- Denmark

- /

- Renewable Energy

- /

- CPSE:ORSTED

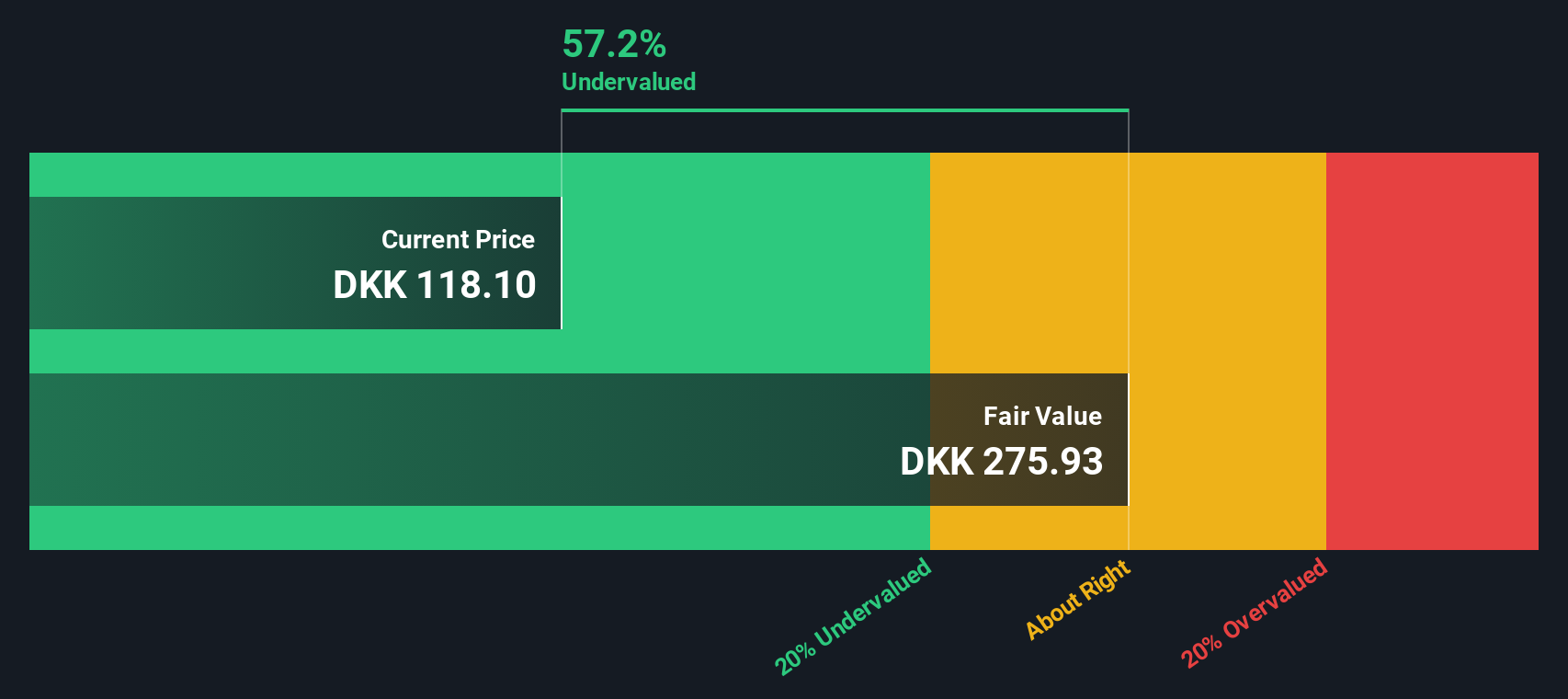

Ørsted (CPSE:ORSTED) Valuation After US Court Overturns Trump-Era Ban on New Wind Projects

Reviewed by Simply Wall St

A US federal court overturning Donald Trump’s ban on new wind projects has given Ørsted (CPSE:ORSTED) a timely sentiment boost, lifting the stock and refocusing attention on its long term US offshore wind pipeline.

See our latest analysis for Ørsted.

The latest ruling arrives after a bruising stretch for Ørsted, with a roughly 11 percent 1 month share price return offering a rebound against a steep year to date slide and weak multi year total shareholder returns. This hints that sentiment may be stabilising rather than decisively turning.

If this legal win has you rethinking the broader clean energy and infrastructure space, it could be worth exploring fast growing stocks with high insider ownership as potential fresh ideas beyond the usual names.

With Ørsted trading only a fraction below analyst targets after heavy long term share price damage but improving growth optics, is this legal tailwind the start of a rerating, or has the market already priced in a recovery?

Price-to-Sales of 2.5x: Is it justified?

On a price-to-sales ratio of 2.5x at the last close of DKK136.25, Ørsted looks modestly valued versus peers despite its bruising share price history.

The price-to-sales multiple compares the company’s market value to its annual revenue, a useful lens for loss making or volatile profit renewable players like Ørsted. With the group still unprofitable but expected to return to the black over the next three years, investors are effectively paying for top line scale today and anticipated margin repair rather than current earnings.

Against that backdrop, trading at 2.5x sales looks restrained when set beside both peer and industry benchmarks. It is materially below the peer group average of 5.6x, suggesting the market is heavily discounting Ørsted’s growth and execution prospects, and even slightly below the wider European renewable energy industry at 2.6x, underlining how sceptically its turnaround story is being priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 2.5x (UNDERVALUED)

However, lingering execution missteps or further US policy reversals on offshore wind could swiftly capsize optimism around Ørsted’s recovery and valuation reset.

Find out about the key risks to this Ørsted narrative.

Another View Using Our DCF Model

Our DCF model paints a much harsher picture, suggesting fair value near DKK60.88, well below the current DKK136.25. That implies Ørsted could be significantly overvalued on cash flows, even if sales-based metrics look cheap. The question for investors is which lens to prioritize.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ørsted for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ørsted Narrative

If you see the story differently or want to dive into the numbers yourself, you can easily build a personalised view in minutes: Do it your way.

A great starting point for your Ørsted research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity. Use the Simply Wall Street Screener to uncover fresh, data driven stock ideas that others may only notice once it is too late.

- Look for potential multibaggers early by scanning these 3598 penny stocks with strong financials with strong balance sheets and fundamentals that could support long term returns.

- Explore opportunities in the next tech wave by targeting these 26 AI penny stocks exposed to structural demand for automation, machine learning, and intelligent software.

- Identify attractive income opportunities by focusing on these 12 dividend stocks with yields > 3% that offer regular payouts alongside solid underlying businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ørsted might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:ORSTED

Ørsted

Owns, develops, constructs, and operates offshore and onshore wind farms, solar farms, energy storage and renewable hydrogen facilities, and bioenergy plants.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion