Today, we'll introduce the concept of the P/E ratio for those who are learning about investing. We'll show how you can use CaixaBank, S.A.'s (BME:CABK) P/E ratio to inform your assessment of the investment opportunity. CaixaBank has a price to earnings ratio of 10.74, based on the last twelve months. That is equivalent to an earnings yield of about 9.3%.

See our latest analysis for CaixaBank

How Do You Calculate CaixaBank's P/E Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Price per Share ÷ Earnings per Share (EPS)

Or for CaixaBank:

P/E of 10.74 = €2.25 ÷ €0.21 (Based on the year to June 2019.)

Is A High Price-to-Earnings Ratio Good?

The higher the P/E ratio, the higher the price tag of a business, relative to its trailing earnings. All else being equal, it's better to pay a low price -- but as Warren Buffett said, 'It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.'

How Does CaixaBank's P/E Ratio Compare To Its Peers?

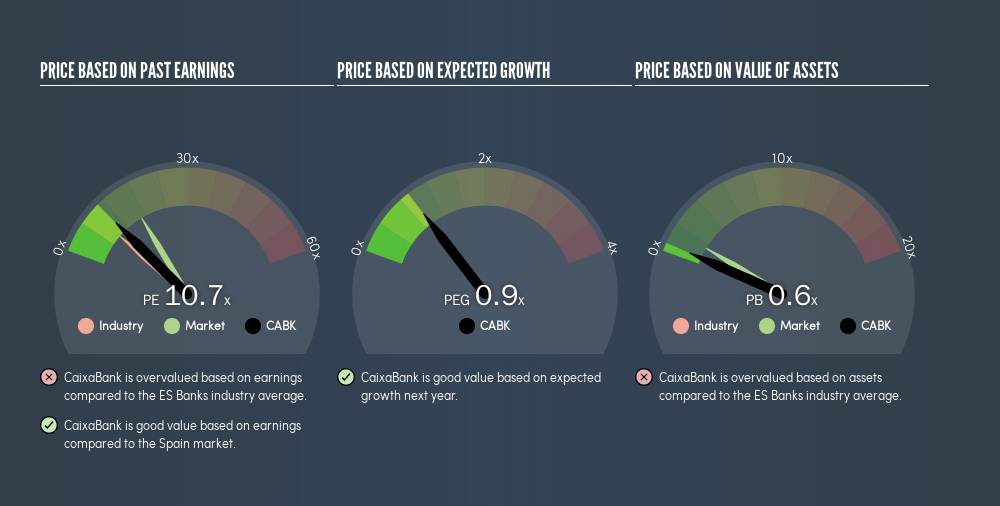

One good way to get a quick read on what market participants expect of a company is to look at its P/E ratio. You can see in the image below that the average P/E (9.1) for companies in the banks industry is lower than CaixaBank's P/E.

That means that the market expects CaixaBank will outperform other companies in its industry.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. Earnings growth means that in the future the 'E' will be higher. That means unless the share price increases, the P/E will reduce in a few years. A lower P/E should indicate the stock is cheap relative to others -- and that may attract buyers.

CaixaBank's earnings per share fell by 40% in the last twelve months. But EPS is up 31% over the last 5 years.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

The 'Price' in P/E reflects the market capitalization of the company. That means it doesn't take debt or cash into account. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

While growth expenditure doesn't always pay off, the point is that it is a good option to have; but one that the P/E ratio ignores.

CaixaBank's Balance Sheet

CaixaBank has net debt worth a very significant 203% of its market capitalization. This is a relatively high level of debt, so the stock probably deserves a relatively low P/E ratio. Keep that in mind when comparing it to other companies.

The Verdict On CaixaBank's P/E Ratio

CaixaBank's P/E is 10.7 which is below average (16.9) in the ES market. Given meaningful debt, and a lack of recent growth, the market looks to be extrapolating this recent performance; reflecting low expectations for the future.

Investors should be looking to buy stocks that the market is wrong about. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine.' So this free visualization of the analyst consensus on future earnings could help you make the right decision about whether to buy, sell, or hold.

But note: CaixaBank may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About BME:CABK

CaixaBank

Provides various banking products and financial services in Spain and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026