What To Know Before Buying Alm. Brand A/S (CPH:ALMB) For Its Dividend

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Dividend paying stocks like Alm. Brand A/S (CPH:ALMB) tend to be popular with investors, and for good reason - some research shows that a significant amount of all stock market returns come from reinvested dividends. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

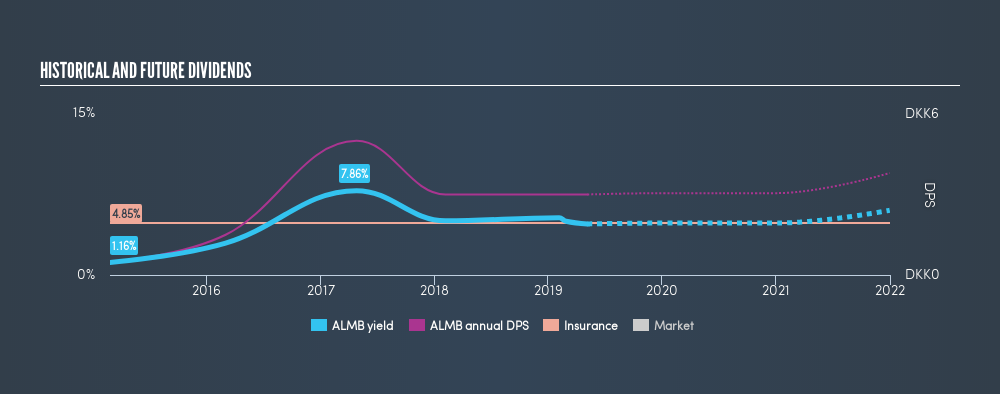

With a goodly-sized dividend yield despite a relatively short payment history, investors might be wondering if Alm. Brand is a new dividend aristocrat in the making. It sure looks interesting on these metrics - but there's always more to the story . The company also bought back stock equivalent to around 2.0% of market capitalisation this year. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Explore this interactive chart for our latest analysis on Alm. Brand!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. Looking at the data, we can see that 42% of Alm. Brand's profits were paid out as dividends in the last 12 months. This is a middling range that strikes a nice balance between paying dividends to shareholders, and retaining enough earnings to invest in future growth. One of the risks is that management reinvests the retained capital poorly instead of paying a higher dividend.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Alm. Brand paid out 18% of its free cash flow as dividends last year, which is conservative and suggests the dividend is sustainable.

Remember, you can always get a snapshot of Alm. Brand's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Alm. Brand has been paying a dividend for the past four years. This company's dividend has been unstable, and with a relatively short history, we think it's a little soon to draw strong conclusions about its long term dividend potential. During the past four-year period, the first annual payment was ø0.50 in 2015, compared to ø3.00 last year. This works out to be a compound annual growth rate (CAGR) of approximately 57% a year over that time. Alm. Brand's dividend payments have fluctuated, so it hasn't grown 57% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

It's not great to see that the payment has been cut in the past. We're generally more wary of companies that have cut their dividend before, as they tend to perform worse in an economic downturn.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Alm. Brand has grown its earnings per share at 29% per annum over the past five years. With high earnings per share growth in recent times and a modest payout ratio, we think this is an attractive combination if earnings can be reinvested to generate further growth.

Conclusion

To summarise, shareholders should always check that Alm. Brand's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Firstly, we like that Alm. Brand has low and conservative payout ratios. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. Overall we think Alm. Brand scores well on our analysis. It's not quite perfect, but we'd definitely be keen to take a closer look.

Now, if you want to look closer, it would be worth checking out our free research on Alm. Brand management tenure, salary, and performance.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About CPSE:ALMB

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives