- Denmark

- /

- Consumer Services

- /

- CPSE:SHAPE

Even after rising 17% this past week, Shape Robotics (CPH:SHAPE) shareholders are still down 32% over the past year

This week we saw the Shape Robotics A/S (CPH:SHAPE) share price climb by 17%. The stock is actually down over the last year. But at least it bettered the loss of 37% in its market.

While the stock has risen 17% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

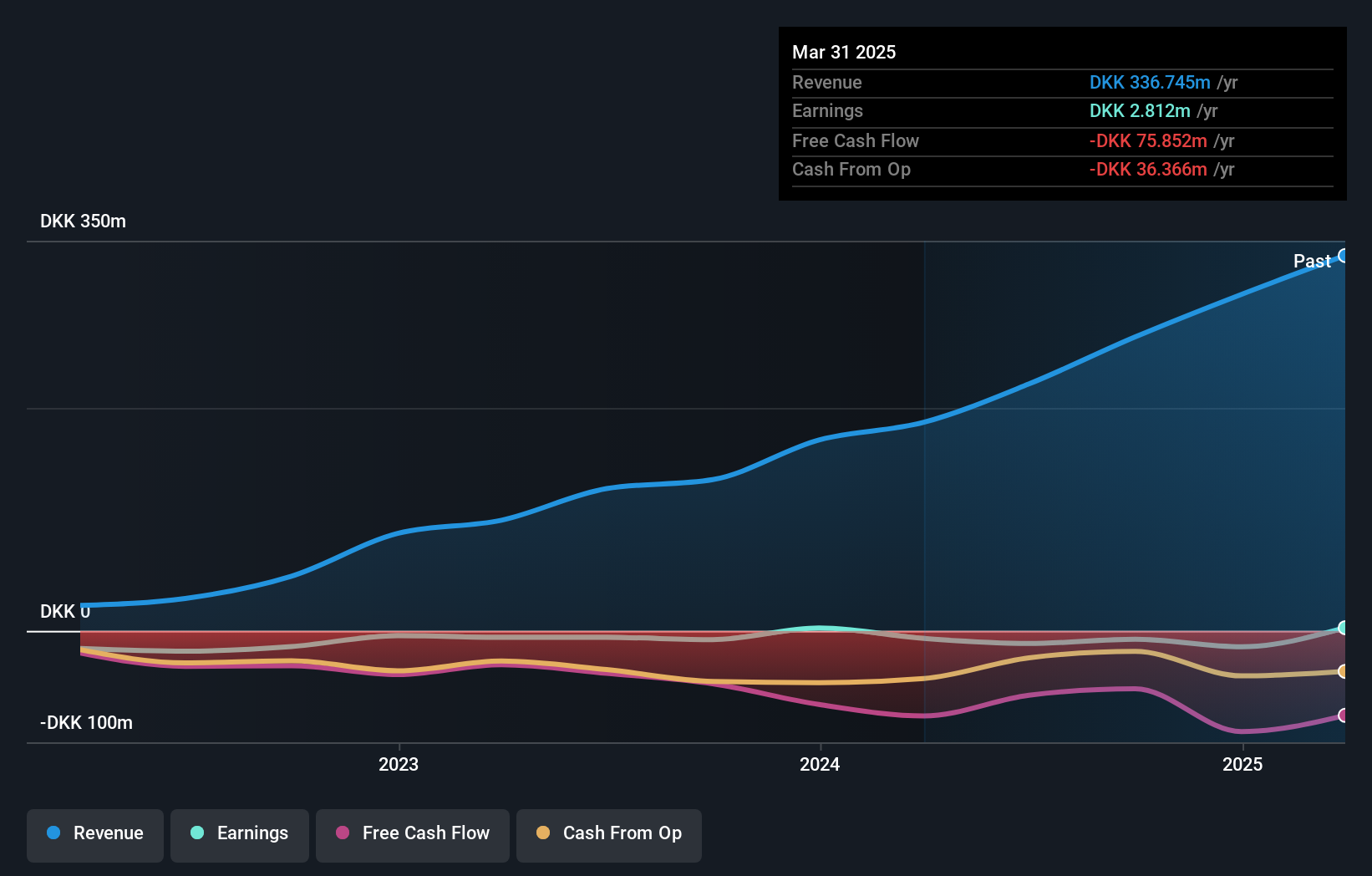

Given that Shape Robotics only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last twelve months, Shape Robotics increased its revenue by 80%. That's a strong result which is better than most other loss making companies. Given that the broader market is down the 32% drop last year isn't too bad. The relative resilience of the share price might reflect the strong revenue growth. For us, this sort of situation smells of opportunity - the share price is down but the revenue is up. Either way, we'd say the mismatch between the revenue growth and the share price justifies a closer look.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Shape Robotics' financial health with this free report on its balance sheet.

A Different Perspective

While it's never nice to take a loss, Shape Robotics shareholders can take comfort that their trailing twelve month loss of 32% wasn't as bad as the market loss of around 37%. Given the total loss of 0.4% per year over five years, it seems returns have deteriorated in the last twelve months. Whilst Baron Rothschild does tell the investor "buy when there's blood in the streets, even if the blood is your own", buyers would need to examine the data carefully to be comfortable that the business itself is sound. It's always interesting to track share price performance over the longer term. But to understand Shape Robotics better, we need to consider many other factors. Even so, be aware that Shape Robotics is showing 5 warning signs in our investment analysis , and 3 of those are a bit unpleasant...

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Danish exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:SHAPE

Shape Robotics

An educational technology company, engages in the provision of intelligent classroom solutions, educational robots, software, and specific services primarily to educational institutions.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026