A Look at Ringkjøbing Landbobank (CPSE:RILBA) Valuation After Recent 19% Share Price Gain

Reviewed by Kshitija Bhandaru

See our latest analysis for Ringkjøbing Landbobank.

Momentum has clearly been building for Ringkjøbing Landbobank, with its share price up nearly 19% year-to-date and the one-year total shareholder return reaching an impressive 36%. That steady climb suggests investors see upside potential, not just recent stability.

If you’re curious about what’s driving other noteworthy moves this year, it might be a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading below analyst targets and a notable discount to estimated intrinsic value, the question now becomes: is Ringkjøbing Landbobank undervalued, or has the market already accounted for its future growth prospects?

Price-to-Earnings of 15.1x: Is it justified?

Ringkjøbing Landbobank’s shares currently trade at a price-to-earnings (P/E) ratio of 15.1x, which is notably higher than both its industry peers and estimated fair value multiples. At the last close of DKK 1,448, the market is pricing in much stronger earnings potential than what similar banks command.

The price-to-earnings ratio is a measure of how much investors are willing to pay for each unit of a company’s earnings. For banks, it indicates confidence in profitability, growth prospects or balance-sheet quality. However, when a company's P/E multiple is stretched well above comparable institutions, it can suggest investors expect superior long-term performance or perhaps have pushed the price too high relative to fundamentals.

Against the European Banks industry average of just 9.8x and a calculated fair P/E of 10.9x, Ringkjøbing Landbobank’s valuation looks significantly expensive. The gap between its current multiple and these benchmarks could narrow if either earnings accelerate or price momentum slows.

Explore the SWS fair ratio for Ringkjøbing Landbobank

Result: Price-to-Earnings of 15.1x (OVERVALUED)

However, slower revenue growth or a dip in net income could quickly challenge the current optimism surrounding Ringkjøbing Landbobank’s elevated valuation.

Find out about the key risks to this Ringkjøbing Landbobank narrative.

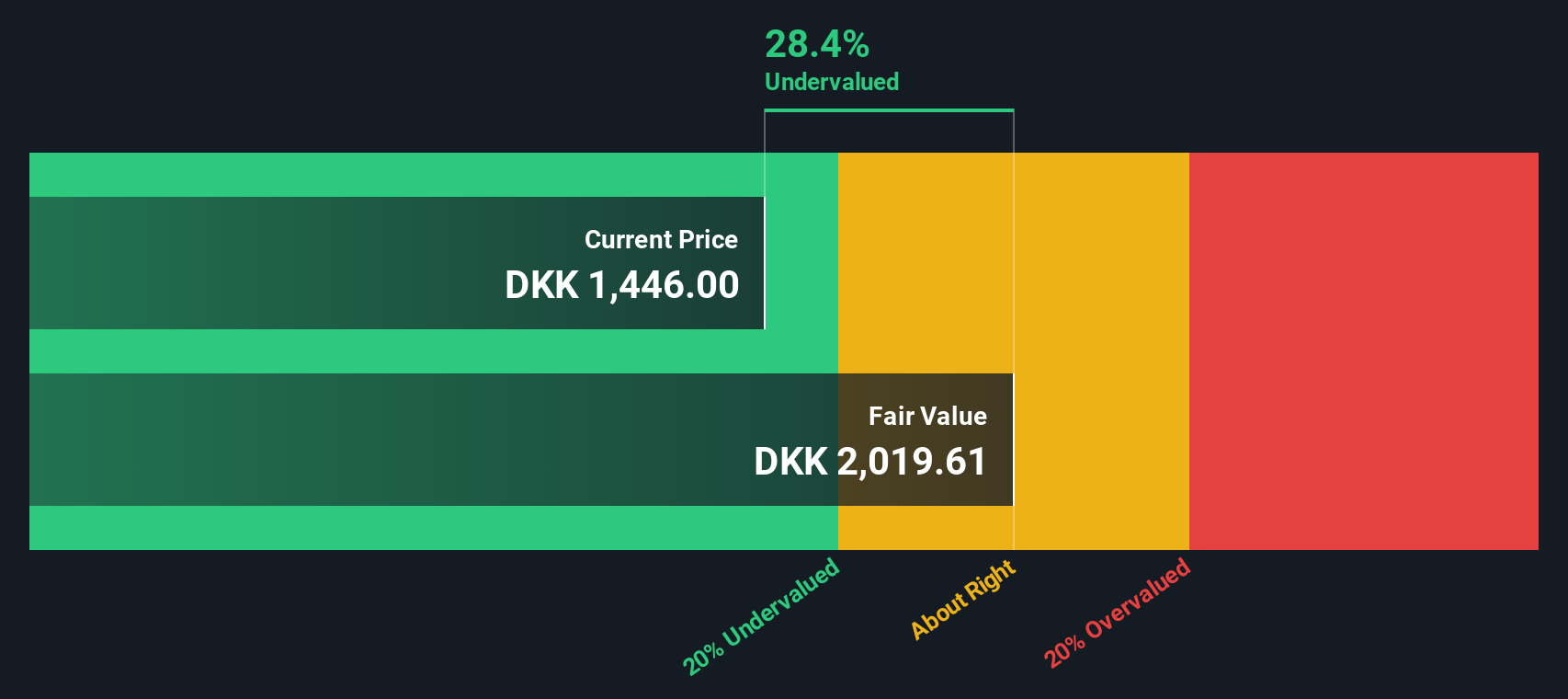

Another View: DCF Points to Undervaluation

While the price-to-earnings story paints Ringkjøbing Landbobank as expensive, our DCF model suggests a very different picture. The SWS DCF model estimates fair value to be around DKK 2,019, which is 28% above today’s price. Could the market be discounting RILBA too harshly?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ringkjøbing Landbobank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ringkjøbing Landbobank Narrative

If you prefer to dive into the numbers personally or think your own analysis might reveal another angle, you can craft your narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Ringkjøbing Landbobank.

Looking for more investment ideas?

Want to get ahead of the pack? Use the Simply Wall Street Screener to uncover opportunities others might miss and take charge of your investment strategy.

- Tap into high potential by scanning these 891 undervalued stocks based on cash flows for shares the market hasn’t fully appreciated. These could be tomorrow’s standouts.

- Boost your passive income and stability with these 19 dividend stocks with yields > 3%, focusing on companies that consistently reward shareholders with attractive yields above 3%.

- Seize the next wave in digital innovation by tracking these 79 cryptocurrency and blockchain stocks that are driving progress in blockchain and cryptocurrency solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:RILBA

Ringkjøbing Landbobank

Provides various financial products and services in Denmark.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives