Here's Why We Think Ringkjøbing Landbobank (CPH:RILBA) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Ringkjøbing Landbobank (CPH:RILBA). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Ringkjøbing Landbobank

How Quickly Is Ringkjøbing Landbobank Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Impressively, Ringkjøbing Landbobank has grown EPS by 25% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

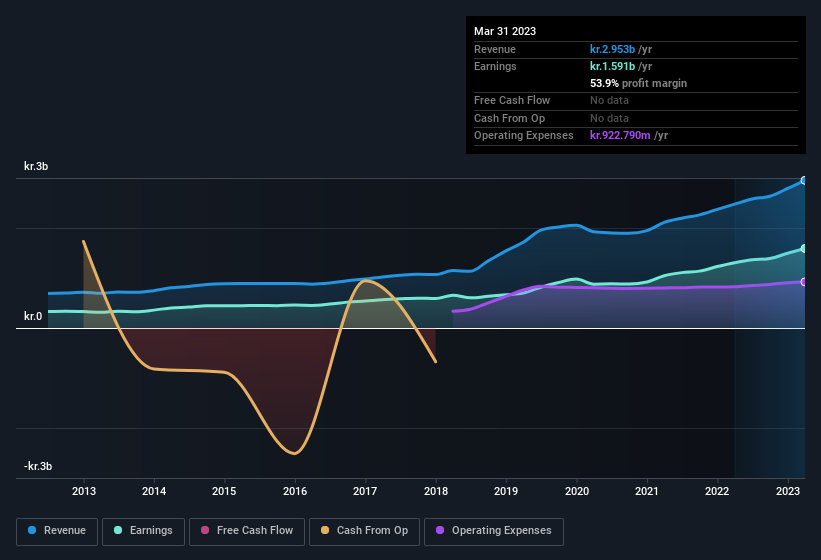

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Our analysis has highlighted that Ringkjøbing Landbobank's revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. While we note Ringkjøbing Landbobank achieved similar EBIT margins to last year, revenue grew by a solid 19% to kr.3.0b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Ringkjøbing Landbobank's forecast profits?

Are Ringkjøbing Landbobank Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

While Ringkjøbing Landbobank insiders did net kr.71k selling stock over the last year, they invested kr.2.0m, a much higher figure. You could argue that level of buying implies genuine confidence in the business. It is also worth noting that it was Independent Chairman Martin Pedersen who made the biggest single purchase, worth kr.1.9m, paying kr.962 per share.

The good news, alongside the insider buying, for Ringkjøbing Landbobank bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have kr.125m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. While their ownership only accounts for 0.5%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, John Fisker is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations between kr.14b and kr.45b, like Ringkjøbing Landbobank, the median CEO pay is around kr.16m.

The Ringkjøbing Landbobank CEO received total compensation of just kr.6.7m in the year to December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Ringkjøbing Landbobank Worth Keeping An Eye On?

You can't deny that Ringkjøbing Landbobank has grown its earnings per share at a very impressive rate. That's attractive. Furthermore, company insiders have been adding to their significant stake in the company. These things considered, this is one stock worth watching. If you think Ringkjøbing Landbobank might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

Keen growth investors love to see insider buying. Thankfully, Ringkjøbing Landbobank isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:RILBA

Ringkjøbing Landbobank

Provides various banking products and services in Denmark.

Flawless balance sheet with solid track record.