In a week marked by busy earnings reports and mixed economic data, global markets showed volatility with major indices like the Nasdaq Composite and S&P 500 experiencing fluctuations. Amidst this backdrop, investors often turn to dividend stocks for their potential to provide steady income streams, especially when growth stocks lag behind value shares. In such times, selecting dividend stocks that demonstrate strong fundamentals and consistent payout histories can be a prudent strategy for maintaining stability in one's portfolio.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Mitsubishi Shokuhin (TSE:7451) | 3.86% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.69% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.12% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.97% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.16% | ★★★★★★ |

| Innotech (TSE:9880) | 4.86% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.57% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.79% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

Click here to see the full list of 2039 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

CaixaBank (BME:CABK)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: CaixaBank, S.A. offers a range of banking products and financial services in Spain and internationally, with a market cap of approximately €41.11 billion.

Operations: CaixaBank, S.A. generates revenue through a diverse array of banking products and financial services offered both domestically in Spain and internationally.

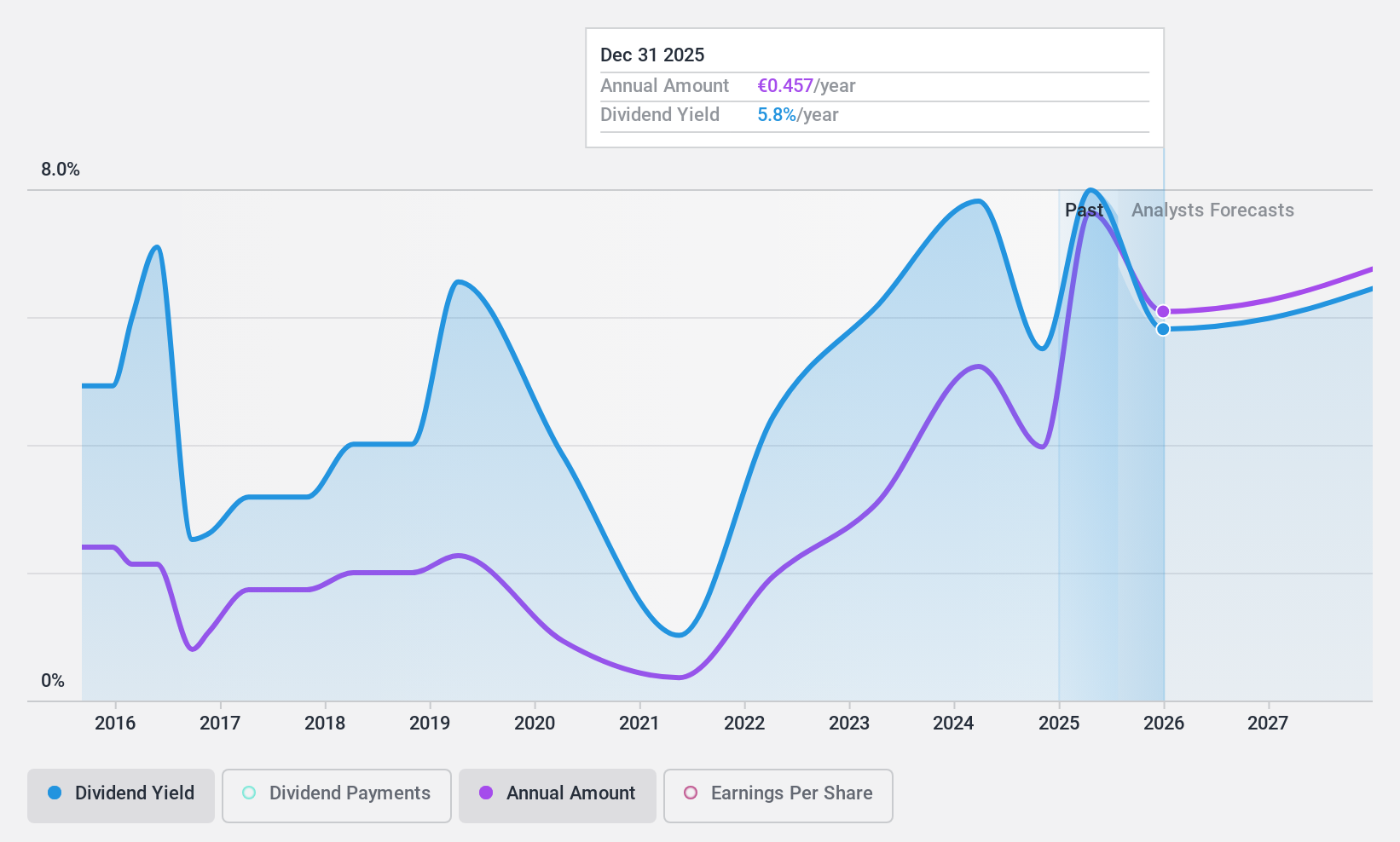

Dividend Yield: 6.9%

CaixaBank's dividend yield of 7.01% ranks in the top 25% of Spanish dividend payers, aided by a payout ratio of 57%, indicating coverage by earnings. However, its dividends have been volatile over the past decade, with periods of significant drops. Recent earnings growth and strong net income figures suggest potential stability, yet high bad loans at 2.6% pose a risk. The bank's recent fixed-income offerings highlight ongoing capital management efforts amidst these challenges.

- Click to explore a detailed breakdown of our findings in CaixaBank's dividend report.

- In light of our recent valuation report, it seems possible that CaixaBank is trading beyond its estimated value.

A.P. Møller - Mærsk (CPSE:MAERSK B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: A.P. Møller - Mærsk A/S, along with its subsidiaries, operates in the ocean transport and logistics sector both in Denmark and globally, with a market cap of DKK172.96 billion.

Operations: A.P. Møller - Mærsk A/S generates its revenue primarily from its ocean transport and logistics operations worldwide.

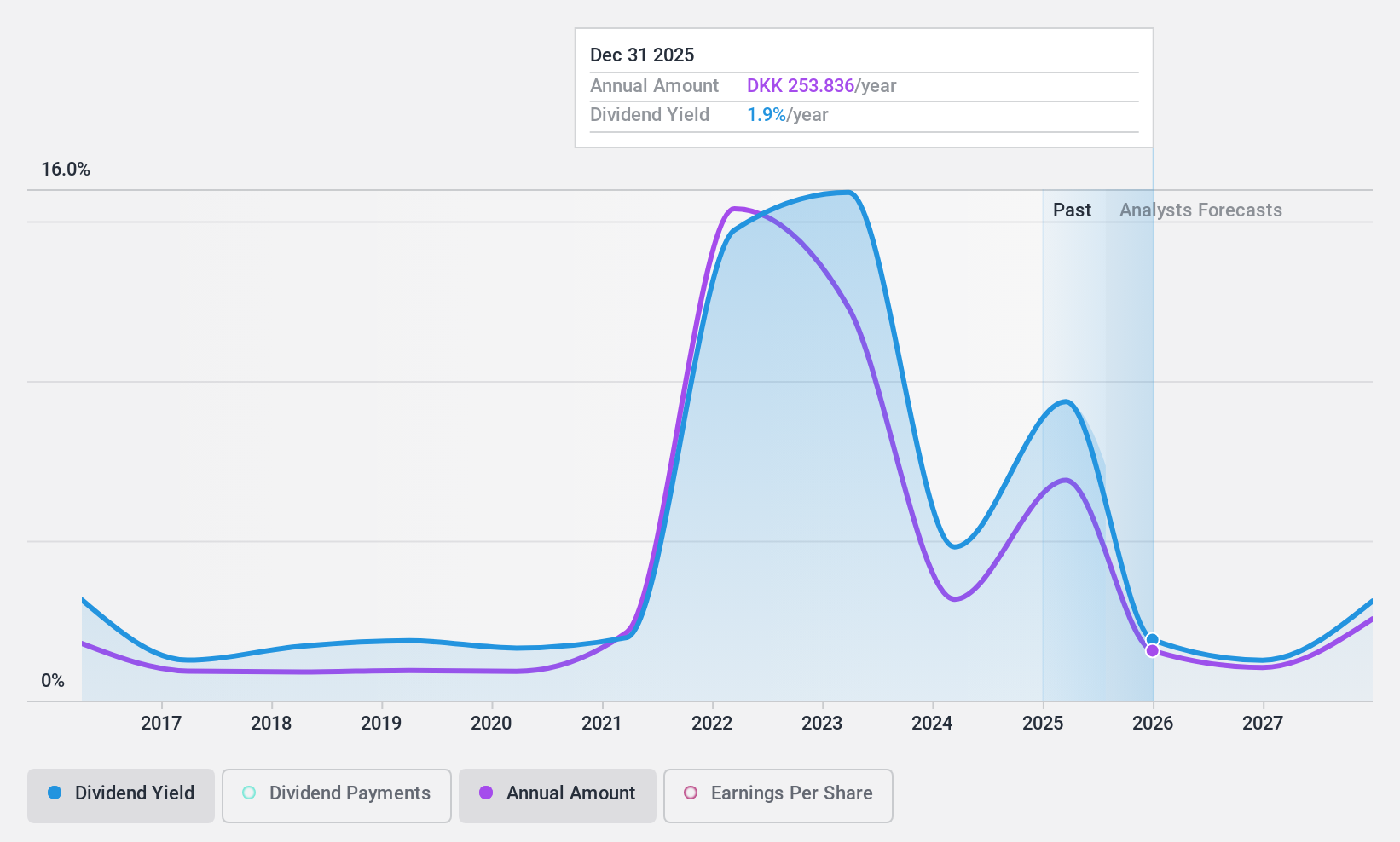

Dividend Yield: 4.5%

A.P. Møller - Mærsk's dividend yield of 4.49% is below the top tier in Denmark, but its payout ratio of 33.9% indicates dividends are well-covered by earnings and cash flows. Despite recent earnings growth, profit margins have decreased to 6.8%. The company's dividend history shows volatility over the past decade, although payments have increased during this period. Recent financial guidance revisions reflect a stronger outlook with EBIT expected between US$5.2 billion and US$5.7 billion for 2024.

- Dive into the specifics of A.P. Møller - Mærsk here with our thorough dividend report.

- According our valuation report, there's an indication that A.P. Møller - Mærsk's share price might be on the expensive side.

Kuriyama Holdings (TSE:3355)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kuriyama Holdings Corporation operates through its subsidiaries in industrial, construction, sports facility, and other materials sectors both in Japan and internationally, with a market cap of ¥24.57 billion.

Operations: Kuriyama Holdings Corporation's revenue is primarily derived from its North America segment at ¥42.72 billion, followed by the Asian Business - Industry Materials at ¥18.21 billion, the Asian Business - Sports and Construction Materials Business at ¥9.27 billion, and the Europe, South America and Oceania Business contributing ¥6.81 billion.

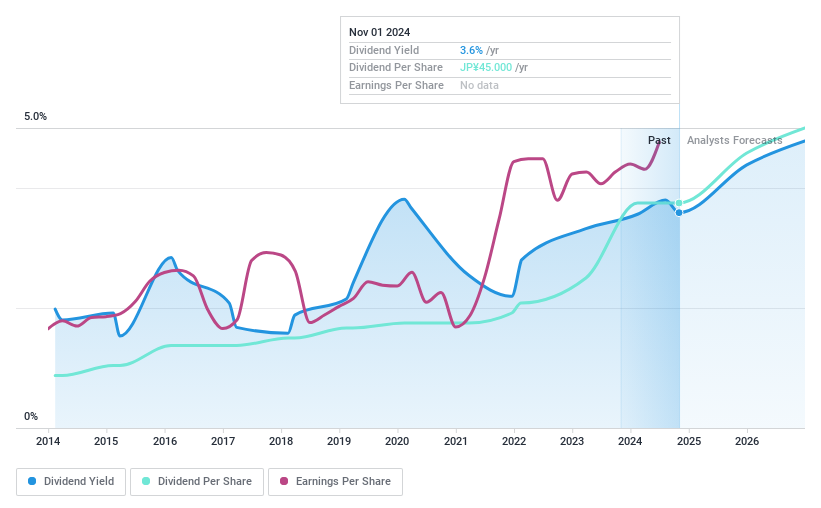

Dividend Yield: 3.6%

Kuriyama Holdings offers a stable dividend history with payments growing over the past decade. Its current yield of 3.59% is slightly below Japan's top-tier payers, but dividends are well-covered by earnings and cash flows, with payout ratios at 29.8% and 17.4%, respectively. The stock trades at a favorable price-to-earnings ratio of 6x compared to the market's 13.3x, though future earnings may face slight declines in coming years due to one-off items impacting results.

- Click here to discover the nuances of Kuriyama Holdings with our detailed analytical dividend report.

- The analysis detailed in our Kuriyama Holdings valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Click this link to deep-dive into the 2039 companies within our Top Dividend Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:CABK

CaixaBank

Provides various banking products and financial services in Spain and internationally.

Established dividend payer with proven track record.