- Egypt

- /

- Infrastructure

- /

- CASE:ALCN

Three Solid Dividend Stocks Offering Up To 6.3% Yield

Reviewed by Simply Wall St

As global markets exhibit mixed signals with modest gains in the U.S. and challenges in sectors like Chinese real estate, investors are keenly observing opportunities for stable returns. In this context, dividend stocks emerge as appealing options, offering potential resilience and consistent yield amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.30% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 7.34% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.49% | ★★★★★★ |

| Huntington Bancshares (NasdaqGS:HBAN) | 4.86% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.75% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 5.96% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.02% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.44% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.12% | ★★★★★★ |

| Innotech (TSE:9880) | 3.99% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

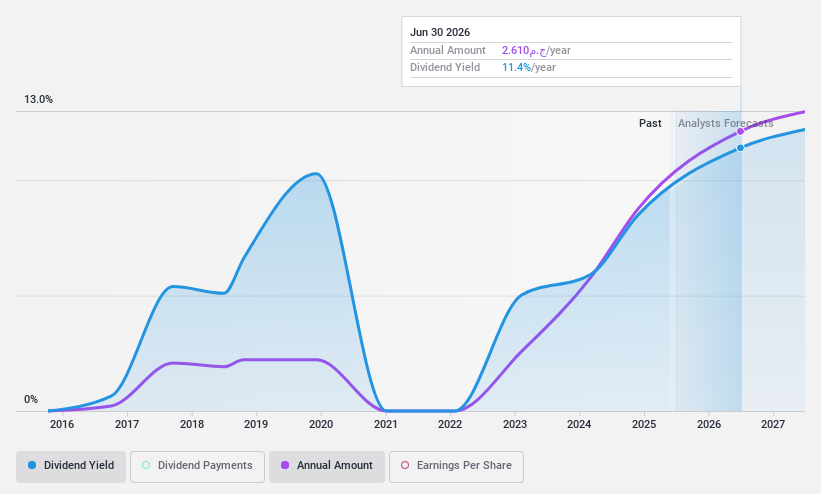

Alexandria Container&Cargo Handling (CASE:ALCN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Alexandria Container & Cargo Handling Company specializes in container handling services in Egypt, with a market capitalization of EGP 64.06 billion.

Operations: Alexandria Container & Cargo Handling Company generates its revenue primarily through specialized container handling operations in Egypt.

Dividend Yield: 5.8%

Alexandria Container & Cargo Handling reported a significant increase in sales and net income for the nine months ending March 2024, with sales rising to EGP 4.18 billion and net income to EGP 4.08 billion. Despite this growth, the company's dividend sustainability is under pressure, evidenced by a high cash payout ratio of 90.7% and concerns about dividend coverage by earnings. However, ALCN has maintained reliable and growing dividends over the past decade, though its current yield of 5.79% lags behind Egypt's top dividend payers.

- Get an in-depth perspective on Alexandria Container&Cargo Handling's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Alexandria Container&Cargo Handling is priced higher than what may be justified by its financials.

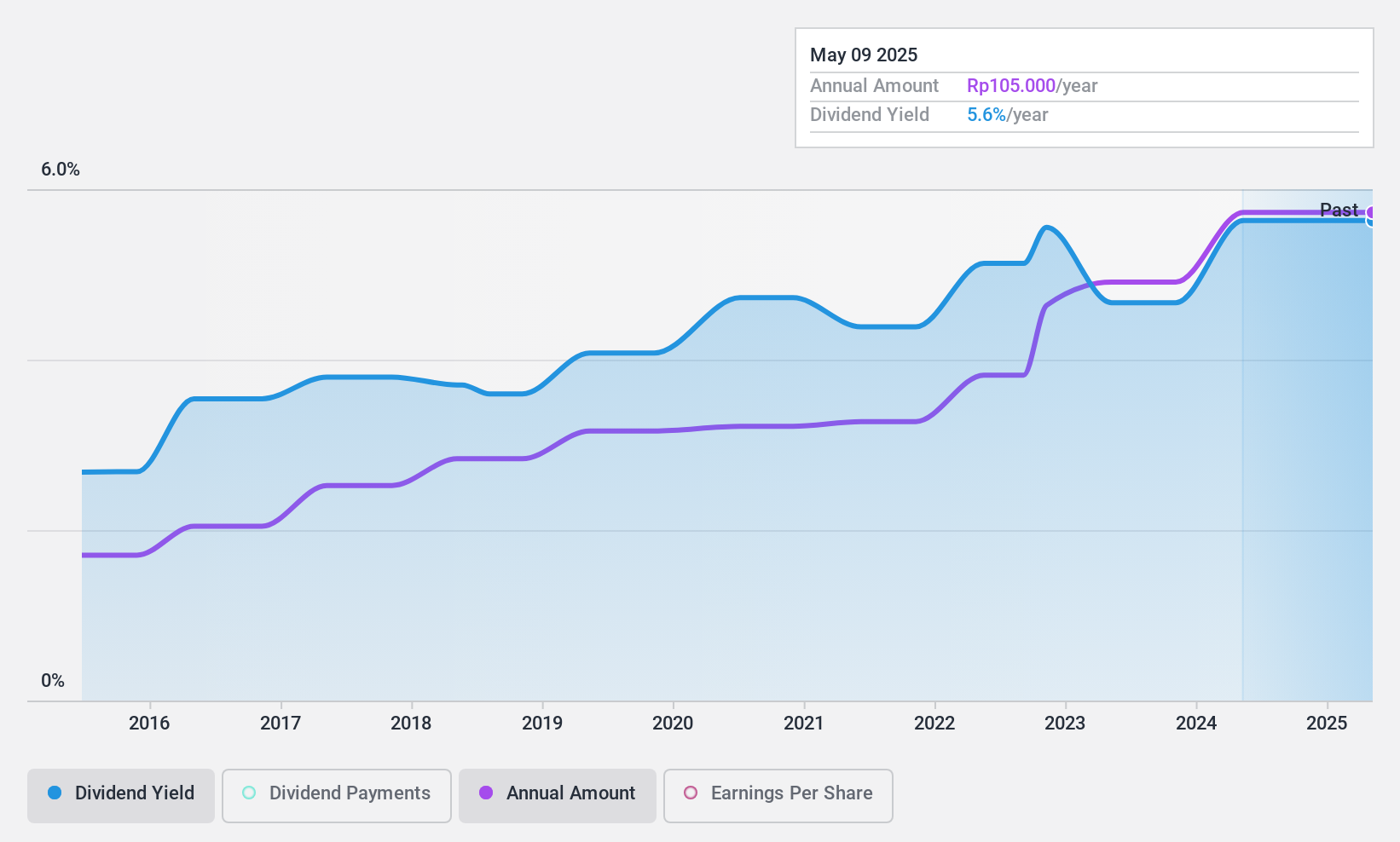

Selamat Sempurna (IDX:SMSM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PT Selamat Sempurna Tbk specializes in manufacturing and selling tools or equipment for vehicles, heavy equipment, and other machinery, with a market capitalization of approximately IDR 10.60 billion.

Operations: PT Selamat Sempurna Tbk generates revenue primarily through its Filter, Trading, Radiator, and Body Maker segments, with earnings of IDR 3.68 billion, IDR 1.46 billion, IDR 0.47 billion, and IDR 0.32 billion respectively.

Dividend Yield: 5.7%

Selamat Sempurna has demonstrated a consistent ability to increase and sustain its dividends, marked by a 10-year history of stable and growing payouts. The company's dividends are well-supported by both earnings, with a payout ratio of 49.1%, and cash flows, reflected in a cash payout ratio of 66.7%. Despite trading at 24.6% below its estimated fair value and offering a dividend yield of 5.71%, this yield is somewhat lower compared to the top quartile in the Indonesian market. Recent financials show a slight decline in quarterly net income year-over-year but robust annual growth with earnings up significantly from the previous year.

- Unlock comprehensive insights into our analysis of Selamat Sempurna stock in this dividend report.

- Our expertly prepared valuation report Selamat Sempurna implies its share price may be lower than expected.

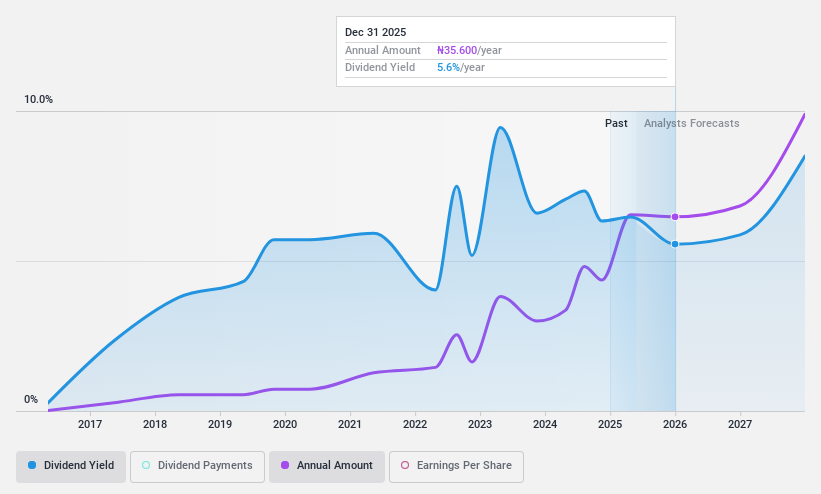

Okomu Oil Palm (NGSE:OKOMUOIL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Okomu Oil Palm Company Plc, operating in Nigeria, focuses on the cultivation and plantation of oil palm and rubber, with a market capitalization of approximately NGN 278.06 billion.

Operations: Okomu Oil Palm Company Plc generates its revenue primarily from the cultivation of oil palm and rubber in Nigeria.

Dividend Yield: 6.3%

Okomu Oil Palm reported a substantial increase in Q1 2024 sales to NGN 43.48 billion and net income to NGN 15.08 billion, with earnings per share rising to NGN 15.81. Despite this growth, the company's dividend history is marked by volatility over the past decade, challenging its reliability as a consistent dividend payer. Its recent cash dividend was set at NGN 14.0 on April 1, 2024. The dividends are covered by earnings and cash flows with payout ratios of 69.1% and 63.7%, respectively; however, its yield of 6.35% lags behind the top quartile in the Nigerian market at over 7%.

- Navigate through the intricacies of Okomu Oil Palm with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Okomu Oil Palm's current price could be inflated.

Seize The Opportunity

- Take a closer look at our Top Dividend Stocks list of 1970 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CASE:ALCN

Alexandria Container&Cargo Handling

Provides container handling services in Egypt.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives