- Germany

- /

- Marine and Shipping

- /

- XTRA:HLAG

Upward Earnings Revision Could Be a Game Changer for Hapag-Lloyd (XTRA:HLAG)

Reviewed by Sasha Jovanovic

- Earlier this week, Hapag-Lloyd announced it has raised its 2025 earnings guidance, now targeting a Group EBIT between US$250 million and US$1.25 billion while reiterating its focus on robust cost controls and network reliability amidst sector challenges.

- This upward revision suggests growing management confidence in navigating the evolving shipping environment and addressing cost pressures through operational efficiency initiatives.

- We'll now examine how Hapag-Lloyd’s increased 2025 earnings targets may shape the company’s investment narrative going forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Hapag-Lloyd Investment Narrative Recap

To own Hapag-Lloyd shares, one should believe in the long-term resilience of global container shipping, supported by ongoing efficiencies and modernization, even as the sector faces persistent rate pressure and moderate volume trends. The company’s upward revision to 2025 EBIT guidance signals confidence in managing near-term volatility, yet it does not materially shift the biggest short-term catalyst: stabilization in freight rates amid trade normalization. The risk of structural margin compression from persistent cost inflation remains central to the investment case.

Among Hapag-Lloyd’s recent updates, the company’s expanded partnership with Camunda to upgrade its Freight Information System stands out. This aligns with the focus on operational efficiency, highlighting ongoing efforts to control costs and sustain margins, which are now even more relevant given the new financial targets and the ongoing push for digital transformation.

However, investors should be aware that against these efficiency improvements, the persistent risk of margin compression from higher structural costs remains a critical factor to monitor...

Read the full narrative on Hapag-Lloyd (it's free!)

Hapag-Lloyd's narrative projects €18.0 billion revenue and €1.1 billion earnings by 2028. This requires a 3.4% yearly revenue decline and a €1.3 billion decrease in earnings from €2.4 billion today.

Uncover how Hapag-Lloyd's forecasts yield a €107.09 fair value, a 6% downside to its current price.

Exploring Other Perspectives

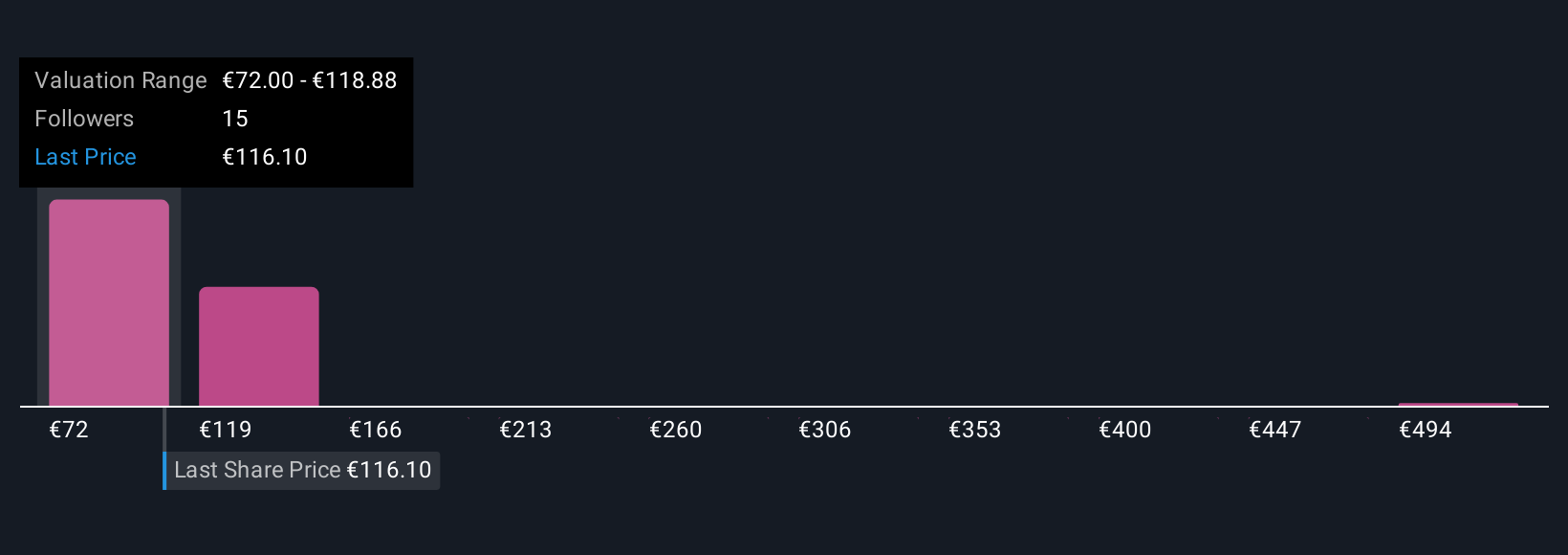

Five distinct Simply Wall St Community members value Hapag-Lloyd shares between €72 and €540.77, showing strong disagreement about future potential. While some expect operational upgrades to improve margins, many caution that ongoing cost inflation could still restrict long-term profitability.

Explore 5 other fair value estimates on Hapag-Lloyd - why the stock might be worth over 4x more than the current price!

Build Your Own Hapag-Lloyd Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hapag-Lloyd research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hapag-Lloyd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hapag-Lloyd's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hapag-Lloyd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HLAG

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives