Does BBVA’s (BME:BBVA) Buyback Reveal Strategic Confidence After the Failed Sabadell Bid?

Reviewed by Sasha Jovanovic

- Earlier this month, Banco Bilbao Vizcaya Argentaria (BBVA) ended its lengthy attempt to acquire Banco Sabadell after failing to secure sufficient shareholder support for its $19 billion offer.

- In response, BBVA promptly announced a €1 billion share buyback and a record interim dividend, highlighting its focus on rewarding investors and maintaining financial strength despite the halted deal.

- We'll explore how BBVA's swift launch of a major share buyback could influence its investment narrative and future outlook.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Banco Bilbao Vizcaya Argentaria Investment Narrative Recap

To be a BBVA shareholder, you generally need to believe in the bank’s strength across Spain and its emerging market presence, underpinned by disciplined cost control and digital innovation. The end of the Sabadell bid doesn’t materially alter the main short-term catalyst, continued shareholder returns, but it could reduce some execution risk, while the key risk remains the exposure to volatile emerging markets, especially Mexico and Turkey.

BBVA’s announced €1 billion share buyback is the most relevant recent development, as it underscores ongoing capital returns following the dropped merger. This move aims to reinforce investor confidence and aligns with the consistent dividend increases seen throughout 2025.

By contrast, investors should also be aware of the risk related to BBVA’s significant operations in emerging markets, where political and currency shifts...

Read the full narrative on Banco Bilbao Vizcaya Argentaria (it's free!)

Banco Bilbao Vizcaya Argentaria's narrative projects €39.4 billion revenue and €11.4 billion earnings by 2028. This requires 7.9% yearly revenue growth and a €1.3 billion earnings increase from €10.1 billion today.

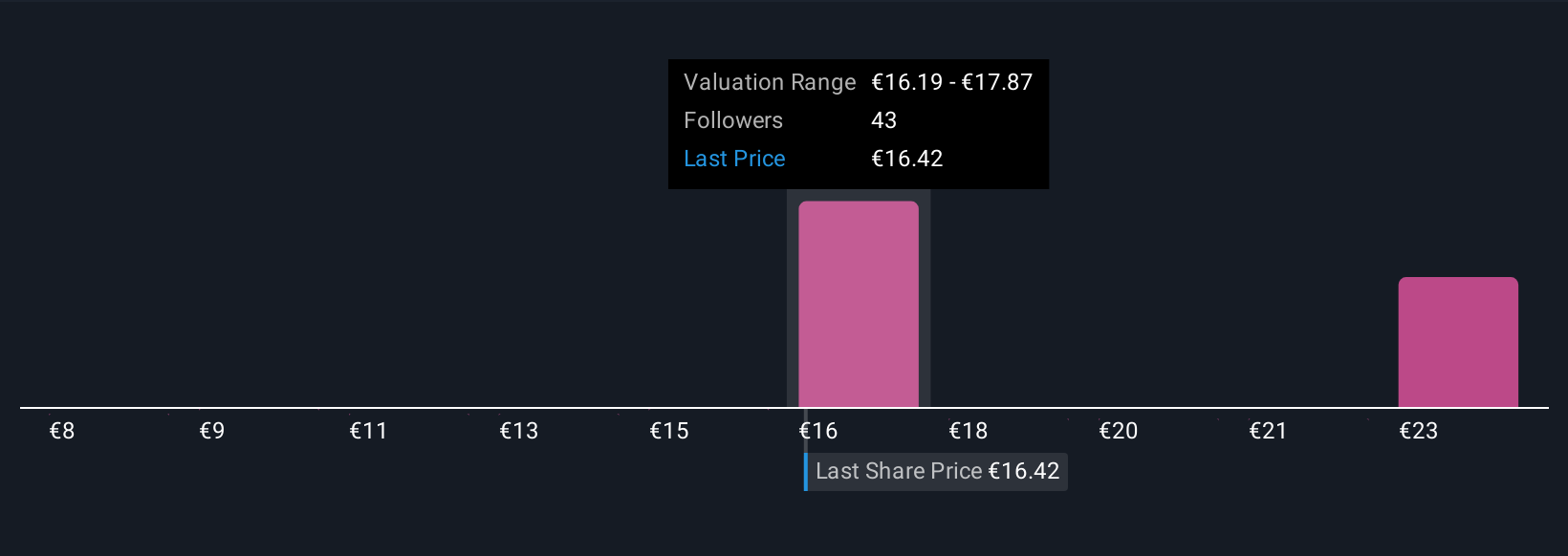

Uncover how Banco Bilbao Vizcaya Argentaria's forecasts yield a €16.90 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members have published nine fair value estimates for BBVA, ranging widely from €10.20 up to €24.14 per share. Against this diversity of views, the risk of macroeconomic and currency volatility in BBVA’s key emerging markets remains a major consideration for long-term performance.

Explore 9 other fair value estimates on Banco Bilbao Vizcaya Argentaria - why the stock might be worth as much as 42% more than the current price!

Build Your Own Banco Bilbao Vizcaya Argentaria Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Banco Bilbao Vizcaya Argentaria research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Banco Bilbao Vizcaya Argentaria research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Banco Bilbao Vizcaya Argentaria's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco Bilbao Vizcaya Argentaria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:BBVA

Banco Bilbao Vizcaya Argentaria

Provides retail banking, wholesale banking, and asset management services primarily in Spain, Mexico, Turkey, South America, rest of Europe, the United States, and Asia.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives