A Fresh Look at Tryg (CPSE:TRYG) Valuation After Recent Stability in Shares

Reviewed by Kshitija Bhandaru

Tryg (CPSE:TRYG) shares have been relatively steady lately, with the stock showing modest movement over the past week and month. Investors may be taking a closer look at performance and valuation trends as they consider their next moves.

See our latest analysis for Tryg.

Tryg’s share price momentum has been generally positive in 2024, which has helped to offset quieter stretches seen in recent months. Over the longer haul, total shareholder returns stand at over 31% for five years, reflecting steady value growth despite short-term swings.

If you’re open to new ideas beyond insurance, now is the perfect chance to explore discovery opportunities with fast growing stocks with high insider ownership.

With shares up over 31% in five years and trading below analyst targets, the real question is whether Tryg is undervalued right now or if the market has already taken all the future growth potential into account.

Most Popular Narrative: 7.5% Undervalued

Tryg's fair value, according to the most widely followed narrative, is set above its last close price. This viewpoint highlights recent operational improvements and digital strategies as key to future gains.

Tryg is leveraging digitalization and automation to streamline operations and lower expense ratios. This operational efficiency is likely to support higher net margins in the future.

Want to know the financial leap these tech-driven changes could unlock? Discover which pivotal numbers and targeted improvements shape this narrative’s bullish outlook. The answer behind the fair value might surprise even seasoned investors.

Result: Fair Value of $175 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued inflationary pressures or regulatory scrutiny could limit growth. These factors challenge optimistic assumptions and may potentially undermine the current bullish valuation narrative.

Find out about the key risks to this Tryg narrative.

Another View: Market Price Versus Industry Ratios

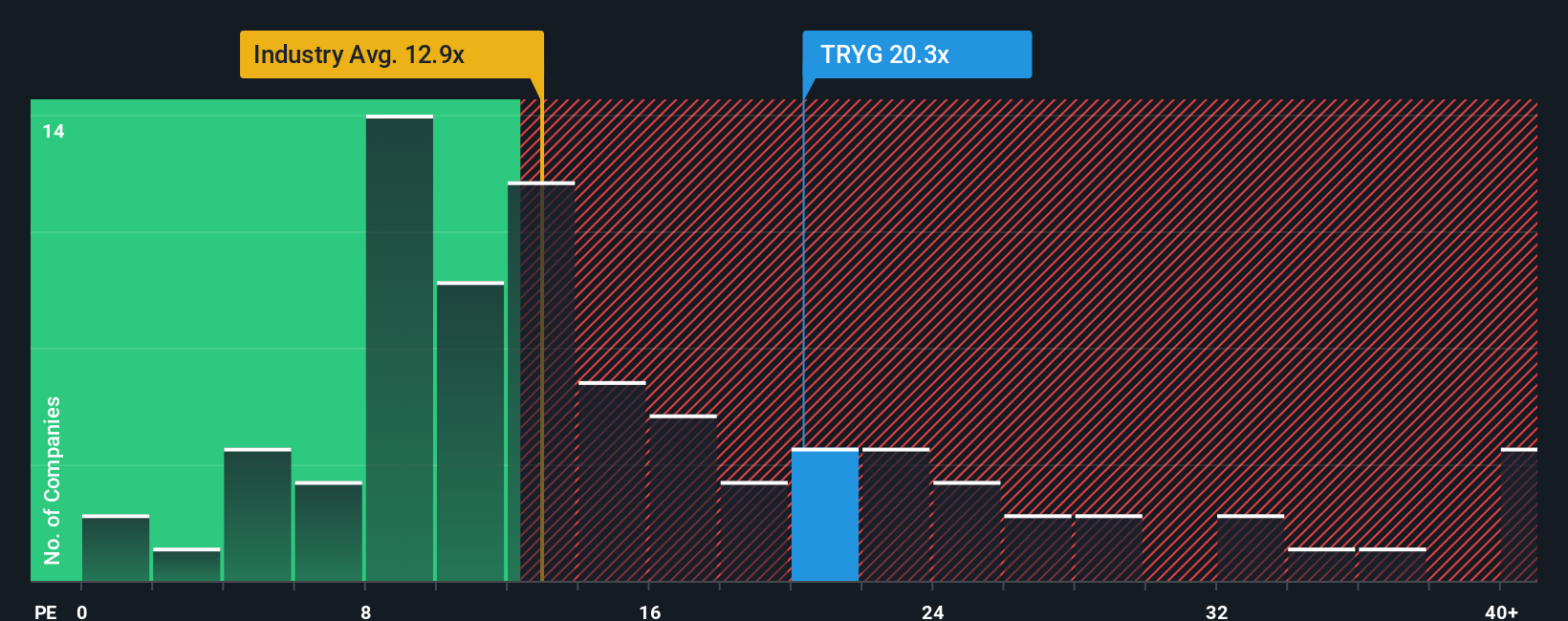

While fair value modeling suggests Tryg is undervalued, the market’s price-to-earnings ratio of 19.6x stands out as steeper than both its European industry peers (12.6x) and direct competitors (16.4x). The fair ratio is higher at 24x. However, such gaps could mean potential valuation risk if the market cools. Are investors leaning too far ahead, or is the market still undervaluing Tryg’s future?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tryg Narrative

If you want to dig deeper or see things differently, there is nothing stopping you from exploring the numbers and building your own perspective in just a few minutes with Do it your way.

A great starting point for your Tryg research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

You could be missing out on the next big winner if you stop here. Take charge of your investing journey and see what’s gaining traction right now.

- Tap into breakthrough opportunities by reviewing these 901 undervalued stocks based on cash flows for stocks trading below their true potential. This gives you the edge on value with every step.

- Unlock the benefits of stable income streams when you browse these 19 dividend stocks with yields > 3%. Explore options with reliable yields trusted by seasoned investors.

- Get ahead of emerging digital trends by researching these 78 cryptocurrency and blockchain stocks. Companies highlighted here are challenging the boundaries of blockchain technology and innovation in finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tryg might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:TRYG

Tryg

Provides insurance products and services for private and corporate customers, and small and medium-sized businesses in Denmark, Sweden, the United Kingdom, and Norway.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives