We Think FOM Technologies (CPH:FOM) Can Afford To Drive Business Growth

Just because a business does not make any money, does not mean that the stock will go down. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given this risk, we thought we'd take a look at whether FOM Technologies (CPH:FOM) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for FOM Technologies

How Long Is FOM Technologies' Cash Runway?

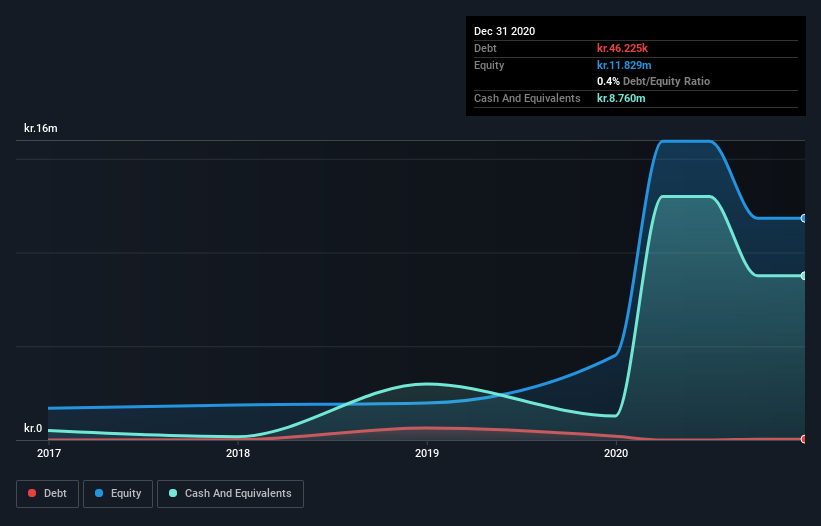

A company's cash runway is calculated by dividing its cash hoard by its cash burn. FOM Technologies has such a small amount of debt that we'll set it aside, and focus on the kr.8.8m in cash it held at December 2020. Looking at the last year, the company burnt through kr.5.4m. Therefore, from December 2020 it had roughly 20 months of cash runway. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. You can see how its cash balance has changed over time in the image below.

How Well Is FOM Technologies Growing?

Some investors might find it troubling that FOM Technologies is actually increasing its cash burn, which is up 28% in the last year. And we must say we find it concerning that operating revenue dropped 18% over the same period. Taken together, we think these growth metrics are a little worrying. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how FOM Technologies has developed its business over time by checking this visualization of its revenue and earnings history.

How Hard Would It Be For FOM Technologies To Raise More Cash For Growth?

FOM Technologies seems to be in a fairly good position, in terms of cash burn, but we still think it's worthwhile considering how easily it could raise more money if it wanted to. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

FOM Technologies' cash burn of kr.5.4m is about 2.3% of its kr.230m market capitalisation. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

Is FOM Technologies' Cash Burn A Worry?

Even though its falling revenue makes us a little nervous, we are compelled to mention that we thought FOM Technologies' cash burn relative to its market cap was relatively promising. While we're the kind of investors who are always a bit concerned about the risks involved with cash burning companies, the metrics we have discussed in this article leave us relatively comfortable about FOM Technologies' situation. Taking a deeper dive, we've spotted 4 warning signs for FOM Technologies you should be aware of, and 1 of them is significant.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CPSE:FOM

FOM Technologies

Engages in the design, development, and sale of machinery and equipment for material production and research in the United States, Canada, the European Union, and Asia.

Adequate balance sheet low.

Market Insights

Community Narratives