Most Shareholders Will Probably Find That The CEO Compensation For GrønlandsBANKEN A/S (CPH:GRLA) Is Reasonable

CEO Martin Kviesgaard has done a decent job of delivering relatively good performance at GrønlandsBANKEN A/S (CPH:GRLA) recently. As shareholders go into the upcoming AGM on 24 March 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. We present our case of why we think CEO compensation looks fair.

View our latest analysis for GrønlandsBANKEN

Comparing GrønlandsBANKEN A/S' CEO Compensation With the industry

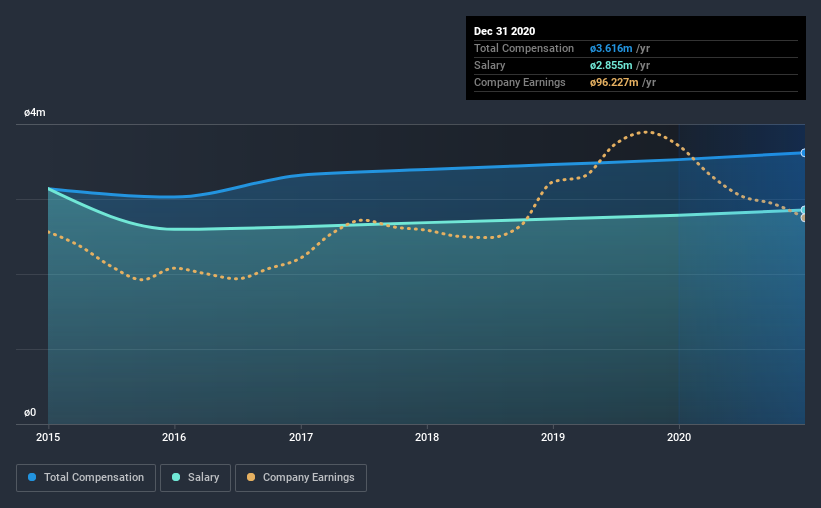

At the time of writing, our data shows that GrønlandsBANKEN A/S has a market capitalization of kr.1.1b, and reported total annual CEO compensation of kr.3.6m for the year to December 2020. That is, the compensation was roughly the same as last year. In particular, the salary of kr.2.86m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar companies from the same industry with market caps ranging from kr.625m to kr.2.5b, we found that the median CEO total compensation was kr.4.1m. This suggests that GrønlandsBANKEN remunerates its CEO largely in line with the industry average. Furthermore, Martin Kviesgaard directly owns kr.917k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | kr.2.9m | kr.2.8m | 79% |

| Other | kr.761k | kr.742k | 21% |

| Total Compensation | kr.3.6m | kr.3.5m | 100% |

Talking in terms of the industry, salary represented approximately 83% of total compensation out of all the companies we analyzed, while other remuneration made up 17% of the pie. Although there is a difference in how total compensation is set, GrønlandsBANKEN more or less reflects the market in terms of setting the salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

GrønlandsBANKEN A/S' Growth

GrønlandsBANKEN A/S has seen its earnings per share (EPS) increase by 2.1% a year over the past three years. In the last year, its revenue is down 3.5%.

We would prefer it if there was revenue growth, but it is good to see a modest EPS growth at least. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has GrønlandsBANKEN A/S Been A Good Investment?

GrønlandsBANKEN A/S has not done too badly by shareholders, with a total return of 8.2%, over three years. It would be nice to see that metric improve in the future. Accordingly, a proposal to increase CEO remuneration without seeing an improvement in shareholder returns might not be met favorably by most shareholders.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 2 warning signs for GrønlandsBANKEN (of which 1 is a bit concerning!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade GrønlandsBANKEN, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade GrønlandsBANKEN, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CPSE:GRLA

GrønlandsBANKEN

Provides various financial services to private and business customers, and public institutions in Greenland.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives