Amidst ongoing concerns about U.S. trade tariffs and economic growth, European markets have experienced a mix of declines and modest gains, with the pan-European STOXX Europe 600 Index ending slightly lower. In this environment of uncertainty, dividend stocks can offer a measure of stability and income potential for investors seeking resilient returns.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.48% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.15% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.50% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.76% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.35% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.32% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 8.03% | ★★★★★★ |

| VERBUND (WBAG:VER) | 5.80% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.61% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.81% | ★★★★★☆ |

Click here to see the full list of 231 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Banco Bilbao Vizcaya Argentaria (BME:BBVA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco Bilbao Vizcaya Argentaria, S.A. is a financial institution offering retail banking, wholesale banking, and asset management services across Spain, Mexico, Turkey, South America, Europe, the United States, and Asia with a market cap of €78.20 billion.

Operations: Banco Bilbao Vizcaya Argentaria's revenue segments include €12.24 billion from Mexico, €3.69 billion from Turkey, €4.04 billion from South America, and €8.81 billion from Spain (including Non-Core Real Estate).

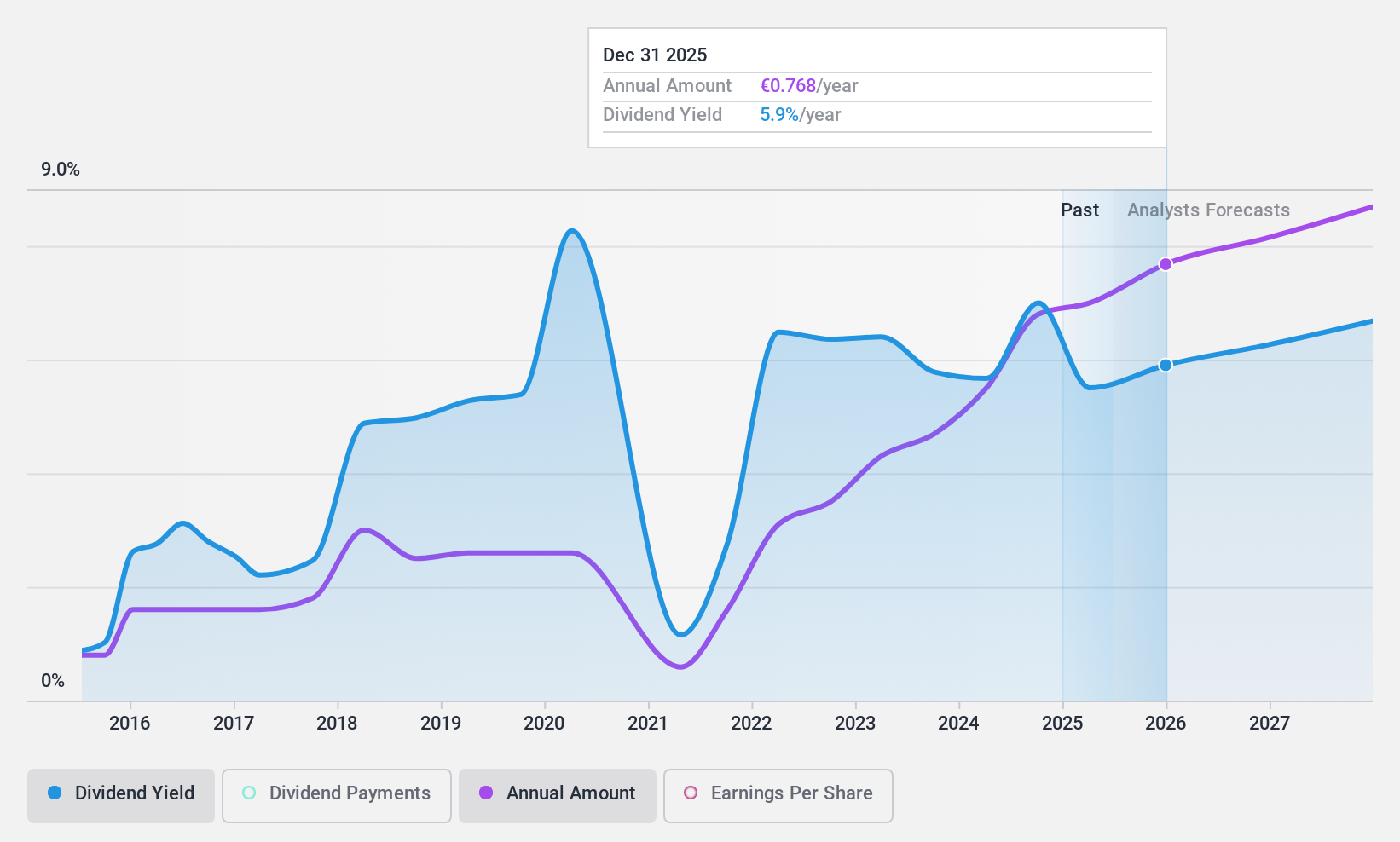

Dividend Yield: 5.2%

Banco Bilbao Vizcaya Argentaria (BBVA) offers an attractive dividend proposition, though not without concerns. The recent announcement of a €0.41 per share cash distribution highlights its commitment to shareholder returns, with dividends well-covered by earnings at a 41.8% payout ratio. Despite this, BBVA's dividend history is marked by volatility and unreliability over the past decade. Its recent earnings growth of 26% and trading below estimated fair value may appeal to value-focused investors despite high bad loan levels at 3.2%.

- Delve into the full analysis dividend report here for a deeper understanding of Banco Bilbao Vizcaya Argentaria.

- The valuation report we've compiled suggests that Banco Bilbao Vizcaya Argentaria's current price could be quite moderate.

SIMONA (DB:SIM0)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SIMONA Aktiengesellschaft is a global company that develops, manufactures, and markets semi-finished thermoplastics, pipes, fittings, and profiles with a market cap of €315 million.

Operations: SIMONA Aktiengesellschaft generates revenue primarily from its segment of semi-finished plastics and pipes, as well as fittings and finished parts, totaling €578.85 million.

Dividend Yield: 3.5%

SIMONA's dividend payments have increased over the past decade, supported by a low payout ratio of 35.7%, indicating strong earnings and cash flow coverage. However, its dividends have been volatile and unreliable, with significant annual drops exceeding 20%. Trading at 74% below estimated fair value may attract investors seeking undervalued opportunities. Despite a modest yield of 3.49%, lower than Germany's top dividend payers, SIMONA's financial stability is underscored by consistent earnings growth of 9.6% annually over five years.

- Navigate through the intricacies of SIMONA with our comprehensive dividend report here.

- According our valuation report, there's an indication that SIMONA's share price might be on the cheaper side.

G5 Entertainment (OM:G5EN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: G5 Entertainment AB (publ) is a Swedish company that develops and publishes free-to-play games for smartphones, tablets, and personal computers, with a market cap of SEK1.05 billion.

Operations: G5 Entertainment AB (publ) generates revenue of SEK1.13 billion from the development and sales of casual games.

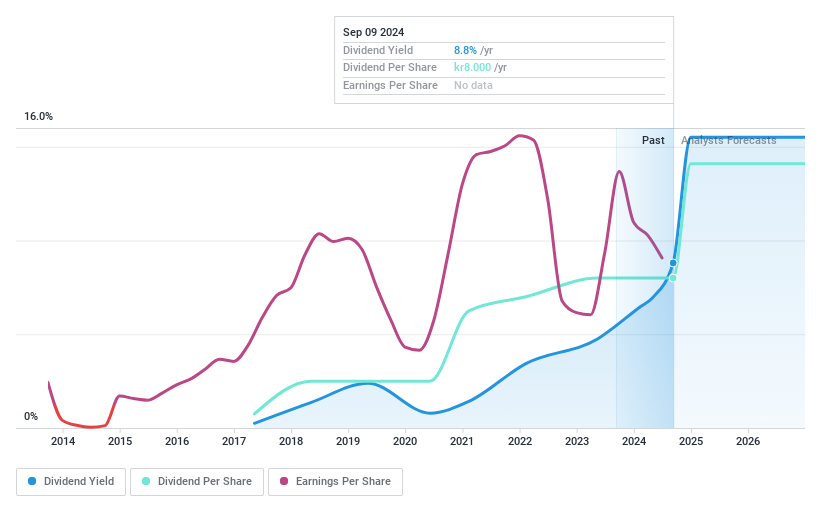

Dividend Yield: 6%

G5 Entertainment offers a dividend yield of 5.95%, placing it in the top 25% of Swedish dividend payers. The company maintains a sustainable payout ratio of 52.5%, with cash flows covering dividends at a low cash payout ratio of 35%. Despite only eight years of dividend history, payments have been reliable and stable. Recent earnings results show net income growth, although sales decreased year-over-year, influencing its strategy to reinvest profits for organic growth while proposing an SEK 8.0 per share dividend.

- Get an in-depth perspective on G5 Entertainment's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that G5 Entertainment is trading behind its estimated value.

Where To Now?

- Embark on your investment journey to our 231 Top European Dividend Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Banco Bilbao Vizcaya Argentaria, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Banco Bilbao Vizcaya Argentaria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:BBVA

Banco Bilbao Vizcaya Argentaria

Provides retail banking, wholesale banking, and asset management services primarily in Spain, Mexico, Turkey, South America, rest of Europe, the United States, and Asia.

Undervalued with proven track record and pays a dividend.