P/F BankNordik (CPH:BNORDIK CSE) investors are up 14% in the past week, but earnings have declined over the last three years

Investors can buy low cost index fund if they want to receive the average market return. But across the board there are plenty of stocks that underperform the market. That's what has happened with the P/F BankNordik (CPH:BNORDIK CSE) share price. It's up 52% over three years, but that is below the market return. Zooming in, the stock is up just 2.5% in the last year.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

View our latest analysis for P/F BankNordik

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

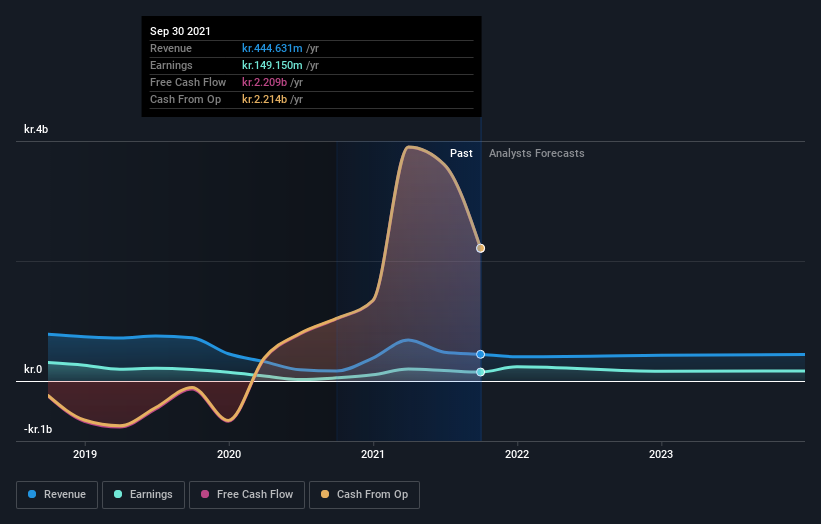

During the three years of share price growth, P/F BankNordik actually saw its earnings per share (EPS) drop 21% per year.

This means it's unlikely the market is judging the company based on earnings growth. Therefore, we think it's worth considering other metrics as well.

The revenue drop of 25% is as underwhelming as some politicians. The only thing that's clear is there is low correlation between P/F BankNordik's share price and its historic fundamental data. Further research may be required!

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that P/F BankNordik has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on P/F BankNordik

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for P/F BankNordik the TSR over the last 3 years was 127%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that P/F BankNordik shareholders have received a total shareholder return of 44% over one year. Of course, that includes the dividend. That's better than the annualised return of 19% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - P/F BankNordik has 2 warning signs (and 1 which is significant) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DK exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:FOBANK

Føroya Banki

Provides personal and corporate banking services in the Faroe Islands and Greenland.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026