Is Now the Right Time to Revisit BBVA Shares After 81.8% Surge in 2024?

Reviewed by Bailey Pemberton

If you have ever scanned a list of European banks looking for breakout stories, Banco Bilbao Vizcaya Argentaria, or BBVA, has almost certainly caught your eye. Deciding what to do with shares after such a significant run can feel daunting. Should you buy, hold tight, or take some profits? Over the past five years, BBVA’s stock has soared by 757.5%, well outpacing much of the sector. More recently, it is up 6.4% over the last month and 81.8% in the past year, while this week’s mild -0.3% dip hardly dents the longer uptrend. All signs point toward an underlying shift as the bank adapts to global market changes, especially with investor sentiment improving around Spanish and emerging market lenders.

For those focused on value, BBVA’s metrics are compelling. The company currently scores a 5 out of 6 on our valuation checklist, indicating it is undervalued in almost all the key criteria we track. That is a rare feat for a bank that has already delivered such impressive returns year-to-date, up 76.6% so far. So, what is behind this valuation rating, and how do traditional models stack up against the unique qualities seen in BBVA’s recent trajectory?

Let’s break down exactly how BBVA performs across common valuation methods. And just when you think you have the full picture, we will look at a smarter way to assess the company’s true value, one that just might change how you see this stock altogether.

Why Banco Bilbao Vizcaya Argentaria is lagging behind its peers

Approach 1: Banco Bilbao Vizcaya Argentaria Excess Returns Analysis

The Excess Returns model evaluates a company by comparing the returns it generates on its equity to the cost of that equity. This helps investors determine whether long-term value is being created above typical market requirements. For Banco Bilbao Vizcaya Argentaria (BBVA), this approach is particularly insightful given its strong recent performance and optimistic analyst projections.

Currently, BBVA boasts a Book Value of €9.51 per share, with a stable Earnings Per Share (EPS) estimate of €2.05 based on the weighted future Return on Equity forecasts from 14 analysts. The Cost of Equity is calculated at €1.10 per share. This means the Excess Return, or the amount by which the company’s returns exceed the cost required by investors, stands at €0.95 per share. BBVA’s average Return on Equity is an impressive 17.68%, and the stable Book Value is projected to reach €11.59 per share, incorporating inputs from eight analyst estimates.

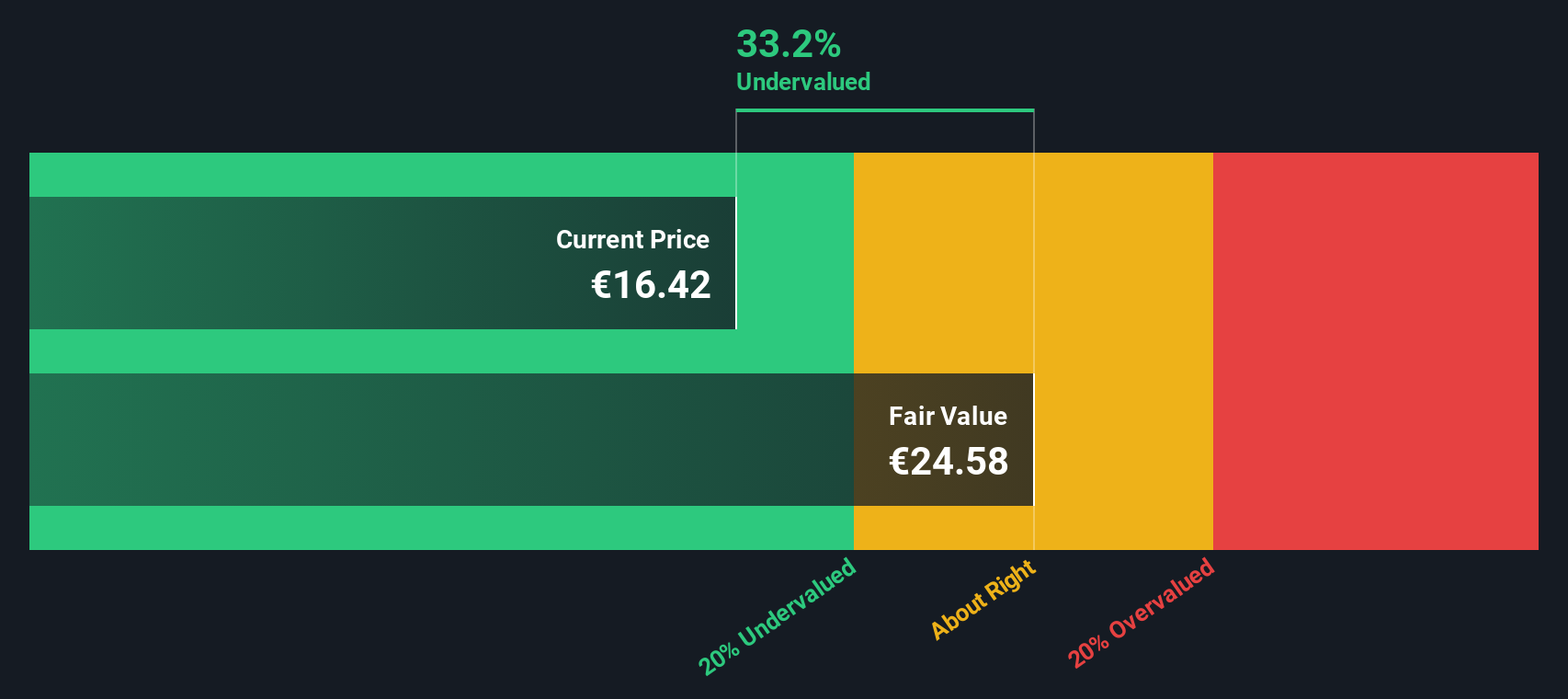

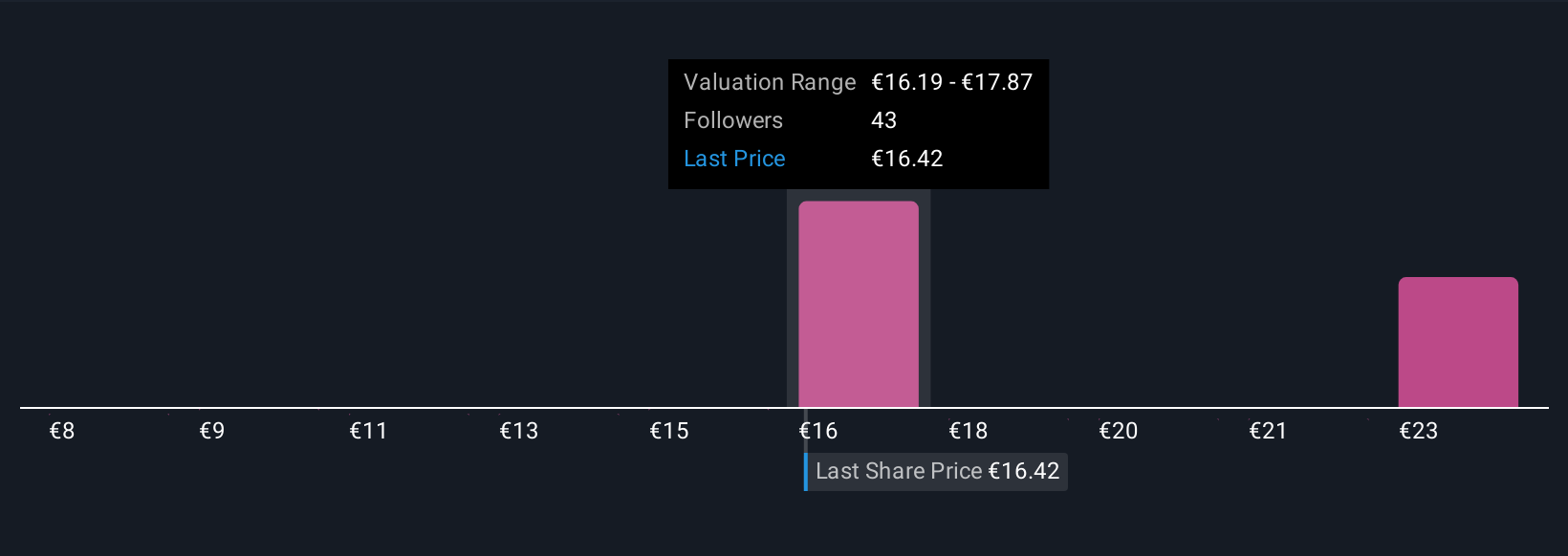

This valuation implies an intrinsic value of €24.58 per share. With the Excess Returns model indicating that BBVA is 33.2% undervalued compared to its current market price, the numbers suggest considerable upside potential if the bank continues delivering at this level.

Result: UNDERVALUED

Our Excess Returns analysis suggests Banco Bilbao Vizcaya Argentaria is undervalued by 33.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Banco Bilbao Vizcaya Argentaria Price vs Earnings

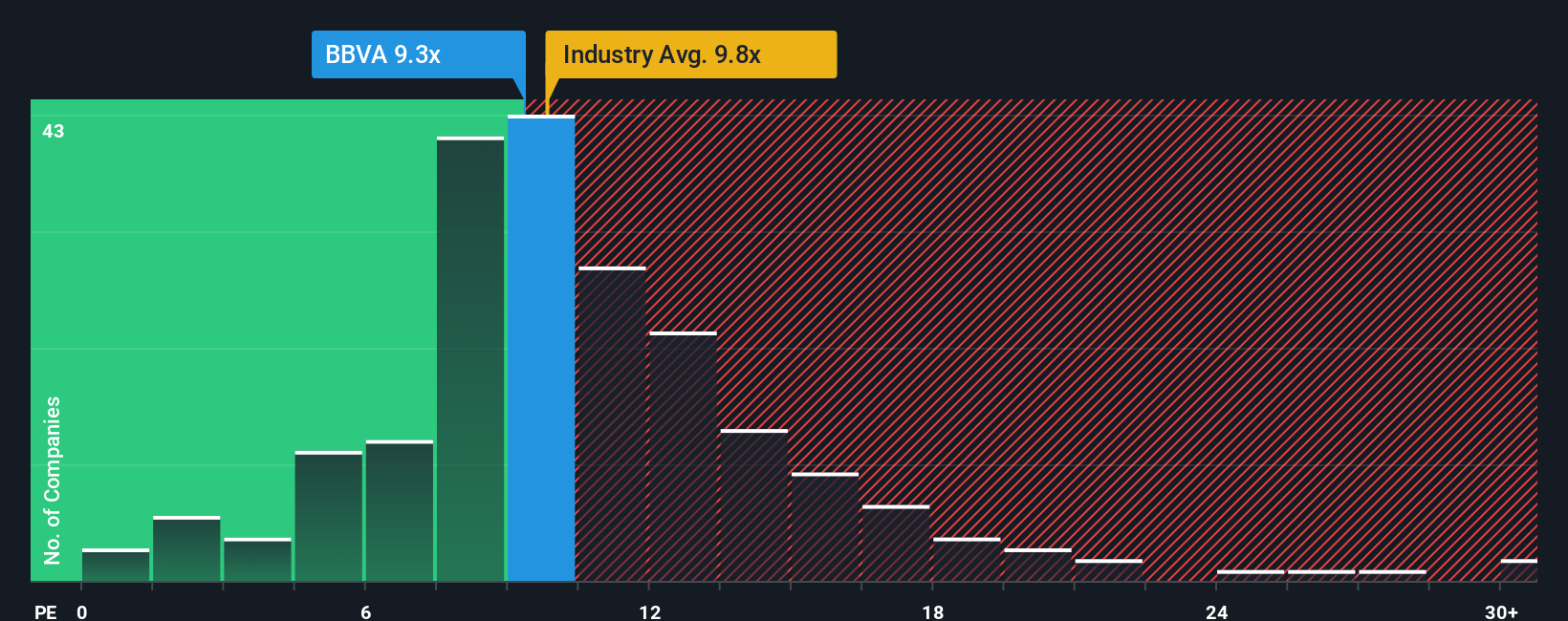

The Price-to-Earnings (PE) ratio is often favored for valuing profitable companies like Banco Bilbao Vizcaya Argentaria, as it directly relates the company’s share price to its actual earnings. The PE ratio reflects not just current profitability, but also the market’s expectations for future growth and the perceived risk of those earnings continuing. In general, higher expected growth or lower risk can justify a higher PE multiple. Lower growth or higher uncertainty typically lead to a lower PE ratio being considered fair.

Currently, BBVA’s PE ratio stands at 9.3x, which is lower than both the industry average of 10.4x and the peer average of 10.7x. At a glance, this may make BBVA seem cheaper than its direct competitors and the broader banking sector. However, because each business has its own unique growth prospects, risk profile, and scale, direct comparisons only tell part of the story.

This is where Simply Wall St’s proprietary Fair Ratio comes in. The Fair Ratio for BBVA is calculated at 11.4x, incorporating not just industry and peer performance, but also BBVA’s own growth outlook, profit margins, size, and financial risks. This makes it a more comprehensive benchmark for judging today's valuation because it goes beyond simple averages to account for company-specific factors that truly drive future returns.

With BBVA trading at 9.3x and its Fair Ratio set at 11.4x, the stock appears attractively priced and suggests investors could be getting worthwhile value for money if the company delivers on its current trajectory.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Banco Bilbao Vizcaya Argentaria Narrative

Earlier, we mentioned there's an even better way to understand a company's value, so let's introduce you to Narratives. A Narrative is your personal storyline about a company, representing your perspective on its future, which you can back up with your own forecasts for revenue, profits, and fair value. Narratives bridge the gap between a company's story and the numbers by tying what you believe about its future to a clear financial forecast, letting you see the fair value that fits your vision.

On Simply Wall St’s Community page, Narratives make these insights simple and accessible, helping millions of investors connect their big picture view to actionable investment decisions. By comparing your Narrative's Fair Value to today’s price, you get a practical framework for when to buy, hold, or consider selling. Narratives also update instantly as new news or results come in, providing timely perspective for your decisions.

For example, some BBVA Narratives assume digital banking growth and emerging market strength will lift future earnings, leading to a higher fair value than consensus. More cautious Narratives see risks from regulation and volatile markets, resulting in much lower fair value estimates. Whichever story you believe, Narratives are your toolkit for making smarter, more dynamic decisions.

Do you think there's more to the story for Banco Bilbao Vizcaya Argentaria? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco Bilbao Vizcaya Argentaria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:BBVA

Banco Bilbao Vizcaya Argentaria

Provides retail banking, wholesale banking, and asset management services primarily in Spain, Mexico, Turkey, South America, rest of Europe, the United States, and Asia.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives