- Germany

- /

- Transportation

- /

- BST:3WB

Undiscovered Gems in Europe for June 2025

Reviewed by Simply Wall St

As European markets navigate through a landscape marked by tensions in the Middle East and varying inflation pressures, the pan-European STOXX Europe 600 Index recently saw a decline of 1.54%, reflecting broader concerns impacting investor sentiment. Amid these challenges, discerning investors might find opportunities in small-cap stocks that demonstrate resilience and potential for growth, particularly those with strong fundamentals and innovative business models tailored to adapt to evolving economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Dekpol | 63.20% | 11.06% | 13.37% | ★★★★★☆ |

| Castellana Properties Socimi | 53.49% | 7.49% | 44.78% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Waberer's International Nyrt (BST:3WB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Waberer's International Nyrt. offers transportation, forwarding, and logistics services across Europe and internationally, with a market cap of €218.85 million.

Operations: The company generates revenue primarily from its insurance segment, which contributes €98.17 million. A notable financial aspect is the segment adjustment amounting to €659.39 million.

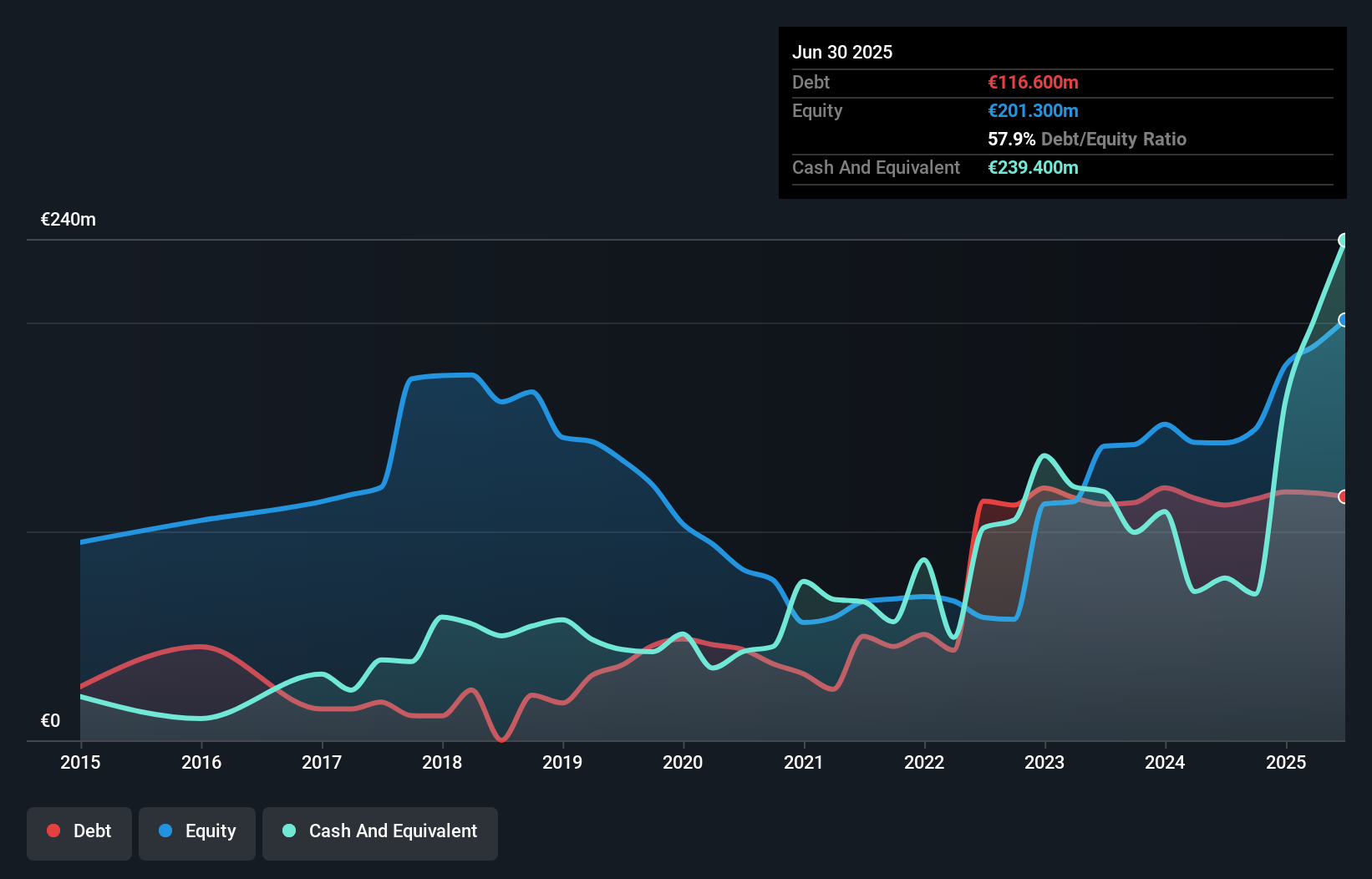

Waberer's International Nyrt. has shown robust earnings growth of 38.6% over the past year, outperforming the transportation industry, which saw a -13.5% change. The company's net income for Q1 2025 was €7.5M, a significant jump from €1.1M in the previous year, reflecting improved profitability despite sales slightly decreasing to €194.4M from €196.7M last year. The debt-to-equity ratio rose to 62.6% over five years; however, interest payments remain well-covered by EBIT at 7.9x coverage and more cash than total debt suggests financial stability amidst these changes.

BTS Group (OM:BTS B)

Simply Wall St Value Rating: ★★★★★★

Overview: BTS Group AB (publ) is a professional services firm with a market capitalization of approximately SEK4.25 billion.

Operations: The company generates revenue primarily from its BTS North America segment with SEK1.56 billion, followed by BTS Other Markets and BTS Europe at SEK838.95 million and SEK631.37 million respectively. Additionally, Advantage Performance Group contributes SEK142.19 million to the overall revenue stream.

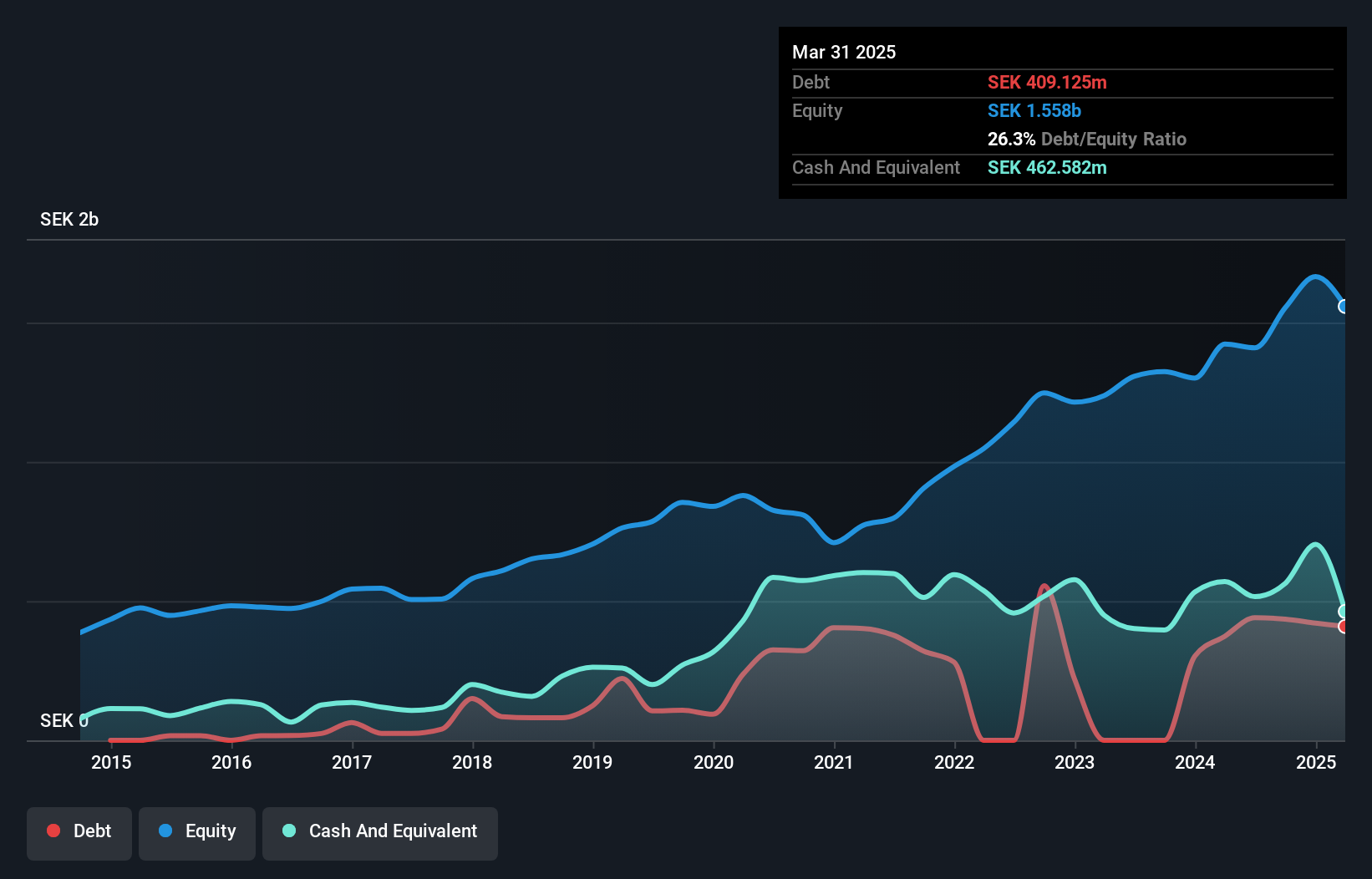

BTS Group, a smaller player in the professional services sector, has shown impressive earnings growth of 46% over the past year, outpacing the industry's 12%. Despite a large one-off gain of SEK167.5M affecting recent results, its debt-to-equity ratio improved slightly from 26.9% to 26.3% in five years. Trading at a significant discount of 57.5% below estimated fair value and having more cash than total debt enhances its appeal. However, net income for Q1 dropped to SEK25.73 million from SEK53.3 million last year, indicating potential volatility ahead despite revenue forecasts suggesting steady growth at about 6.7%.

RaySearch Laboratories (OM:RAY B)

Simply Wall St Value Rating: ★★★★★★

Overview: RaySearch Laboratories AB (publ) is a medical technology company that develops software solutions for cancer treatment globally, with a market cap of SEK10.78 billion.

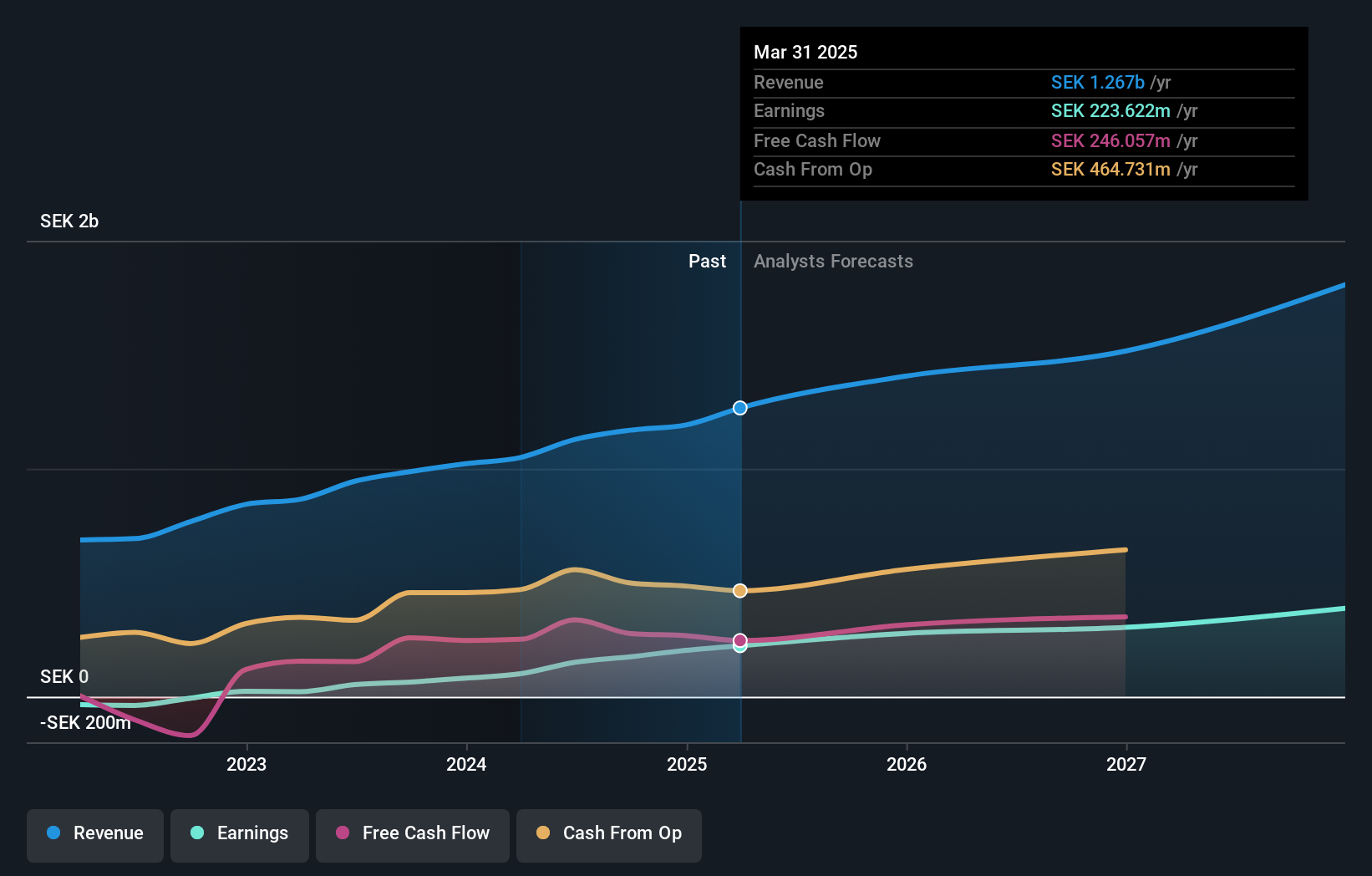

Operations: RaySearch Laboratories generates revenue primarily from its healthcare software segment, totaling SEK1.27 billion. It focuses on developing software solutions for cancer treatment worldwide.

RaySearch Labs, a nimble player in medical technology, is making strides with its innovative software solutions for cancer treatment. The company has seen earnings soar by 122% over the past year, outpacing the healthcare services industry. With no debt on its books compared to a 24.9% debt-to-equity ratio five years ago, RaySearch stands financially robust. Recent upgrades to their RayStation and RayCare systems aim to streamline adaptive treatment planning through AI integration. However, challenges like exchange rate volatility and regulatory hurdles could impact growth despite projected annual revenue increases of 13.9%.

Key Takeaways

- Discover the full array of 336 European Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waberer's International Nyrt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BST:3WB

Waberer's International Nyrt

Provides transportation, forwarding, and logistics services in Europe and internationally.

Solid track record and good value.

Market Insights

Community Narratives