Banco Sabadell (BME:SAB): What Recent Momentum Means for the Bank’s Current Valuation

Reviewed by Kshitija Bhandaru

Banco de Sabadell (BME:SAB) continues to attract investor attention, with its shares showing strong growth over the past year. The stock’s performance, especially through the past 3 months, offers some interesting talking points for anyone following Spanish banks.

See our latest analysis for Banco de Sabadell.

Sabadell shares are riding solid momentum, with the stock’s 90-day share price return outpacing many sector peers. That consistent upward movement is catching eyes, especially as its 1-year total shareholder return stands at nearly 1%. Both short-term and long-term performances suggest investors are steadily warming up to the bank's prospects, even as the broader sector landscape shifts.

If you’re looking to spot more trends beyond banking, this is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

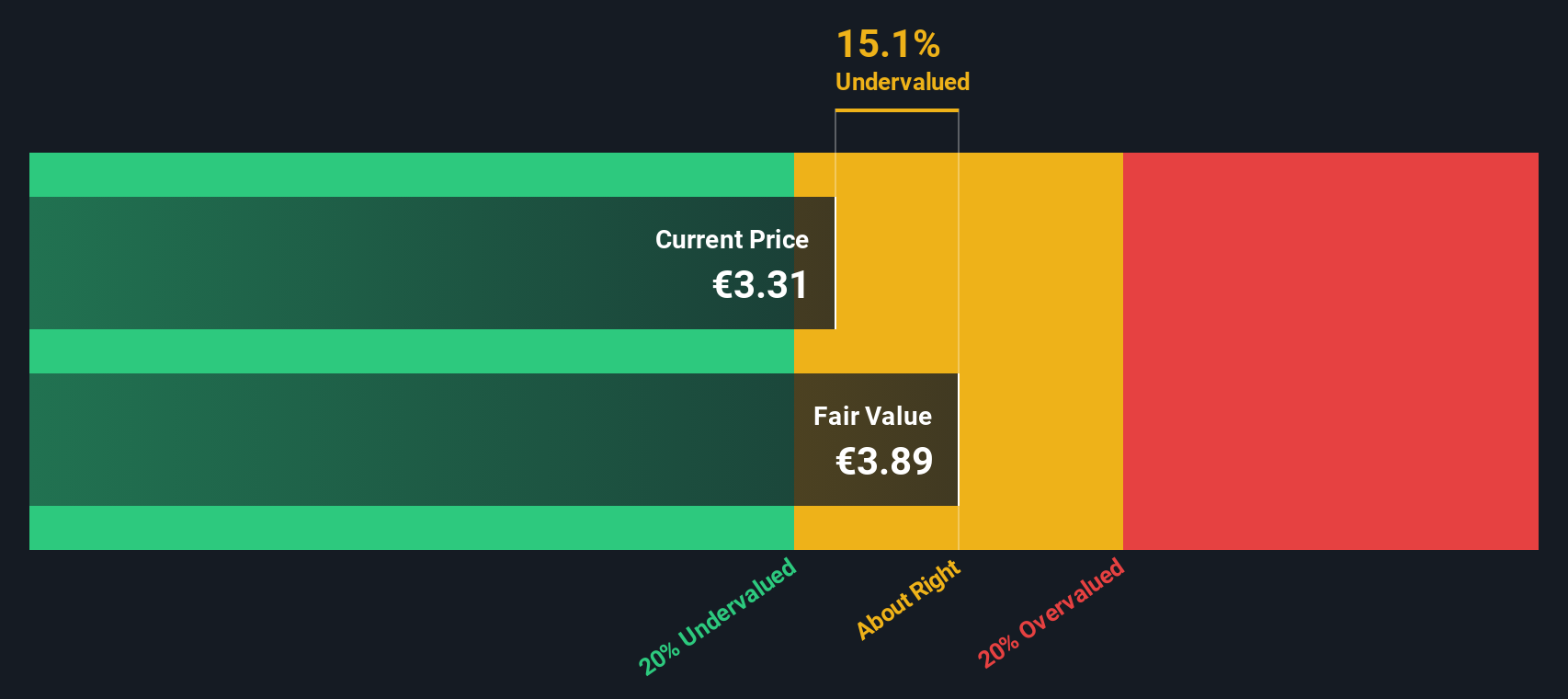

With Sabadell’s share price surge and strong returns on display, investors are left wondering if its impressive run is signaling an undervalued opportunity or if the market has already priced in all the future growth.

Most Popular Narrative: 3% Overvalued

Banco de Sabadell’s most widely followed narrative estimates a fair value slightly below its last close price, leading to a lively debate about whether the market’s recent optimism is now running ahead of analyst consensus. The current market price sits just above the calculated fair value, making for a contentious call on where shares might head next.

The analysts have a consensus price target of €3.113 for Banco de Sabadell based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €4.0, and the most bearish reporting a price target of just €2.3.

Who sets the tone for Sabadell's future? Analysts are betting on a decisive shift in core profits and margin pressures. There is one surprising assumption behind their fair value target. The real twist is buried in the growth and earnings mix that only unfolds deeper in the narrative.

Result: Fair Value of €3.19 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Sabadell’s heavy focus on Spain and uncertainty around net interest income could challenge continued earnings growth if local conditions worsen.

Find out about the key risks to this Banco de Sabadell narrative.

Another View: Our DCF Model Suggests Undervaluation

Looking at Banco de Sabadell through our DCF model offers a different perspective and suggests the stock is undervalued by a notable margin. This implies the market may be overlooking some future cash flows or growth potential that are not fully reflected in the current price. Could this be an opportunity waiting to be uncovered?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Banco de Sabadell Narrative

Feel free to dig into the numbers and challenge these conclusions. It's quick and easy to craft your own view of Sabadell’s story in just minutes with Do it your way

A great starting point for your Banco de Sabadell research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

If you want to get ahead of the market, now is your chance to spot high-potential stocks outside your current watchlist. Don’t let unique opportunities pass you by. Expand your horizon today!

- Tap into potential growth by checking out these 910 undervalued stocks based on cash flows, which screens for companies trading below their intrinsic value and showing healthy fundamentals.

- Get in early on innovation when you browse these 26 quantum computing stocks, where pioneering breakthroughs in computing can offer an edge few investors are watching.

- Boost your portfolio’s income stream by seeking out these 19 dividend stocks with yields > 3%, featuring stocks with reliable yields above 3% and a track record of steady payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco de Sabadell might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:SAB

Banco de Sabadell

Provides banking products and services to personal, business, and private customers in Spain and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives