A Look at Tryg’s (CPSE:TRYG) Valuation Following Earnings Growth and Consistent Operating Results

Reviewed by Kshitija Bhandaru

Tryg (CPSE:TRYG) just reported its latest earnings, showing that net income and basic earnings per share have both edged higher compared to last year. Investors are taking note of the company’s steady operating performance.

See our latest analysis for Tryg.

Following the earnings announcement and dividend affirmation, Tryg’s share price has shown resilience, with a year-to-date gain of 3.78%. The company’s 1-year total shareholder return of 3.46% points to steady, if modest, progress. Three- and five-year returns of 21.43% and 37.94%, respectively, highlight the benefits of holding over the long term. This demonstrated stability suggests momentum is building as the market takes note of consistent performance and reliable dividends.

If you’re tracking companies with dependable growth and shareholder focus, now could be a great time to broaden your perspective and discover fast growing stocks with high insider ownership

With earnings and dividends both trending upward, investors are left to wonder if Tryg’s current share price is still a bargain or if the market is already anticipating further growth ahead.

Most Popular Narrative: 8.9% Undervalued

Tryg’s most popular narrative estimates a fair value modestly above the recent closing price, implying upside if future targets are met. This view is built on growing earnings power and the company’s push toward digital transformation.

The company is focusing on strategic pillars such as Scale & Simplicity, Technical Excellence, and Customer & Commercial Excellence to achieve an insurance service result growth of DKK 1 billion by 2027. This strategy is anticipated to improve revenue and earnings by enhancing operational efficiencies and customer value.

What drives this valuation? The main factors are Tryg’s ambitious plan for operational upgrades and higher margins, in addition to a projected pattern of steady earnings growth. If you want to see which bold forecasts anchor the fair value, check out the full narrative and discover why analysts believe the runway might be longer than you think.

Result: Fair Value of $175 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation or tougher regulatory scrutiny could challenge Tryg’s earnings trajectory. This could potentially put pressure on both growth and profitability.

Find out about the key risks to this Tryg narrative.

Another View: Market Comparisons

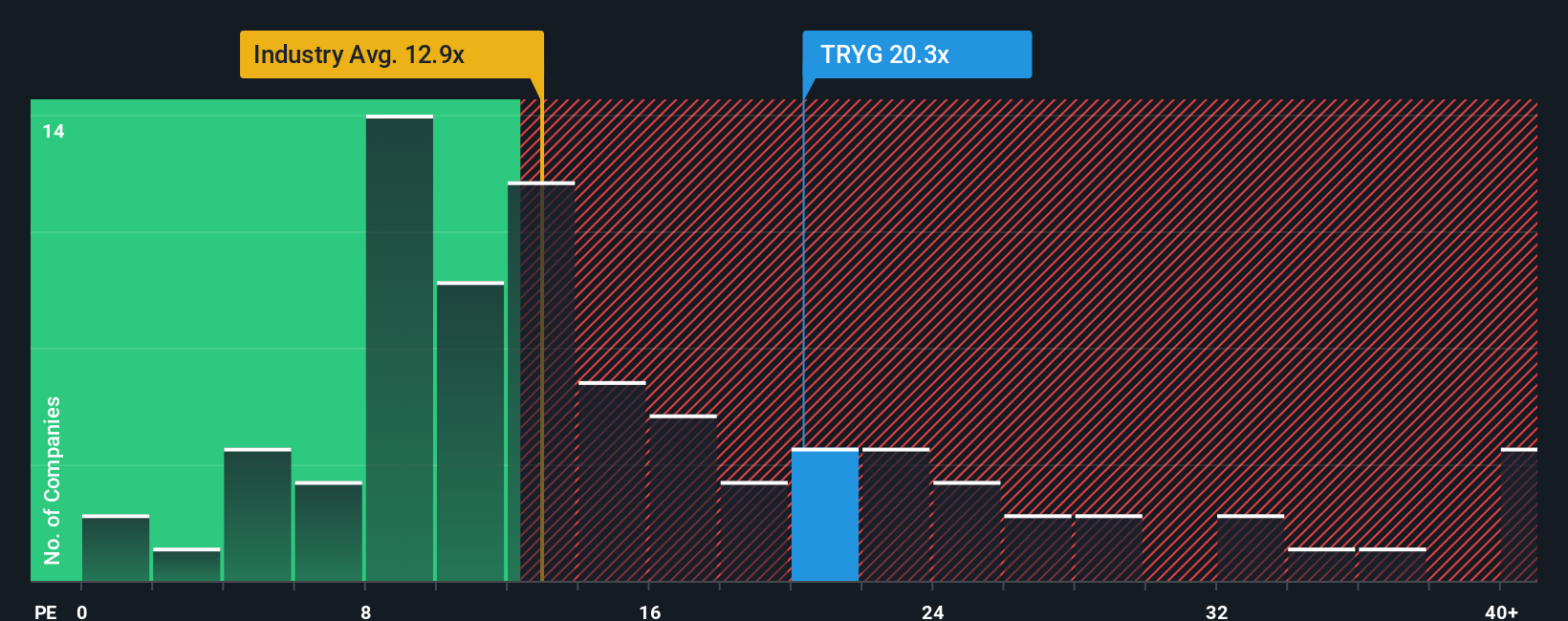

Looking from another angle, Tryg trades at a price-to-earnings ratio of 19.8x, which is pricier than both the European Insurance industry average of 12.3x and its peers at 16.1x. Yet, compared with its fair ratio of 24.3x, the current valuation could leave room for upside or downside if sentiment shifts. Does paying a premium bring greater risk, or might the market eventually catch up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tryg Narrative

If you have a different perspective or want to dig deeper into the numbers, you can build your own view in just a few minutes. Do it your way.

A great starting point for your Tryg research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities slip by. The right stock can transform your portfolio, so power up your research now with these timely, hand-picked ideas:

- Unleash your earnings potential and tap into fresh momentum by reviewing these 18 dividend stocks with yields > 3%, which offers attractive yields and stable payouts.

- Catalyze your watchlist with future-ready companies, starting with these 26 quantum computing stocks, which drives quantum breakthroughs and rapid innovation.

- Spot stocks trading below their worth and secure value by checking out these 878 undervalued stocks based on cash flows, based on robust cash flows and fundamental strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tryg might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:TRYG

Tryg

Provides insurance products and services for private and corporate customers, and small and medium-sized businesses in Denmark, Sweden, the United Kingdom, and Norway.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives