Evaluating Lufthansa (XTRA:LHA) After Kepler Cheuvreux’s Buy Upgrade and Turnaround Optimism

Reviewed by Simply Wall St

Deutsche Lufthansa (XTRA:LHA) jumped after Kepler Cheuvreux raised its rating to Buy, highlighting a turnaround plan that is mostly scheduled for execution next year along with improving conditions in long-haul travel.

See our latest analysis for Deutsche Lufthansa.

The rating upgrade lands on top of already strong momentum, with a 37.48% year to date share price return and a 33.38% one year total shareholder return suggesting confidence in Lufthansa’s multi year recovery story.

If this rebound in air travel has your attention, it could be a good moment to explore other aerospace and defense stocks that might benefit from similar structural tailwinds.

Yet even after a 37% year to date surge, valuation signals such as a large intrinsic discount hint at further upside and raise the question: is Lufthansa still a buy, or is future growth already fully priced in?

Most Popular Narrative: 7.2% Overvalued

Deutsche Lufthansa's widely followed narrative points to a fair value slightly below the last close, framing the current rally as already pricing in much of the recovery.

The market appears to be pricing in sustained, above-trend revenue growth for Lufthansa driven by elevated post-pandemic travel demand, continued international expansion (e.g., ITA Airways integration and additional wide-body deliveries), and successful upselling to premium and ancillary products, despite mounting evidence of softening yields and mixed forward bookings in key markets, which could undercut top-line expectations.

Curious how modest growth, shifting margins, and a lower risk premium can still justify a premium earnings multiple for a legacy airline? Unpack the full narrative to see which forecast levers really carry this valuation.

Result: Fair Value of $7.89 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if fleet modernization and the turnaround plan deliver faster margin gains, Lufthansa’s earnings power could surprise consensus and challenge the overvaluation view.

Find out about the key risks to this Deutsche Lufthansa narrative.

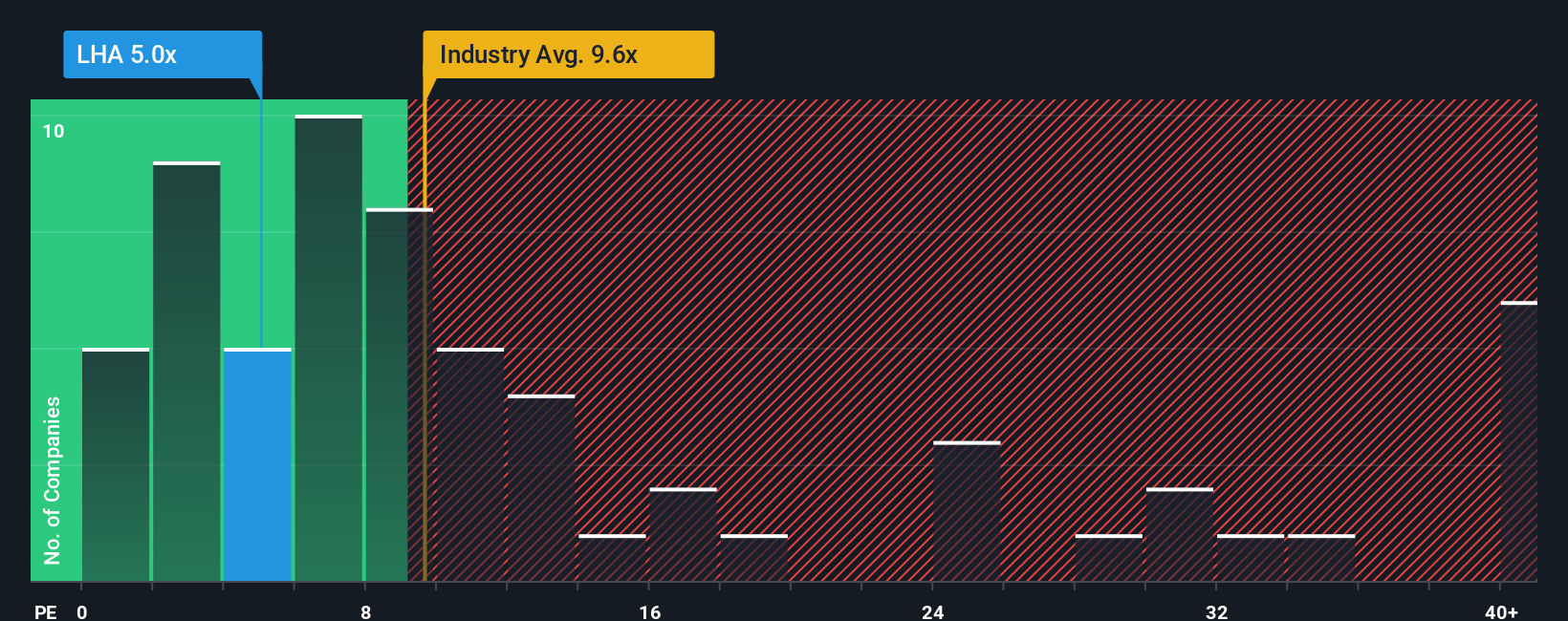

Another View: Multiples Paint a Cheaper Picture

While the narrative suggests Lufthansa is 7.2% overvalued on fair value, its 6.2x price to earnings looks strikingly low against the 9.3x global airlines average, 12x peer average, and a 12.7x fair ratio, which may hint at upside potential if sentiment and earnings remain supportive.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Deutsche Lufthansa Narrative

If your perspective differs or you prefer to dig into the numbers yourself, you can build a tailored story for Lufthansa in minutes using Do it your way.

A great starting point for your Deutsche Lufthansa research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, use the Simply Wall St Screener to quickly surface high conviction stock ideas tailored to different strategies so you are never short of opportunities.

- Capture potential bargains with strong cash flow support by scanning these 906 undervalued stocks based on cash flows that may be trading below what their fundamentals imply.

- Ride the next wave of intelligent automation by targeting these 30 healthcare AI stocks pushing data driven breakthroughs in diagnostics, treatment, and patient care.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that aim to deliver reliable yields above cash and many bond alternatives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:LHA

Deutsche Lufthansa

Operates as an aviation company in Germany and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)