- Spain

- /

- Telecom Services and Carriers

- /

- BME:CLNX

3 Stocks Estimated To Be 14.0% To 49.6% Below Their Intrinsic Value

Reviewed by Simply Wall St

As global markets show signs of recovery with U.S. indexes approaching record highs and broad-based gains, investors are keeping a close eye on economic indicators such as jobless claims and housing reports that suggest continued economic growth. In this environment of cautious optimism, identifying stocks that are trading below their intrinsic value can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen Lifotronic Technology (SHSE:688389) | CN¥15.53 | CN¥30.89 | 49.7% |

| SeSa (BIT:SES) | €75.10 | €149.67 | 49.8% |

| HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540) | ₩201500.00 | ₩402771.51 | 50% |

| PLAIDInc (TSE:4165) | ¥1597.00 | ¥3193.25 | 50% |

| EnomotoLtd (TSE:6928) | ¥1473.00 | ¥2932.52 | 49.8% |

| Winking Studios (Catalist:WKS) | SGD0.27 | SGD0.54 | 49.7% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.96 | THB9.87 | 49.7% |

| SK Biopharmaceuticals (KOSE:A326030) | ₩95400.00 | ₩190022.03 | 49.8% |

| Cavotec (OM:CCC) | SEK17.55 | SEK35.07 | 50% |

| Snap (NYSE:SNAP) | US$11.42 | US$22.72 | 49.7% |

Let's uncover some gems from our specialized screener.

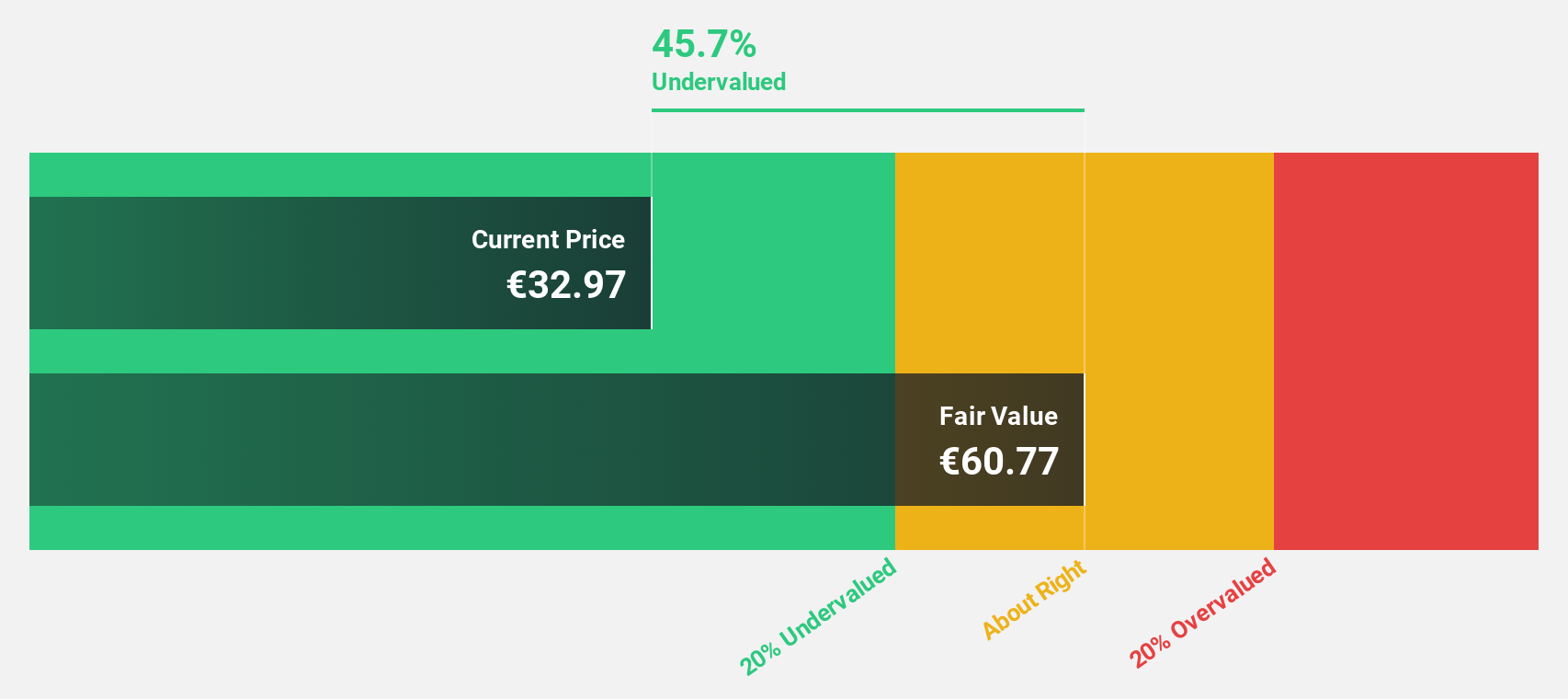

Cellnex Telecom (BME:CLNX)

Overview: Cellnex Telecom, S.A. operates wireless telecommunication infrastructure across several European countries including Austria, Denmark, and Spain, with a market cap of €22.96 billion.

Operations: Cellnex Telecom generates revenue through its operations in wireless telecommunication infrastructure across multiple European countries such as France, Ireland, and Italy.

Estimated Discount To Fair Value: 49.6%

Cellnex Telecom is trading at €32.54, significantly below its estimated fair value of €64.59, suggesting it may be undervalued based on cash flows. Despite a net loss of €140 million for the first nine months of 2024, improved from a €198 million loss last year, Cellnex's earnings are forecast to grow substantially at 73.17% annually. The halted sale of its Polish business highlights strategic cost management efforts amidst expected revenue growth above the Spanish market average.

- Insights from our recent growth report point to a promising forecast for Cellnex Telecom's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Cellnex Telecom.

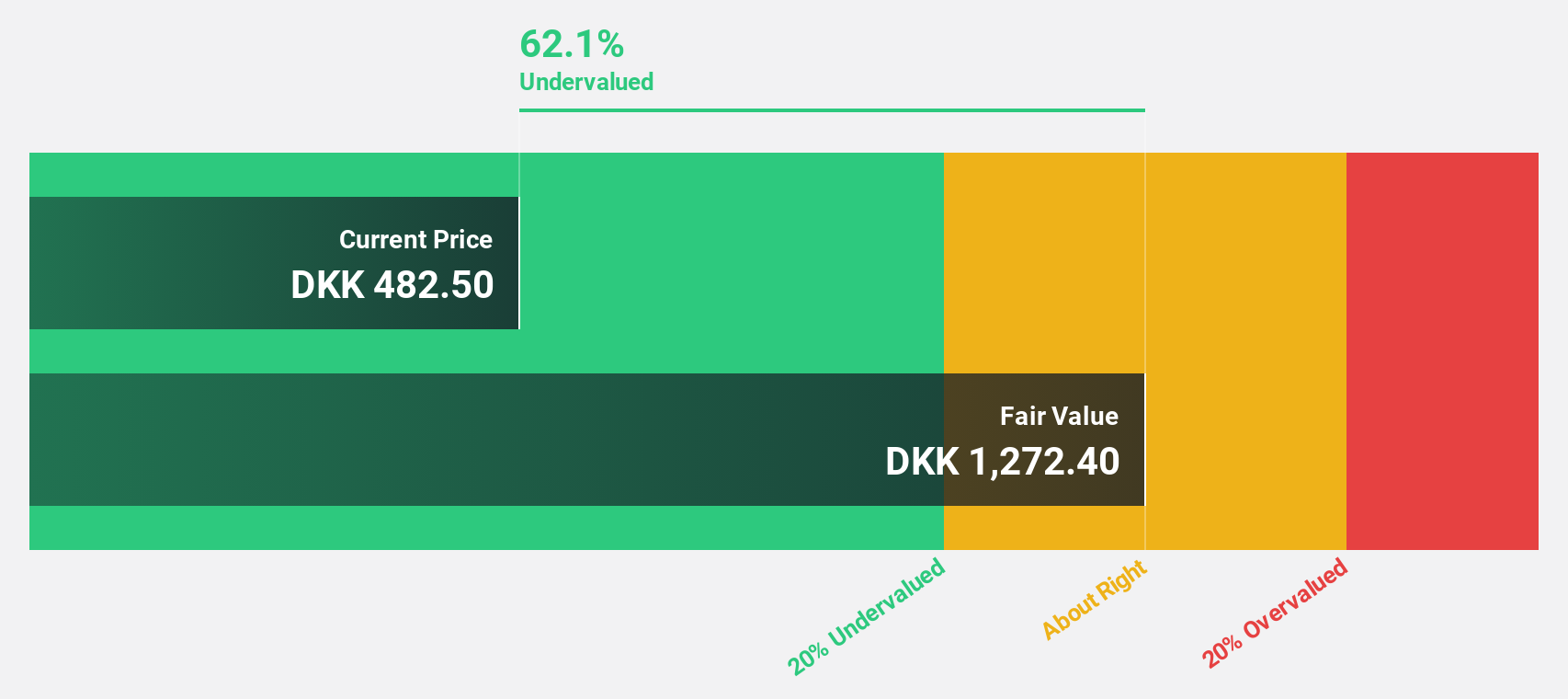

Novo Nordisk (CPSE:NOVO B)

Overview: Novo Nordisk A/S, along with its subsidiaries, focuses on the research, development, manufacture, and distribution of pharmaceutical products across Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America and internationally with a market cap of DKK3.32 trillion.

Operations: The company's revenue is primarily derived from two segments: Diabetes and Obesity Care, generating DKK253.08 billion, and Rare Disease, contributing DKK17.51 billion.

Estimated Discount To Fair Value: 34.5%

Novo Nordisk is trading at DKK 750.9, well below its estimated fair value of DKK 1,146.32, indicating potential undervaluation based on cash flows. Recent earnings reports show robust growth with third-quarter sales reaching DKK 71.31 billion and net income at DKK 27.30 billion, reflecting strong operational performance despite legal challenges over insulin pricing practices. The company's revenue and earnings are forecast to grow faster than the Danish market average, supported by strategic partnerships and product innovations.

- Our comprehensive growth report raises the possibility that Novo Nordisk is poised for substantial financial growth.

- Click here to discover the nuances of Novo Nordisk with our detailed financial health report.

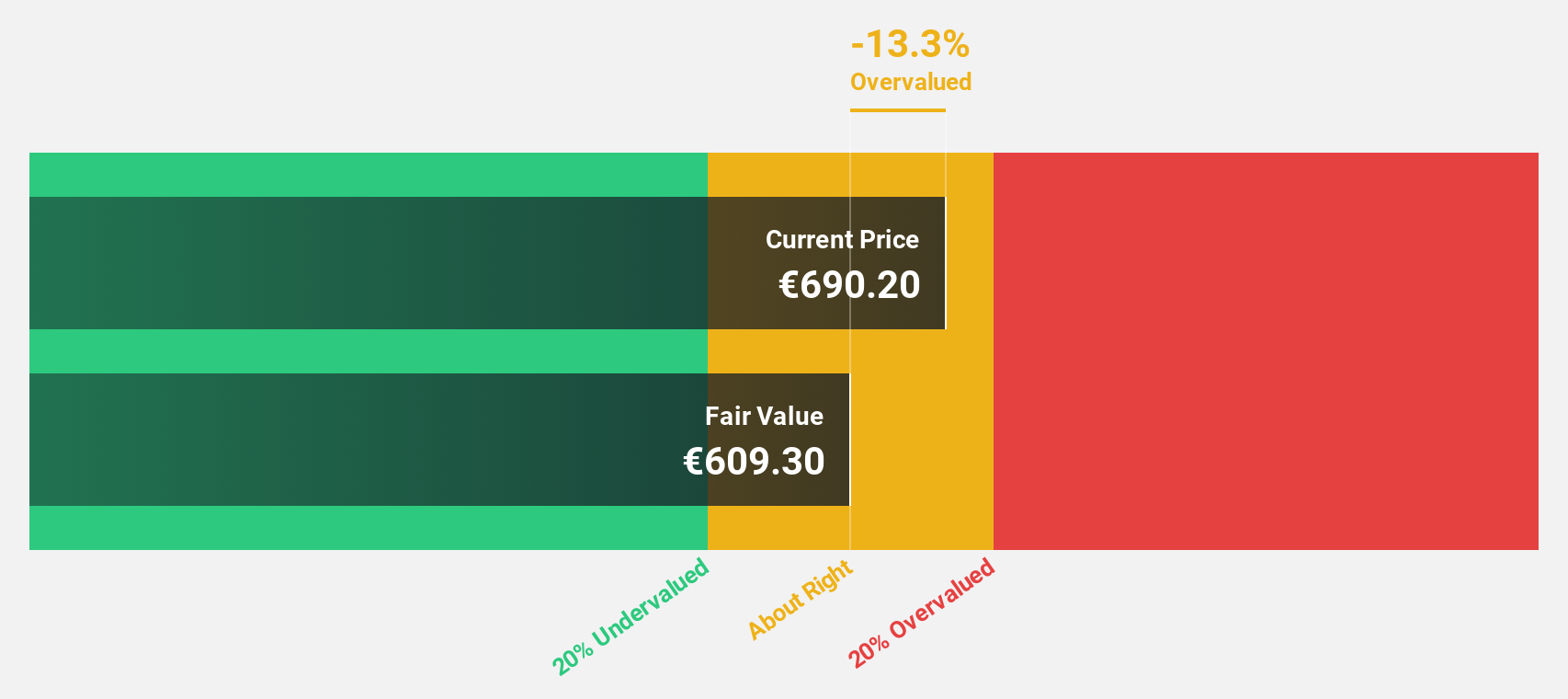

ASML Holding (ENXTAM:ASML)

Overview: ASML Holding N.V. develops, produces, markets, sells, and services advanced semiconductor equipment systems for chipmakers and has a market cap of approximately €252.36 billion.

Operations: The company's revenue of €26.24 billion is primarily derived from its semiconductor equipment and services segment.

Estimated Discount To Fair Value: 14.0%

ASML Holding, trading at €642.1, is undervalued compared to its fair value estimate of €746.27, despite recent legal challenges and market volatility. Forecasts predict earnings growth of 18.8% annually, outpacing the Dutch market average. However, recent financial disclosures revealed a significant decline in net bookings and reduced guidance for 2025 sales and margins due to industry downturns and decreased demand from China following export restrictions, impacting investor sentiment negatively.

- According our earnings growth report, there's an indication that ASML Holding might be ready to expand.

- Dive into the specifics of ASML Holding here with our thorough financial health report.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 916 Undervalued Stocks Based On Cash Flows now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:CLNX

Cellnex Telecom

Operates infrastructure for wireless telecommunication in Austria, Denmark, Spain, France, Ireland, Italy, the Netherlands, Poland, Portugal, the United Kingdom, Sweden, and Switzerland.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives