European Value Stocks Trading Below Estimated Intrinsic Values March 2025

Reviewed by Simply Wall St

As European markets continue to show resilience, with the STOXX Europe 600 Index posting its longest streak of weekly gains since 2012, investors are increasingly turning their attention to value stocks that may be trading below their intrinsic values. In this environment, a good stock is often characterized by strong fundamentals and the potential for growth despite broader economic uncertainties, making it a compelling choice for those seeking opportunities in undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK55.40 | SEK108.15 | 48.8% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €54.60 | €107.22 | 49.1% |

| Vimi Fasteners (BIT:VIM) | €0.96 | €1.91 | 49.8% |

| Net Insight (OM:NETI B) | SEK4.82 | SEK9.39 | 48.6% |

| CD Projekt (WSE:CDR) | PLN221.00 | PLN441.00 | 49.9% |

| Tinexta (BIT:TNXT) | €7.83 | €15.45 | 49.3% |

| Storytel (OM:STORY B) | SEK92.60 | SEK179.62 | 48.4% |

| Canatu Oyj (HLSE:CANATU) | €12.40 | €24.73 | 49.9% |

| IONOS Group (XTRA:IOS) | €24.70 | €48.78 | 49.4% |

| Nordic Semiconductor (OB:NOD) | NOK137.55 | NOK266.28 | 48.3% |

Here we highlight a subset of our preferred stocks from the screener.

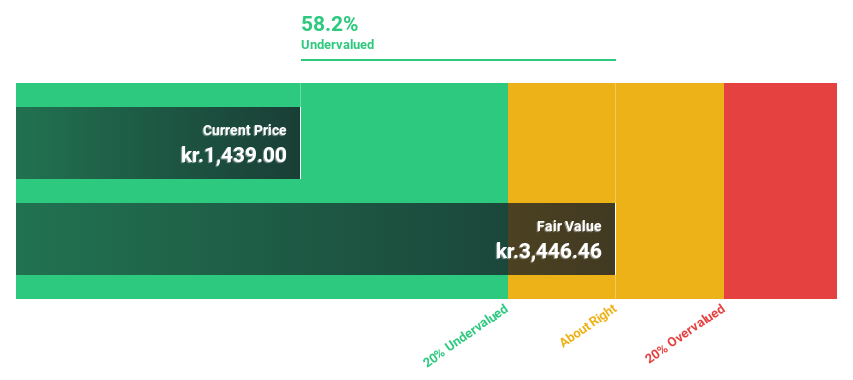

DSV (CPSE:DSV)

Overview: DSV A/S provides transport and logistics services across multiple regions including Europe, the Middle East, Africa, North America, South America, Asia, Australia, and the Pacific with a market cap of DKK341.64 billion.

Operations: The company's revenue is derived from several segments: Road (DKK40.51 billion), Solutions (DKK25.62 billion), Air Freight (DKK55.17 billion), and Sea Freight (DKK49.33 billion).

Estimated Discount To Fair Value: 20.9%

DSV is currently trading at DKK 1453.5, below its estimated fair value of DKK 1836.86, suggesting undervaluation based on discounted cash flow analysis. Analysts anticipate a stock price rise of 22.5%. Earnings are forecast to grow significantly at 20.21% annually, outpacing the Danish market's growth rate. Despite a decline in net income from DKK 12,315 million to DKK 10,109 million in 2024, revenue increased to DKK 167 billion from the previous year's DKK 150 billion.

- Our comprehensive growth report raises the possibility that DSV is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of DSV.

Basler (XTRA:BSL)

Overview: Basler Aktiengesellschaft develops, manufactures, and sells digital cameras for professional users both in Germany and internationally, with a market cap of €244.10 million.

Operations: The company generates revenue primarily from its camera segment, amounting to €182.31 million.

Estimated Discount To Fair Value: 24.8%

Basler is trading at €7.94, below its estimated fair value of €10.55, indicating it is undervalued based on discounted cash flow analysis by over 20%. Although revenue growth of 10.8% annually surpasses the German market average, earnings are expected to grow significantly at 113.84% per year as Basler becomes profitable within three years. However, the share price has been highly volatile recently and forecasted return on equity remains low at 6.5%.

- The growth report we've compiled suggests that Basler's future prospects could be on the up.

- Dive into the specifics of Basler here with our thorough financial health report.

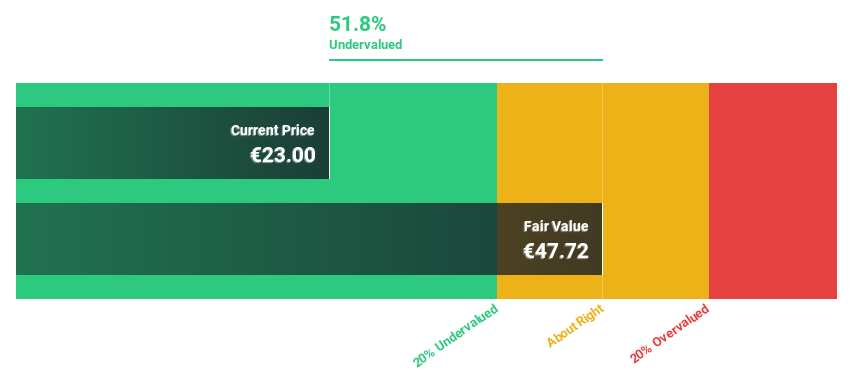

IONOS Group (XTRA:IOS)

Overview: IONOS Group SE provides web presence, productivity, and cloud solutions across several countries including Germany, the United States, and the United Kingdom, with a market cap of €3.44 billion.

Operations: The company's revenue segment is derived from Internet Information Providers, generating €1.51 billion.

Estimated Discount To Fair Value: 49.4%

IONOS Group, trading at €24.7, is significantly undervalued with a fair value estimate of €48.78 based on discounted cash flow analysis. Despite high debt levels, earnings are projected to grow 17.58% annually, outpacing the German market's 16.9%. Recent inclusion in the TECDAX Index and a €210 million follow-on equity offering highlight its growth potential. However, revenue growth remains moderate at 7.7% per year compared to higher benchmarks for significant growth.

- In light of our recent growth report, it seems possible that IONOS Group's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in IONOS Group's balance sheet health report.

Seize The Opportunity

- Gain an insight into the universe of 205 Undervalued European Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:DSV

DSV

Offers transport and logistics services in Europe, the Middle East, Africa, North America, South America, Asia, Australia, and the Pacific.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives