- Japan

- /

- Healthtech

- /

- TSE:4820

3 Dividend Stocks Yielding Up To 9.7%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by accelerating U.S. inflation and climbing stock indexes, investors are keenly observing how these dynamics influence their portfolios. With the S&P 500 and Nasdaq Composite nearing record highs, dividend stocks remain an attractive option for those seeking steady income amidst market volatility. A good dividend stock in such conditions typically offers a reliable yield, financial stability, and the potential for growth even as economic policies shift globally.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.89% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.24% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.95% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.23% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.04% | ★★★★★★ |

Click here to see the full list of 1986 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

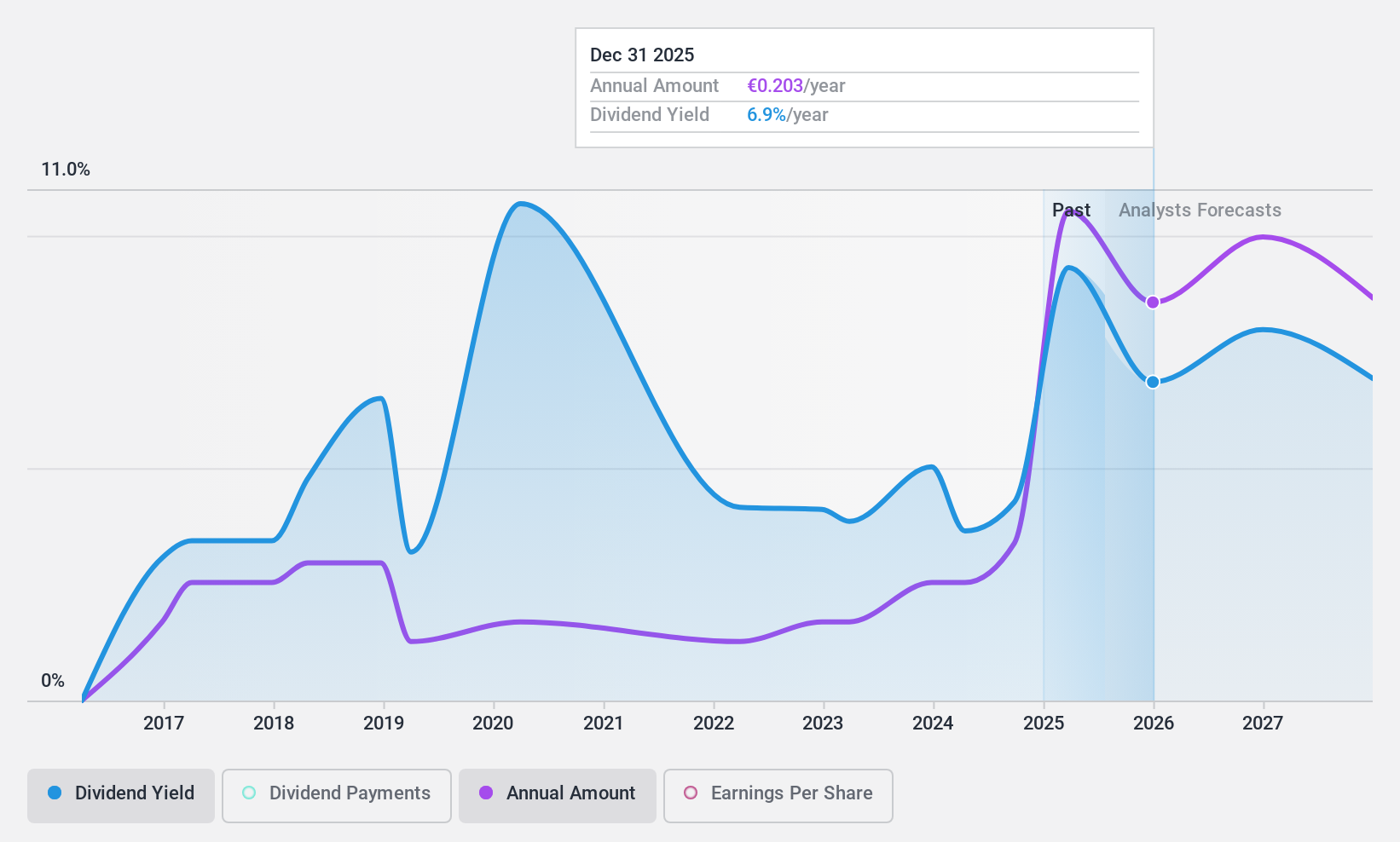

Banco de Sabadell (BME:SAB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco de Sabadell, S.A. offers a range of banking products and services to personal, business, and private customers both in Spain and internationally, with a market capitalization of approximately €13.32 billion.

Operations: Banco de Sabadell's revenue is primarily derived from its Banking Business in Spain, which generates €4.17 billion, followed by the United Kingdom with €1.24 billion, and Mexico contributing €188 million.

Dividend Yield: 9.8%

Banco de Sabadell's dividend yield is among the top 25% in Spain, but its history of volatile payments over nine years raises concerns about reliability. Despite a reasonable payout ratio of 63.6%, suggesting dividends are covered by earnings, the bank's high level of bad loans (2.8%) and low allowance for these loans (62%) pose risks. Recent earnings growth and a planned cash dividend increase indicate positive short-term performance, yet future earnings are forecasted to decline.

- Click here and access our complete dividend analysis report to understand the dynamics of Banco de Sabadell.

- Our valuation report here indicates Banco de Sabadell may be undervalued.

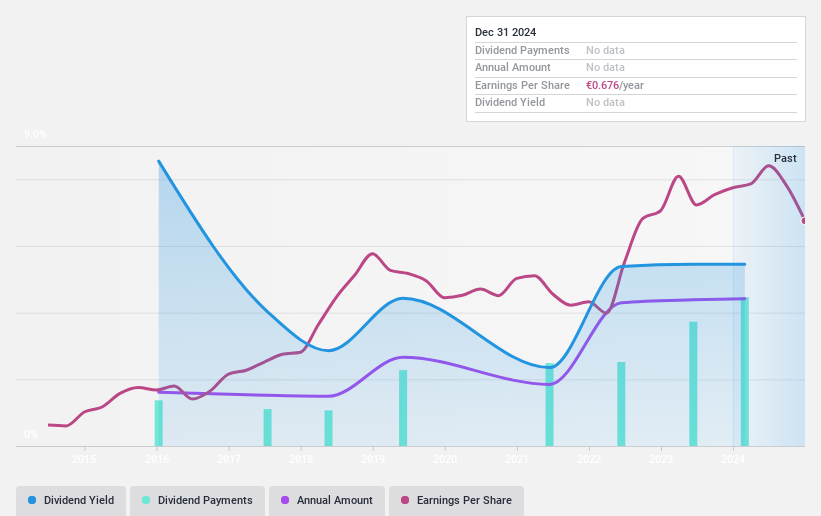

Payton Planar Magnetics (ENXTBR:PAY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Payton Planar Magnetics Ltd. and its subsidiaries develop, manufacture, and market planar and conventional transformers globally, with a market cap of €128.99 million.

Operations: Payton Planar Magnetics Ltd. generates revenue primarily from its transformer segment, which accounted for $56.31 million.

Dividend Yield: 7.5%

Payton Planar Magnetics offers a high dividend yield within the Belgian market's top 25%, but its nine-year history of payments has been unreliable and volatile. Despite this, the company's dividends are well-covered by earnings and cash flows, with a payout ratio of 65.6% and a cash payout ratio of 51.9%. Recent earnings results show stable growth, yet declining quarterly sales may impact future dividend stability. The stock trades significantly below its estimated fair value.

- Navigate through the intricacies of Payton Planar Magnetics with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Payton Planar Magnetics is trading behind its estimated value.

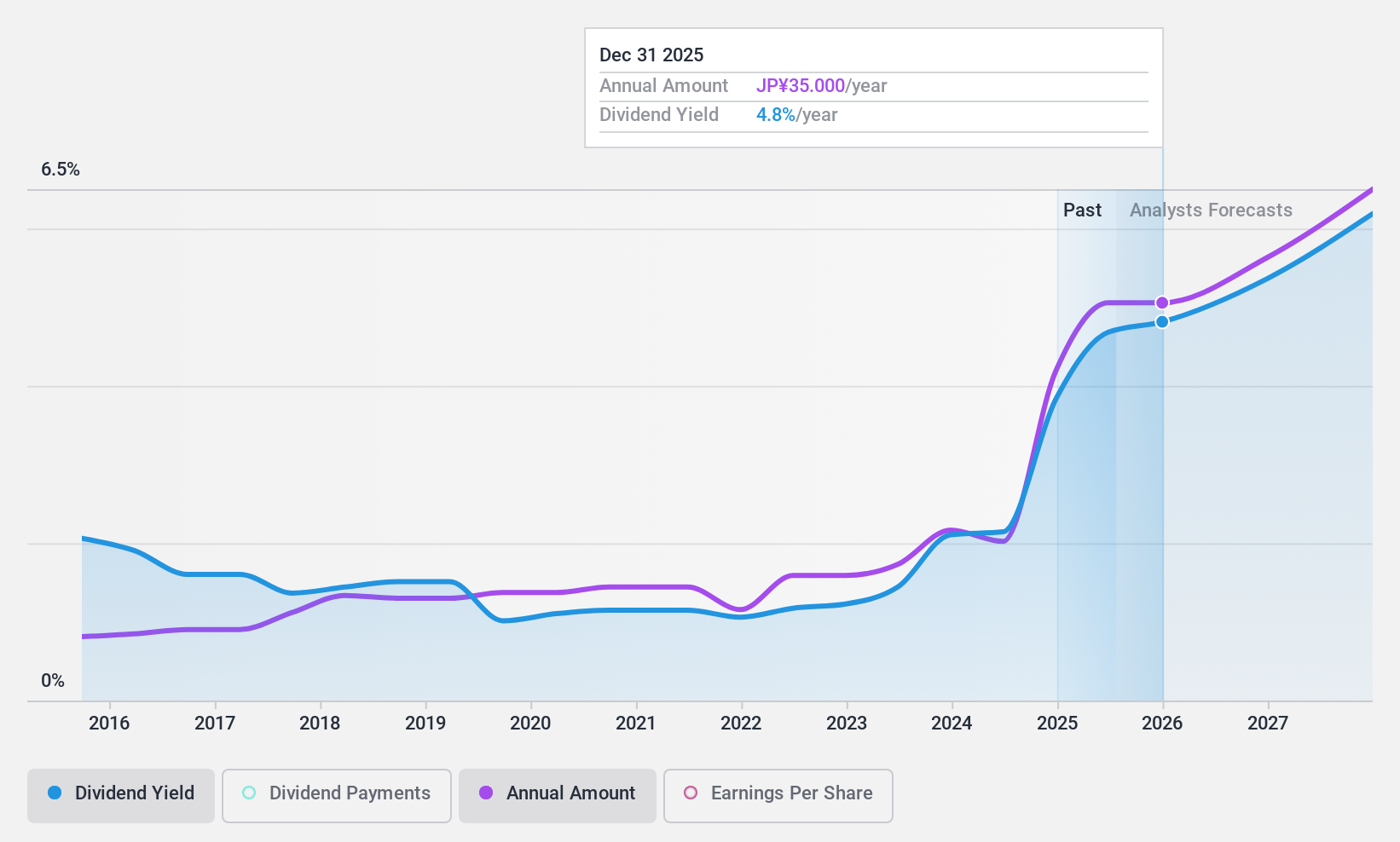

EM Systems (TSE:4820)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: EM Systems Co., Ltd. develops and sells IT systems for pharmacies, clinics, and care/welfare businesses in Japan, with a market cap of ¥53.09 billion.

Operations: EM Systems Co., Ltd. generates revenue primarily from its Dispensing System Business at ¥20.70 billion, followed by the Medical System Business at ¥2.56 billion, and the Nursing/Welfare System Business at ¥570 million.

Dividend Yield: 3.7%

EM Systems' dividend stability is notable, with consistent growth over the past decade. The payout ratio of 53.2% and cash payout ratio of 40.1% indicate dividends are well covered by earnings and cash flows. Although its 3.66% yield is below the top tier in Japan, it remains reliable. Recent buybacks totaling ¥999.25 million could enhance shareholder value despite large one-off items affecting earnings quality, while trading at a discount to fair value offers potential upside.

- Take a closer look at EM Systems' potential here in our dividend report.

- According our valuation report, there's an indication that EM Systems' share price might be on the cheaper side.

Turning Ideas Into Actions

- Unlock our comprehensive list of 1986 Top Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EM Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4820

EM Systems

Develops and sells various IT systems for pharmacies, clinics, and care/welfare other business in Japan.

6 star dividend payer with excellent balance sheet.

Market Insights

Community Narratives