Key Takeaways

- Integration of AI and new treatment modules is anticipated to boost efficiency, driving demand and potential revenue growth for RaySearch.

- Expansion into new applications and increasing integration capabilities may significantly enhance market share and revenue prospects.

- Exchange rate volatility and regulatory challenges in key markets could limit revenue growth and impact earnings and cash flow stability.

Catalysts

About RaySearch Laboratories- A medical technology company, provides software solutions for cancer treatment worldwide.

- The integration of machine learning and new adaptive replanning modules in the latest version of RayStation is expected to enhance automation in treatment planning, leading to improved efficiencies for customers. This is likely to drive increased demand and revenue for RaySearch.

- Significant order intake growth, highlighted by large orders such as from Heyou Hospital, suggests strong future revenue streams that are secured even if they have not yet been recognized as revenue.

- Expansion into new applications like liver ablation, coupled with pending regulatory approvals, could open additional market opportunities and drive revenue growth as these offerings become available.

- Increasing the penetration of RayCare, particularly with the ability to integrate with widely-used machines like Varian's TrueBeam, could significantly boost RaySearch's market share and recurring revenue from support and services.

- The focus on adaptive radiotherapy and the successful proof-of-concept for online adaptation with Varian's TrueBeam may strengthen RaySearch's competitive position, potentially resulting in increased sales and improved operating margins as these capabilities are adopted by more clinics.

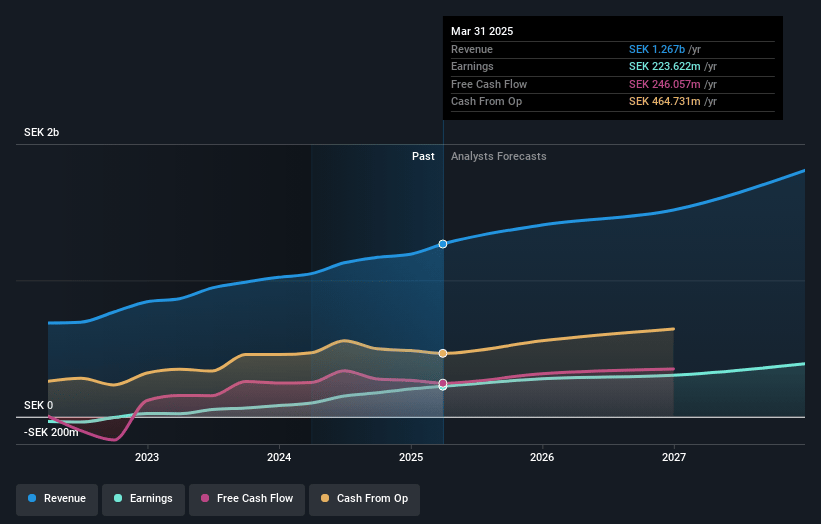

RaySearch Laboratories Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming RaySearch Laboratories's revenue will grow by 13.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.7% today to 21.9% in 3 years time.

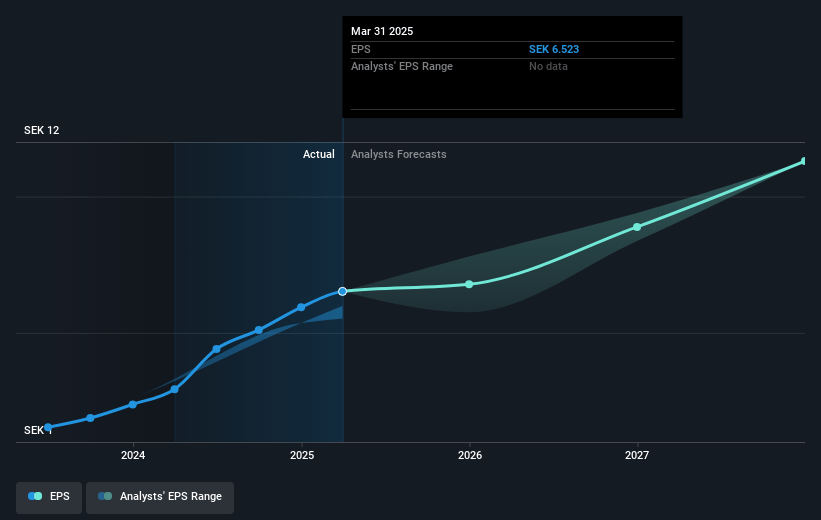

- Analysts expect earnings to reach SEK 409.4 million (and earnings per share of SEK 11.92) by about May 2028, up from SEK 223.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.0x on those 2028 earnings, down from 51.7x today. This future PE is lower than the current PE for the GB Healthcare Services industry at 76.9x.

- Analysts expect the number of shares outstanding to decline by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.91%, as per the Simply Wall St company report.

RaySearch Laboratories Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Political turbulence and currency fluctuations in the U.S. significantly impacted RaySearch's operating profit, indicating a risk related to exchange rate volatility, which could adversely affect net margins and earnings.

- The Chinese market represents a challenge due to regulatory hurdles and preferences for domestic suppliers, which could limit revenue growth opportunities within this significant geography.

- Risks associated with the reliance on large orders or major projects, such as the Heyou Hospital order, can introduce revenue volatility, impacting earnings predictability and cash flows.

- The increase in operational expenses, largely due to a higher employee count, could put pressure on net margins if revenue growth does not sufficiently offset these rising costs.

- Competitive pressures, particularly from established companies like Varian and Elekta with integrated hardware-software solutions, could impact RaySearch's ability to capture market share, thereby affecting its revenue trajectory.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of SEK335.0 for RaySearch Laboratories based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of SEK370.0, and the most bearish reporting a price target of just SEK300.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be SEK1.9 billion, earnings will come to SEK409.4 million, and it would be trading on a PE ratio of 35.0x, assuming you use a discount rate of 5.9%.

- Given the current share price of SEK318.5, the analyst price target of SEK335.0 is 4.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.