- Denmark

- /

- Renewable Energy

- /

- CPSE:ORSTED

Ørsted (CPSE:ORSTED) Valuation in Focus Following Major Equity Offering Announcement

Reviewed by Kshitija Bhandaru

Ørsted (CPSE:ORSTED) just made a move that has everyone in the market talking. The company’s announcement of a massive follow-on equity offering—nearly DKK 60 billion in new shares—signals a clear intent to raise substantial capital. For investors, this kind of capital raising isn’t just about strengthening the balance sheet, it often means management is laying the groundwork for future expansion or tackling emerging risks head-on. When a leading energy player taps the market at this scale, the implications for shareholder value and growth strategy become impossible to ignore.

This announcement follows a year of choppy price action for Ørsted’s stock. Shares have seen momentum wane, with the price down roughly 56% over the past year and sliding further in recent months. Other strategic moves and market pressures have also made headlines, but none have matched the scale or potential impact of this equity offering. Investors watching the stock’s long slide are now left balancing the risks and opportunities that fresh capital could bring to the business and its valuation.

So, after a tough year that has seen Ørsted’s shares battered, is the market overlooking a genuine buying opportunity, or is every ounce of future growth already baked into the price?

Price-to-Earnings of 7.5x: Is it justified?

Based on the price-to-earnings ratio, Ørsted appears significantly undervalued relative to its European renewable energy peers, trading at just half their average multiple.

The price-to-earnings ratio (P/E) compares a company’s share price to its per-share earnings. It provides a snapshot of how the market is valuing current profits. For renewable energy firms like Ørsted, this measure helps investors judge if the stock offers a bargain or trades at a premium compared to competitors.

The notably low P/E signals that the market may be discounting Ørsted’s future growth prospects or perhaps factoring in uncertainties around profitability or industry challenges. The key question is whether the low multiple is warranted by fundamentals or if the market has been too pessimistic.

Result: Fair Value of $261.02 (UNDERVALUED)

See our latest analysis for Ørsted.However, ongoing industry challenges and potential profit headwinds could limit multiple expansion. As a result, investor caution may remain elevated despite the current discount.

Find out about the key risks to this Ørsted narrative.Another View: What Does the SWS DCF Model Say?

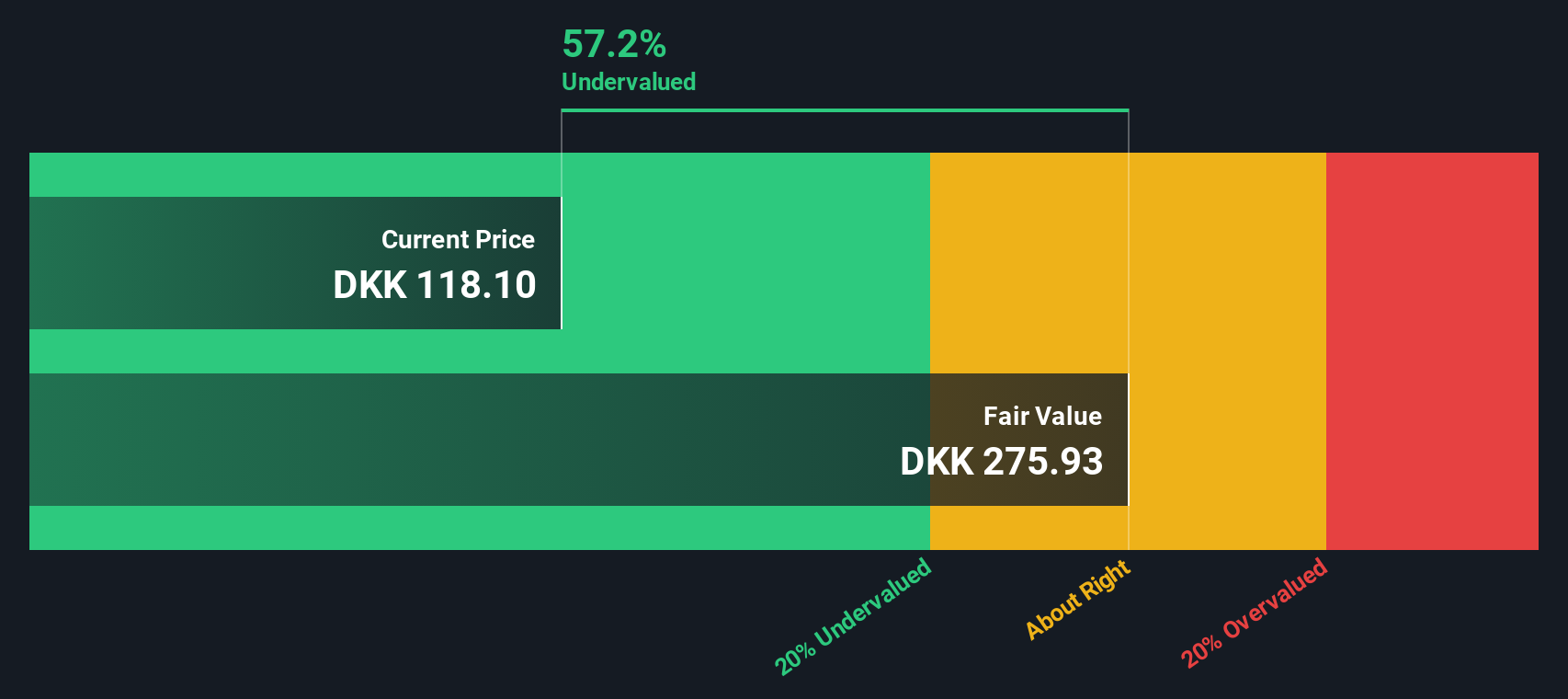

Looking from a different angle, our SWS DCF model also points to the shares being undervalued at current levels. While multiples look cheap, the DCF reinforces that potential value exists. However, can either approach fully capture the risks and upside in this changing market?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ørsted Narrative

If you have a different perspective or want to dive deeper into the numbers on your own, you can shape your own view in just a few minutes: Do it your way.

A great starting point for your Ørsted research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to get ahead of the curve. Use these powerful tools to spot standout opportunities and invest confidently in tomorrow’s winners:

- Tap into the world of transformational tech by finding quantum computing stocks, which is driving the next wave of innovation.

- Unlock steady income streams with market leaders offering dividend stocks with yields > 3% and watch your returns grow with resilient payouts.

- Unearth hidden gems trading at attractive prices by checking out undervalued stocks based on cash flows that could deliver real long-term value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ørsted might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:ORSTED

Ørsted

Owns, develops, constructs, and operates offshore and onshore wind farms, solar farms, energy storage and renewable hydrogen facilities, and bioenergy plants.

Good value with low risk.

Similar Companies

Market Insights

Community Narratives