Assessing Sabadell Shares After a 400% Three-Year Surge and Recent Pullback

Reviewed by Bailey Pemberton

Thinking about what to do with Banco de Sabadell shares? You are not alone. This stock has been on quite the ride lately, leaving both cautious investors and bullish optimists on their toes. After a long stretch of impressive gains, up more than 70% year-to-date and soaring nearly 400% over the past three years, recent trading has been a little rocky. In the past month alone, Banco de Sabadell's share price has slipped 5.9%, with a 4.6% dip just in the most recent week. Yet those longer-term numbers still command respect, with a staggering 1,261.2% gain over five years making this bank one of Europe's best-performing stocks in its sector.

The recent volatility can be traced back to shifting market sentiment around Spanish and European lenders, as investors weigh global interest rate trends and increased M&A speculation in the banking space. But does this mean Banco de Sabadell’s stellar run is over, or could the current pullback actually signal an opportunity?

This is where a focused look at valuation scores becomes especially useful. According to our analysis, Banco de Sabadell scores a 4 out of 6 on our undervaluation checklist, which is a solid indicator that the company’s shares may still be attractively priced compared to peers, despite the recent slide.

So, where does the value really lie? Let's dig into the main approaches used to gauge whether Banco de Sabadell is undervalued or overpriced. And if you are truly curious about the smartest way to judge value, stick around. Our final section goes beyond the usual checklists for a deeper perspective.

Why Banco de Sabadell is lagging behind its peers

Approach 1: Banco de Sabadell Excess Returns Analysis

The Excess Returns model is a valuation method that focuses on how efficiently a company reinvests its profits and generates returns above its cost of equity. Instead of simply tallying up expected cash flows, it measures how much value Banco de Sabadell is creating for shareholders through its fundamental banking operations.

For Banco de Sabadell, the Excess Returns model provides a snapshot of its long-term sustainability. The bank has a Book Value of €2.73 per share and analysts estimate a stable Earnings Per Share (EPS) of €0.35. Banco de Sabadell’s cost of equity is €0.26 per share, which means the bank earns an Excess Return of €0.08 per share. This is supported by an average future Return on Equity of 12.55% and a stable projected Book Value of €2.77 per share, according to consensus from multiple analysts.

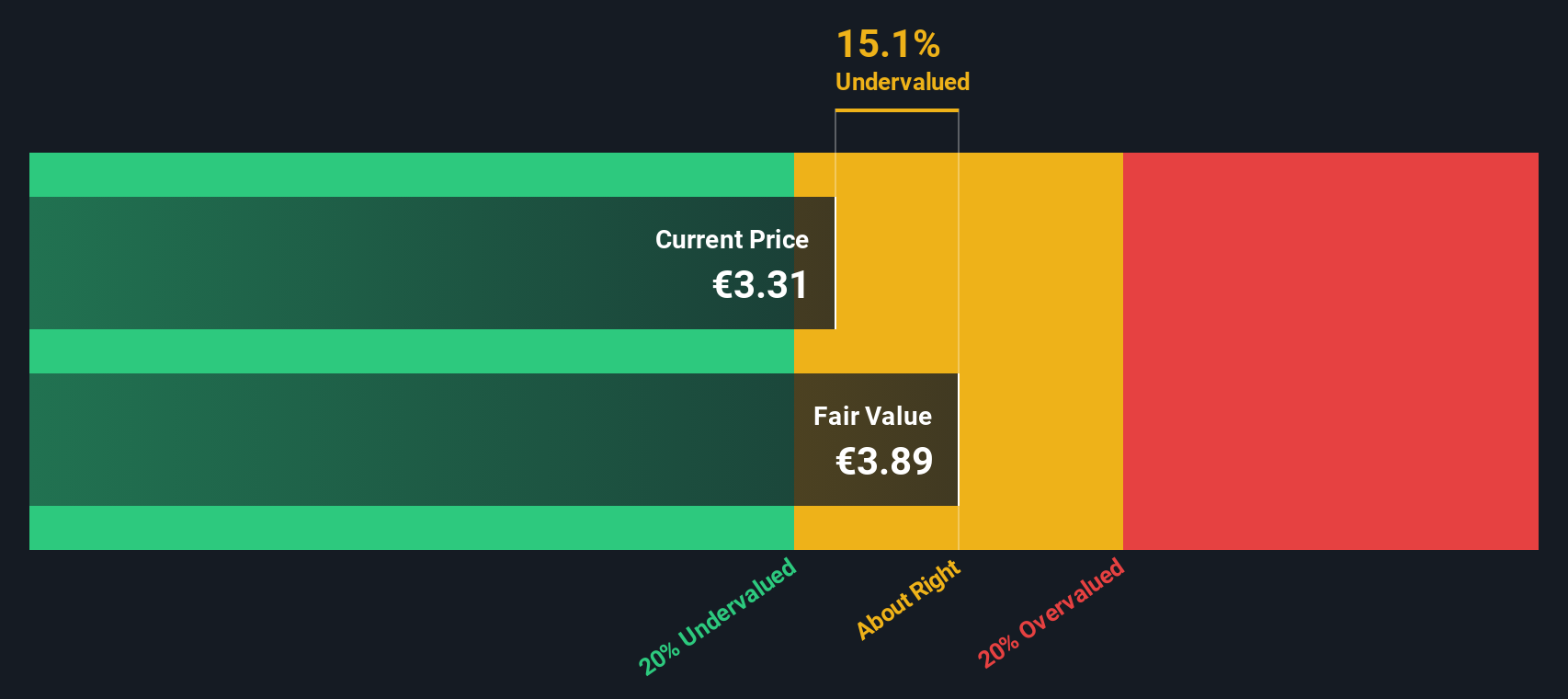

Given these inputs, the Excess Returns valuation puts Banco de Sabadell’s intrinsic value at €3.93 per share. With the stock currently trading at a 19.5% discount to this estimate, the case for undervaluation is strong.

Result: UNDERVALUED

Our Excess Returns analysis suggests Banco de Sabadell is undervalued by 19.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

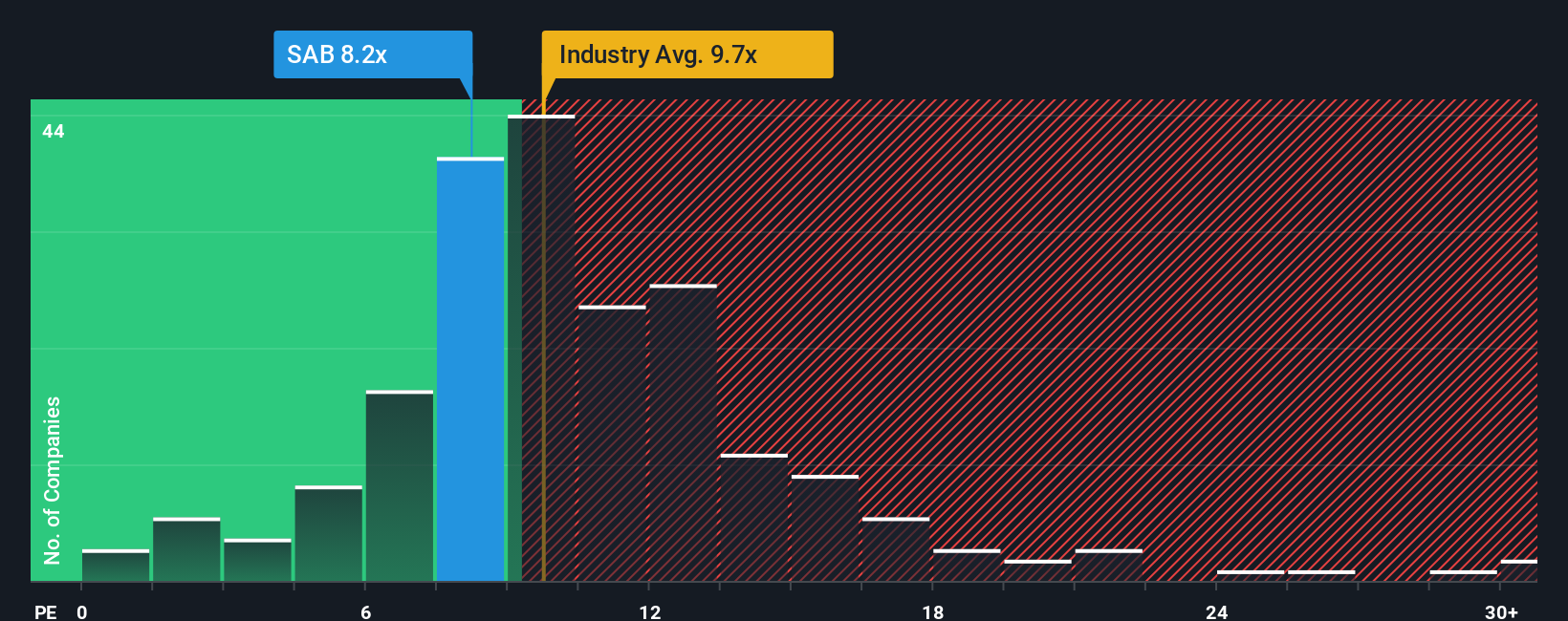

Approach 2: Banco de Sabadell Price vs Earnings

For profitable companies like Banco de Sabadell, the Price-to-Earnings (PE) ratio is an intuitive and widely used valuation yardstick. It measures how much investors are willing to pay for every euro of earnings, making it particularly effective for comparing businesses with stable profits and consistent performance over time.

The level at which a PE ratio is considered “fair” depends on more than just raw profit. Faster-growing companies or those with lower risk profiles typically command a higher PE, while those facing headwinds or added risks trade at a discount. It is essential to compare the company’s current PE ratio not only to its sector but also to an objective benchmark that adjusts for these factors.

Banco de Sabadell currently trades on a PE ratio of 8.32x, which is lower than both the industry average of 10.37x and the peer group average of 10.45x. To move beyond surface-level comparisons, Simply Wall St calculates a proprietary “Fair Ratio” in this case, 9.03x. The Fair Ratio adjusts for earnings growth, profit margin, market cap, and risks to reflect what a suitable multiple should be for Banco de Sabadell, not just for the average bank or peer. This makes it a more nuanced and meaningful benchmark.

With Banco de Sabadell’s current PE just 0.71x below its Fair Ratio, the valuation lands in a sweet spot. The stock appears priced about right, balancing risk, growth, and profitability in line with what investors should expect.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Banco de Sabadell Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives. A Narrative is a simple, powerful approach that lets you create a story connecting your perspective on a company to the financial forecast and fair value behind your investment decision. Instead of just relying on ratios or checklists, Narratives help you clarify your assumptions about future revenue, profit margins, and business trends, then calculate what the company is really worth, all within a few steps on Simply Wall St's Community page where millions of investors share and compare ideas every day.

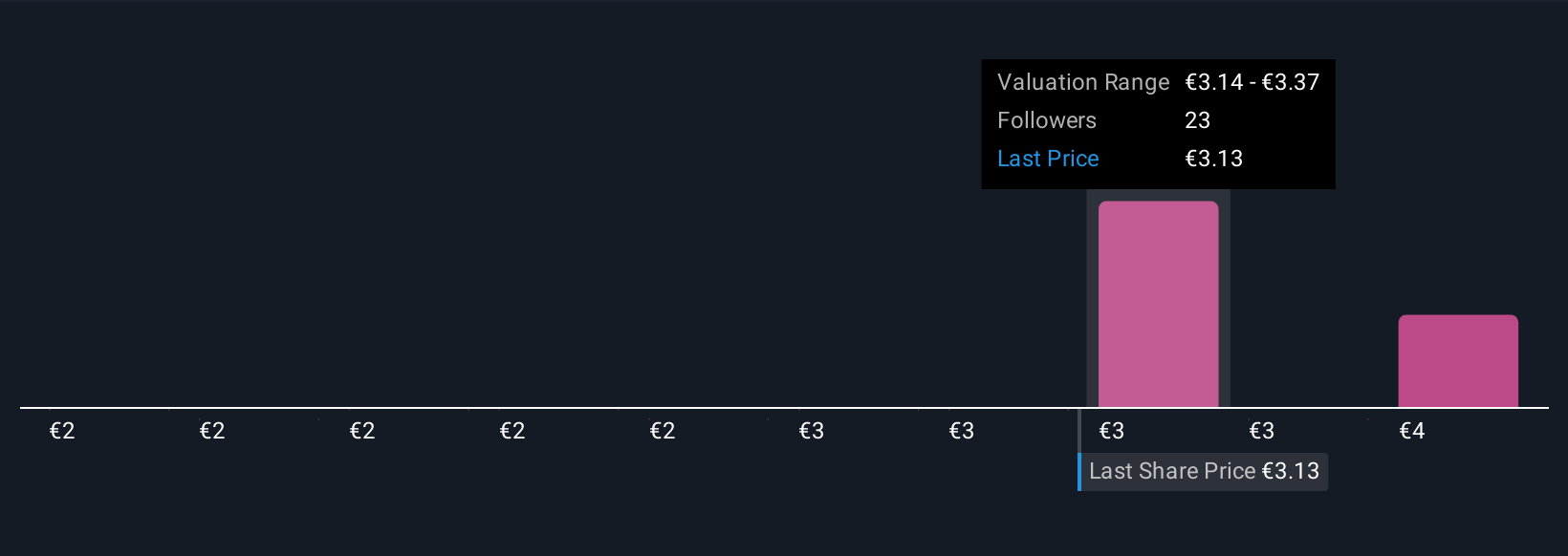

Narratives make it easy to see if Banco de Sabadell’s fair value (based on your story and forecast) is higher or lower than today’s share price, helping you decide whether it is time to buy, sell, or watch. Because Narratives update dynamically whenever major news or quarterly results are released, they keep your thinking fresh and relevant. For example, one investor's Narrative around robust Spanish lending and digital progress might lead them to a bullish €4.00 target, while a more cautious view, perhaps emphasizing margin pressures and reliance on the Spanish economy, could arrive at a bearish €2.30 fair value. This shows just how much your perspective matters.

Do you think there's more to the story for Banco de Sabadell? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Banco de Sabadell might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:SAB

Banco de Sabadell

Provides banking products and services to personal, business, and private customers in Spain and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion