- Germany

- /

- Hospitality

- /

- XTRA:ACX

3 European Penny Stocks With Market Caps Under €30M

Reviewed by Simply Wall St

The European stock market has shown a modest rise, with the pan-European STOXX Europe 600 Index gaining 0.54%, buoyed by optimism around potential trade deals between the EU and the U.S. This backdrop of cautious optimism presents an intriguing landscape for investors considering penny stocks, which are often associated with smaller or newer companies offering affordability and growth potential. Though the term 'penny stocks' may seem outdated, these investments can still present valuable opportunities when backed by strong financial health, as we explore three such European companies in this article.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Maps (BIT:MAPS) | €3.42 | €45.43M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €306.69M | ✅ 3 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.48 | RON16.71M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.90 | €61.17M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.88 | €18.25M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.60 | PLN12.4M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK3.26 | SEK3.12B | ✅ 4 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.21 | €305.12M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.96 | €32.37M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 337 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Nextedia (ENXTPA:ALNXT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nextedia S.A. operates in France, offering cybersecurity, cloud and digital workspace, and customer experience solutions with a market cap of €18.68 million.

Operations: The company generates revenue primarily from its Direct Marketing segment, amounting to €64.62 million.

Market Cap: €18.68M

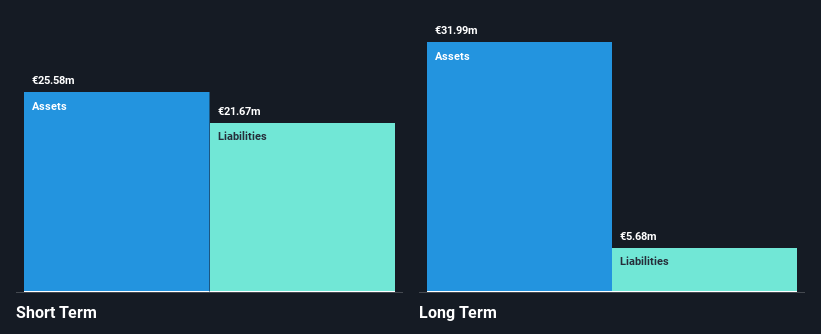

Nextedia S.A. operates with a market cap of €18.68 million and generates substantial revenue from its Direct Marketing segment, amounting to €64.62 million. The company demonstrates financial stability with short-term assets exceeding both short- and long-term liabilities, and it maintains strong interest coverage at 19.6 times EBIT. Despite a decline in earnings over the past five years, recent performance shows significant improvement with a 214.8% earnings growth last year, surpassing industry averages and improving net profit margins to 2.4%. However, the stock remains highly volatile compared to most French stocks but is trading at good value relative to peers.

- Click here to discover the nuances of Nextedia with our detailed analytical financial health report.

- Understand Nextedia's earnings outlook by examining our growth report.

bet-at-home.com (XTRA:ACX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: bet-at-home.com AG, with a market cap of €20.49 million, operates through its subsidiaries to offer online sports betting and casino services across Germany, Austria, Eastern Europe, and the rest of Western Europe.

Operations: The company's revenue is primarily derived from online sports bets, contributing €47.48 million, and online gaming activities such as casino and poker, which generate €6.20 million.

Market Cap: €20.49M

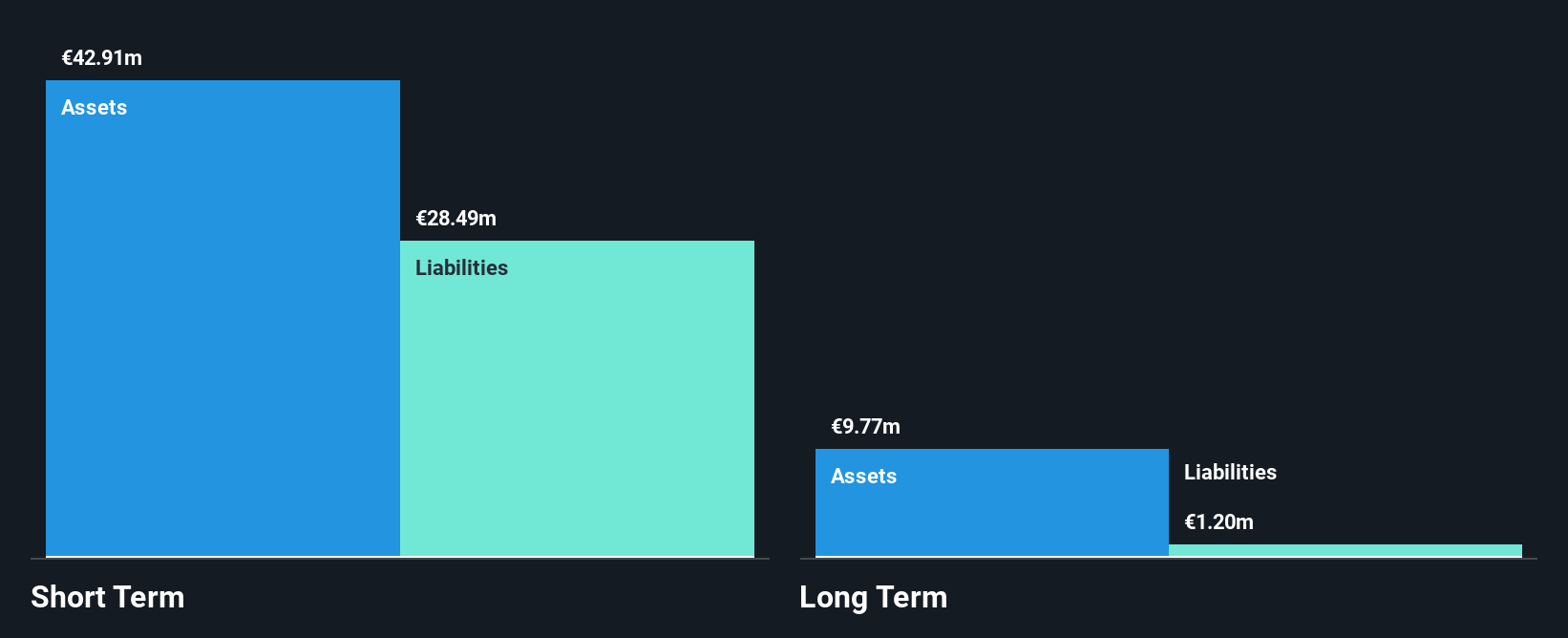

bet-at-home.com AG, with a market cap of €20.49 million, has shown a stable financial position as its short-term assets exceed both short- and long-term liabilities. Despite being unprofitable and experiencing increased losses over the past five years, the company reported improved earnings in Q1 2025 with sales rising to €13.52 million from €11.74 million year-on-year and net income increasing to €0.887 million. The recent appointment of Claus Retschitzegger as CEO may bring strategic continuity given his extensive tenure within the company since 2007, potentially impacting future operations positively amidst high share price volatility.

- Take a closer look at bet-at-home.com's potential here in our financial health report.

- Evaluate bet-at-home.com's prospects by accessing our earnings growth report.

aconnic (XTRA:CFC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: aconnic AG offers telecommunication system solutions in Germany with a market cap of €14.53 million.

Operations: The company's revenue is derived from three main segments: Systems (€28.92 million), Service (€12.89 million), and Engineering & Managed Supply (€6.15 million).

Market Cap: €14.53M

Aconnic AG, with a market cap of €14.53 million, faces financial challenges as its short-term assets (€20.2M) are insufficient to cover short-term liabilities (€38.3M). Despite being unprofitable and experiencing increased losses over the past five years, the company maintains a positive cash flow and has a cash runway exceeding three years. Recent earnings results for 2024 showed a decline in sales to €48.61 million from €74.42 million the previous year, alongside an increased net loss of €8.51 million compared to €1.16 million last year, highlighting ongoing operational difficulties amidst significant debt levels and high return volatility.

- Jump into the full analysis health report here for a deeper understanding of aconnic.

- Gain insights into aconnic's past trends and performance with our report on the company's historical track record.

Where To Now?

- Dive into all 337 of the European Penny Stocks we have identified here.

- Curious About Other Options? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ACX

bet-at-home.com

Through its subsidiaries, provides online sports betting and online casino services in Germany, Austria, Eastern Europe, and rest of Western Europe.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)