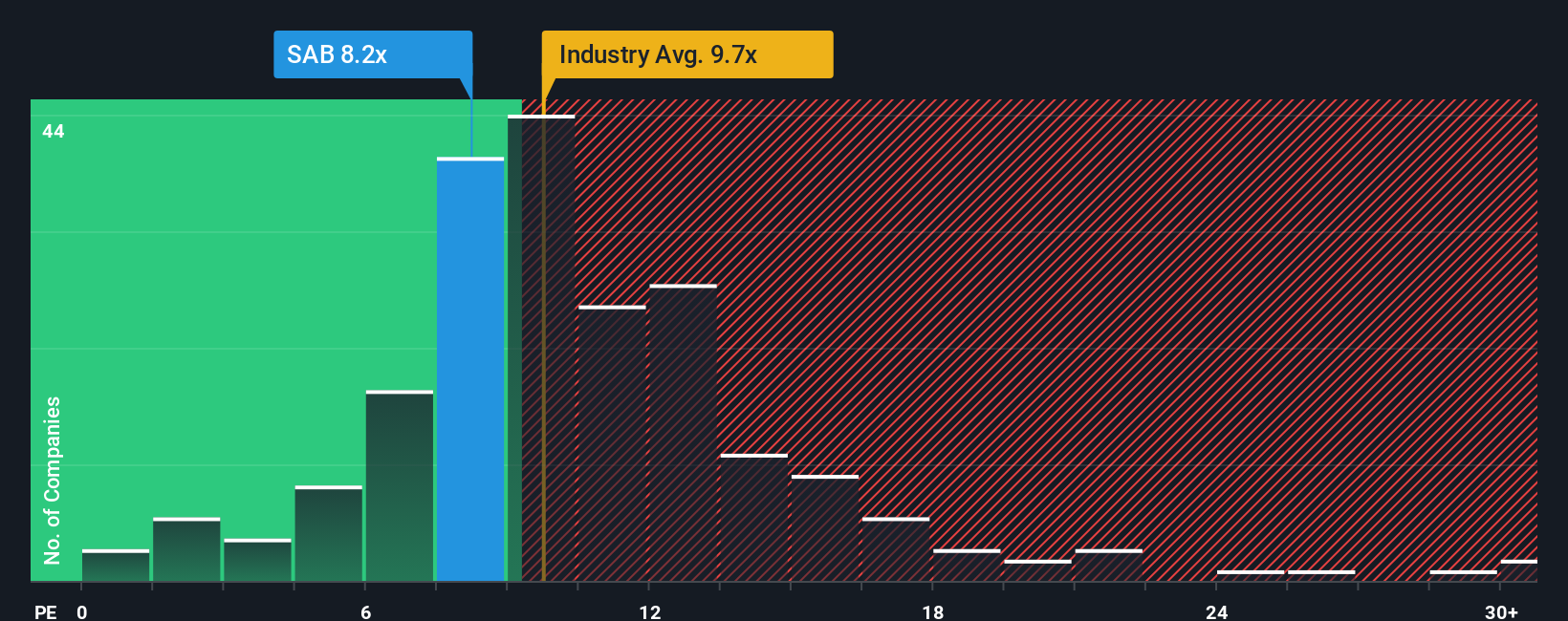

The Price-to-Earnings (PE) ratio is widely regarded as the go-to valuation multiple for profitable companies because it directly relates a company’s stock price to its underlying earnings power. It provides a practical measure of how much investors are willing to pay today for a euro of earnings. This makes it especially relevant for banks like Banco de Sabadell with consistent profits.

Of course, what constitutes a “normal” or “fair” PE ratio varies depending on growth outlook and risk profile. Higher earnings growth and stability typically justify a higher PE, while greater uncertainty or slower growth exert downward pressure on the multiple.

At the moment, Sabadell trades at a PE ratio of 7.9x. This is noticeably below both the industry average of 10.2x and the average of its listed peers at 10.4x. Taken at face value, this might suggest Sabadell is undervalued, but context is crucial.

This is where Simply Wall St's “Fair Ratio” enters the picture. The Fair Ratio for Sabadell is currently calculated at 9.0x. This reflects a combination of the company’s growth prospects, profit margins, market cap, and specific sector risks. Unlike a simple peer or industry comparison, the Fair Ratio is tailored to Sabadell’s exact profile and provides a sharper sense of whether its market price is justified given its fundamentals and risk/reward balance.

With Sabadell’s actual PE at 7.9x compared to a Fair Ratio of 9.0x, the stock appears undervalued using this method. There is still room for its multiple to re-rate upwards if fundamentals remain robust and market conditions stabilize.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Banco de Sabadell Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is the story you believe about a company’s future. It ties together your view of how Banco de Sabadell will grow, what its revenues, earnings, and margins could be, and what a fair price might look like, all backed up by your own financial forecasts. Narratives connect the dots between the company’s latest news, your expectations, and an estimated fair value, offering not just numbers but a full story behind those numbers.

On Simply Wall St’s Community page, millions of investors are already creating and updating Narratives with just a few clicks. These tools make it easy for anyone, whether you are a pro or just starting out, to turn your perspective into a valuation model that updates automatically whenever new results or news hit the market.

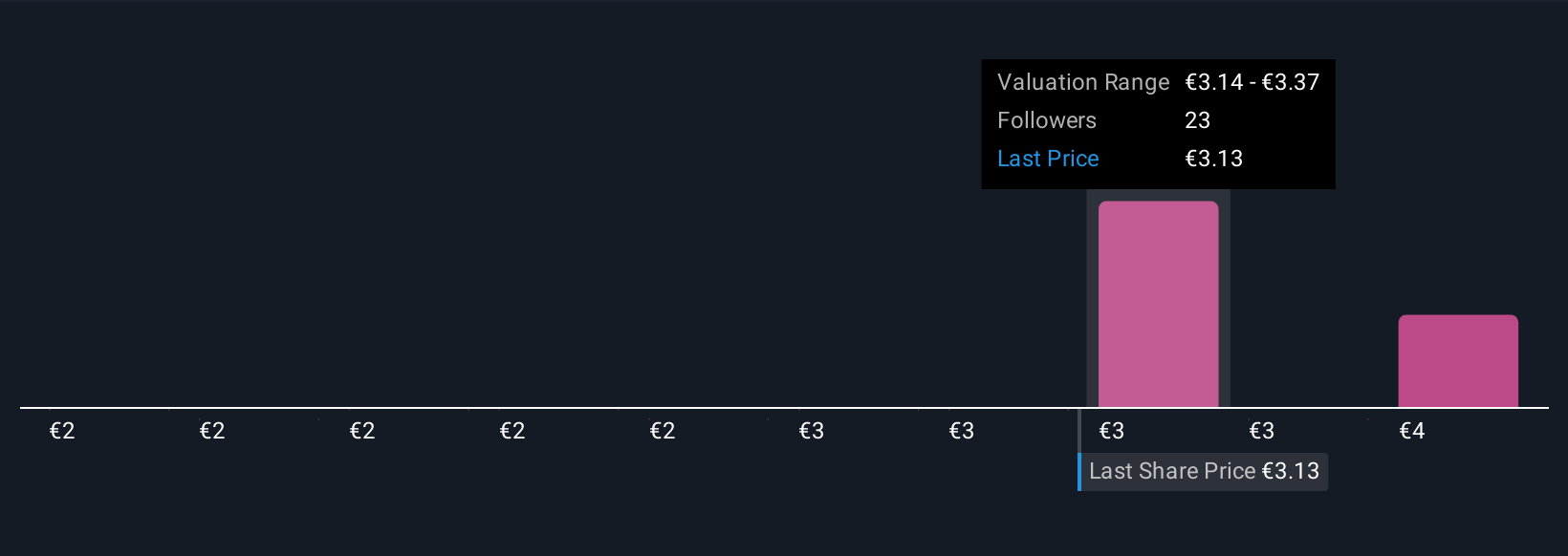

Narratives can help you decide when to buy or sell: for example, some investors see Sabadell’s fair value as high as €4.00 based on robust digital progress and capital returns, while more cautious views point to a fair value closer to €2.30 due to reliance on Spain and ongoing margin pressures.

No matter your take, Narratives let you connect your reasoning to real numbers and a live fair value, making your decision process smarter, faster, and more transparent.

Do you think there's more to the story for Banco de Sabadell? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Banco de Sabadell might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:SAB

Banco de Sabadell

Provides banking products and services to personal, business, and private customers in Spain and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)