Netcompany Group A/S' (CPH:NETC) CEO Will Probably Have Their Compensation Approved By Shareholders

We have been pretty impressed with the performance at Netcompany Group A/S (CPH:NETC) recently and CEO Andre Rogaczewski deserves a mention for their role in it. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 02 March 2022. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

View our latest analysis for Netcompany Group

How Does Total Compensation For Andre Rogaczewski Compare With Other Companies In The Industry?

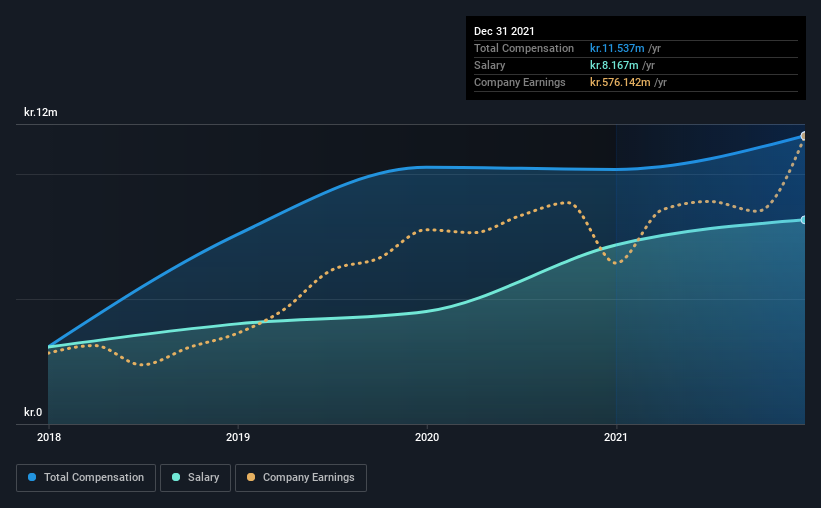

Our data indicates that Netcompany Group A/S has a market capitalization of kr.21b, and total annual CEO compensation was reported as kr.12m for the year to December 2021. Notably, that's an increase of 13% over the year before. Notably, the salary which is kr.8.17m, represents most of the total compensation being paid.

For comparison, other companies in the same industry with market capitalizations ranging between kr.13b and kr.42b had a median total CEO compensation of kr.12m. So it looks like Netcompany Group compensates Andre Rogaczewski in line with the median for the industry.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | kr.8.2m | kr.7.2m | 71% |

| Other | kr.3.4m | kr.3.0m | 29% |

| Total Compensation | kr.12m | kr.10m | 100% |

Speaking on an industry level, nearly 70% of total compensation represents salary, while the remainder of 30% is other remuneration. Netcompany Group is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Netcompany Group A/S' Growth

Netcompany Group A/S's earnings per share (EPS) grew 47% per year over the last three years. In the last year, its revenue is up 28%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Netcompany Group A/S Been A Good Investment?

We think that the total shareholder return of 79%, over three years, would leave most Netcompany Group A/S shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 2 warning signs for Netcompany Group (of which 1 is significant!) that you should know about in order to have a holistic understanding of the stock.

Important note: Netcompany Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Netcompany Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:NETC

Netcompany Group

Provides business critical IT solutions to private and public customers in Denmark, Norway, the United Kingdom, the Netherlands, Greece, Belgium, Luxembourg, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)