- Denmark

- /

- Transportation

- /

- CPSE:NTG

Here's Why I Think NTG Nordic Transport Group (CPH:NTG) Might Deserve Your Attention Today

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like NTG Nordic Transport Group (CPH:NTG). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for NTG Nordic Transport Group

NTG Nordic Transport Group's Improving Profits

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. You can imagine, then, that it almost knocked my socks off when I realized that NTG Nordic Transport Group grew its EPS from kr.1.56 to kr.13.44, in one short year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement. Could this be a sign that the business has reached an inflection point?

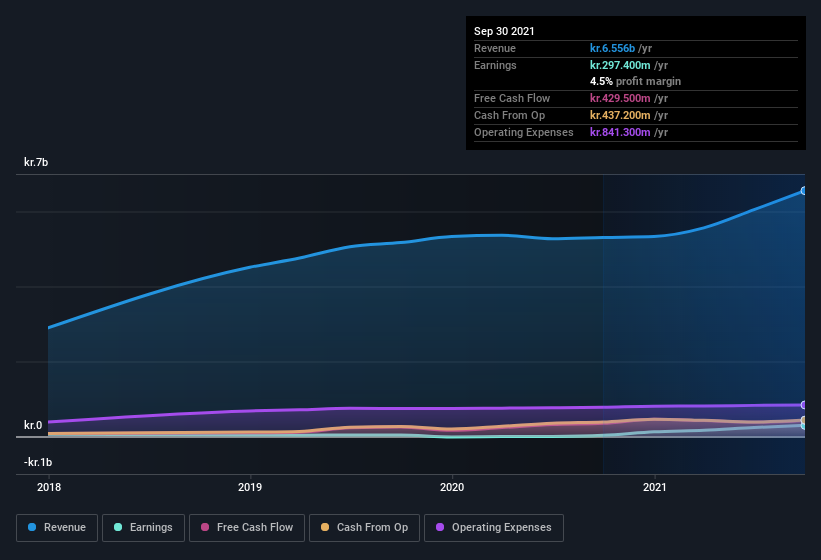

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that NTG Nordic Transport Group is growing revenues, and EBIT margins improved by 2.6 percentage points to 7.1%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are NTG Nordic Transport Group Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. As a result, I'm encouraged by the fact that insiders own NTG Nordic Transport Group shares worth a considerable sum. Indeed, they have a glittering mountain of wealth invested in it, currently valued at kr.3.4b. That equates to 29% of the company, making insiders powerful and aligned with other shareholders. So it might be my imagination, but I do sense the glimmer of an opportunity.

Does NTG Nordic Transport Group Deserve A Spot On Your Watchlist?

NTG Nordic Transport Group's earnings per share have taken off like a rocket aimed right at the moon. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So yes, on this short analysis I do think it's worth considering NTG Nordic Transport Group for a spot on your watchlist. Once you've identified a business you like, the next step is to consider what you think it's worth. And right now is your chance to view our exclusive discounted cashflow valuation of NTG Nordic Transport Group. You might benefit from giving it a glance today.

Although NTG Nordic Transport Group certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if NTG Nordic Transport Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:NTG

NTG Nordic Transport Group

Provides asset-light freight forwarding services through road, rail, air, and ocean in Denmark, Sweden, the United States, Germany, Finland, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives