BioPorto (CPH:BIOPOR shareholders incur further losses as stock declines 10% this week, taking five-year losses to 31%

For many, the main point of investing is to generate higher returns than the overall market. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term BioPorto A/S (CPH:BIOPOR) shareholders for doubting their decision to hold, with the stock down 46% over a half decade. We also note that the stock has performed poorly over the last year, with the share price down 36%. Furthermore, it's down 21% in about a quarter. That's not much fun for holders. However, one could argue that the price has been influenced by the general market, which is down 11% in the same timeframe.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for BioPorto

BioPorto wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, BioPorto saw its revenue increase by 6.7% per year. That's a fairly respectable growth rate. We doubt many shareholders are ok with the fact the share price has fallen 8% each year for half a decade. Those who bought back then clearly believed in stronger growth - and maybe even profits. There is always a big risk of losing money yourself when you buy shares in a company that loses money.

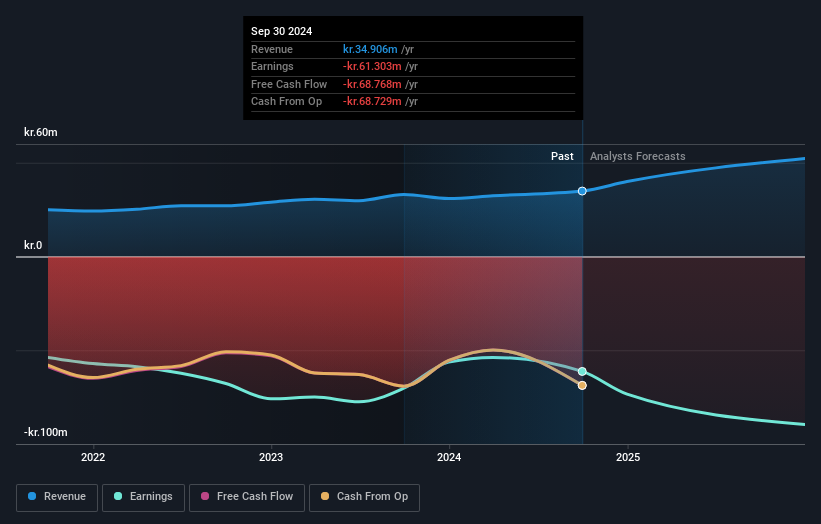

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on BioPorto's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We've already covered BioPorto's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that BioPorto's TSR, at -31% is higher than its share price return of -46%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

While the broader market gained around 13% in the last year, BioPorto shareholders lost 36%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 6% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 5 warning signs for BioPorto (1 is potentially serious) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Danish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if BioPorto might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:BIOPOR

BioPorto

An in-vitro diagnostics company, provides biomarker tools and antibodies for clinical research in Europe, North America, Asia, and internationally.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives