As European markets continue to show resilience, with the STOXX Europe 600 Index climbing 2.35% and major single-country indexes also posting gains, investors are increasingly focusing on dividend stocks as a means to generate steady income amidst economic uncertainties. In this context, selecting dividend stocks that demonstrate consistent payouts and align with broader market stability can provide a reliable income stream while navigating fluctuating economic conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.31% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.54% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.08% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.91% | ★★★★★★ |

| Evolution (OM:EVO) | 4.79% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.17% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 10.14% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.36% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.68% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.45% | ★★★★★☆ |

Click here to see the full list of 213 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

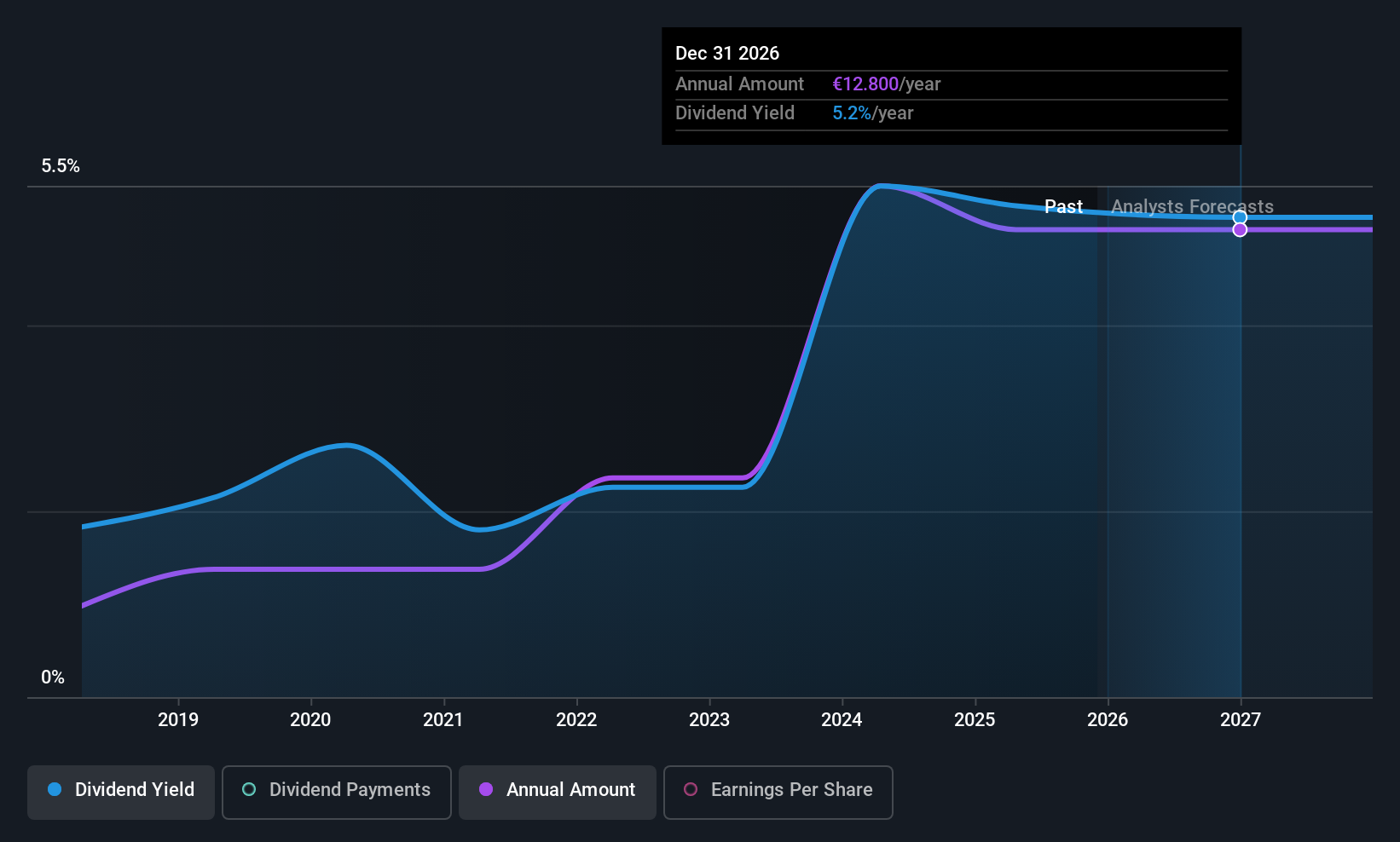

Erste Group Bank (WBAG:EBS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Erste Group Bank AG offers a variety of banking and financial services to retail, corporate, and public sector clients, with a market cap of €37.86 billion.

Operations: Erste Group Bank AG generates revenue through several segments, including Retail (€4.91 billion), Corporates (€2.34 billion), Group Markets (€836 million), and Savings Banks (€2.36 billion).

Dividend Yield: 3.1%

Erste Group Bank offers a stable dividend with a payout ratio of 40.3%, indicating dividends are well covered by earnings. Despite having a high level of bad loans at 2.3% and low allowance for these, the bank maintains reliable dividend payments over the past decade. Recent upgrades in earnings guidance and stable net income growth support its dividend sustainability. However, its current yield of 3.08% is lower than top-tier Austrian market payers at 4.51%.

- Get an in-depth perspective on Erste Group Bank's performance by reading our dividend report here.

- Our valuation report unveils the possibility Erste Group Bank's shares may be trading at a discount.

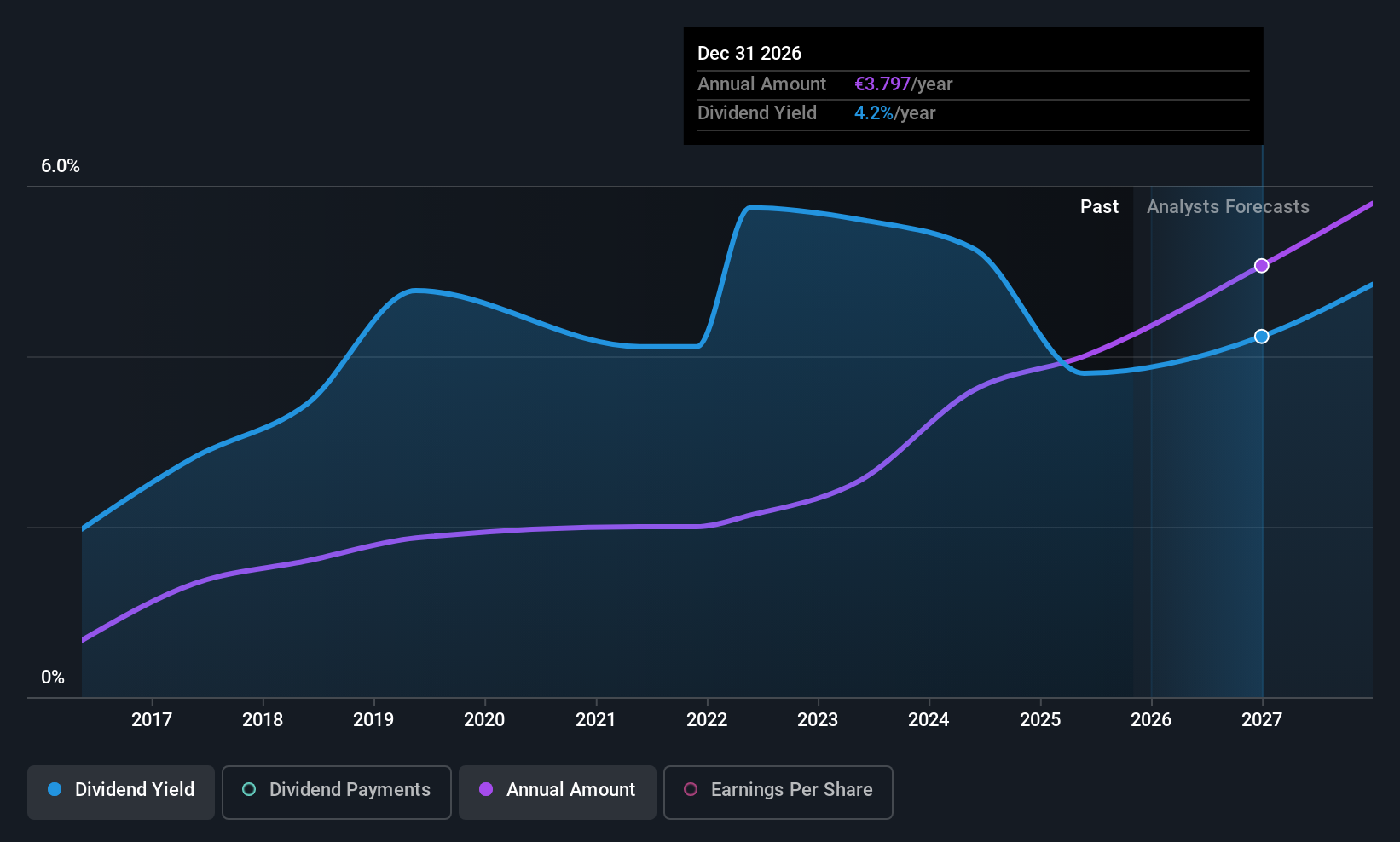

Mennica Polska (WSE:MNC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mennica Polska S.A. is involved in the manufacture and distribution of minting and engraved/medallist products both in Poland and internationally, with a market cap of PLN1.83 billion.

Operations: Mennica Polska S.A. generates revenue primarily through its production and distribution of minting and engraved/medallist products on a domestic and international scale.

Dividend Yield: 3.1%

Mennica Polska's recent earnings report shows significant growth, with net income rising to PLN 406.54 million in Q3 2025 from PLN 24.96 million a year ago, supporting its dividend coverage through a low payout ratio of 31.2%. However, the company's dividends have been unreliable and volatile over the past decade despite being covered by cash flows and earnings. Trading below estimated fair value, its current yield of 3.07% remains modest compared to top Polish market payers at 7.33%.

- Take a closer look at Mennica Polska's potential here in our dividend report.

- According our valuation report, there's an indication that Mennica Polska's share price might be on the cheaper side.

Logwin (XTRA:TGHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Logwin AG offers logistics and transport solutions across Germany, Austria, other European countries, Asia/Pacific, and internationally with a market cap of €742.84 million.

Operations: Logwin AG's revenue is primarily derived from its Air + Ocean segment at €1.24 billion and its Solutions segment at €252.53 million.

Dividend Yield: 5%

Logwin's dividend payments have been reliable, growing with little volatility over its 8-year history, and are covered by both earnings and cash flows with payout ratios of 58.6% and 36.6%, respectively. Despite a forecasted decline in earnings, the dividend yield remains competitive within the German market's top quartile. The company's revenue guidance for 2025 is between €1.27 billion and €1.55 billion, suggesting stability amidst broader financial challenges.

- Dive into the specifics of Logwin here with our thorough dividend report.

- The analysis detailed in our Logwin valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Click this link to deep-dive into the 213 companies within our Top European Dividend Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:MNC

Mennica Polska

Engages in the manufacture and distribution of minting and engraved/medallist products in Poland and internationally.

Solid track record, good value and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026