3 German Stocks That May Be Trading At Up To 34.5% Below Intrinsic Value

Reviewed by Simply Wall St

The German market has recently seen a positive shift, with the DAX index rising 1.46% amid a second consecutive interest rate cut by the European Central Bank, which has fueled expectations for further monetary easing. In this environment, identifying undervalued stocks becomes crucial as investors seek opportunities that may offer potential value against the backdrop of changing economic policies.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| technotrans (XTRA:TTR1) | €16.15 | €30.73 | 47.4% |

| init innovation in traffic systems (XTRA:IXX) | €36.30 | €52.11 | 30.3% |

| 2G Energy (XTRA:2GB) | €23.75 | €41.21 | 42.4% |

| Formycon (XTRA:FYB) | €52.90 | €81.74 | 35.3% |

| CeoTronics (DB:CEK) | €5.40 | €10.06 | 46.3% |

| Schweizer Electronic (XTRA:SCE) | €3.78 | €7.19 | 47.5% |

| Your Family Entertainment (DB:RTV) | €2.50 | €4.32 | 42.1% |

| LPKF Laser & Electronics (XTRA:LPK) | €9.09 | €12.41 | 26.7% |

| MTU Aero Engines (XTRA:MTX) | €311.00 | €564.55 | 44.9% |

| Basler (XTRA:BSL) | €8.20 | €12.52 | 34.5% |

Let's review some notable picks from our screened stocks.

Basler (XTRA:BSL)

Overview: Basler Aktiengesellschaft develops, manufactures, and sells digital cameras for professional users in Germany and internationally, with a market cap of €252.09 million.

Operations: The company generates revenue primarily from its camera segment, amounting to €180.06 million.

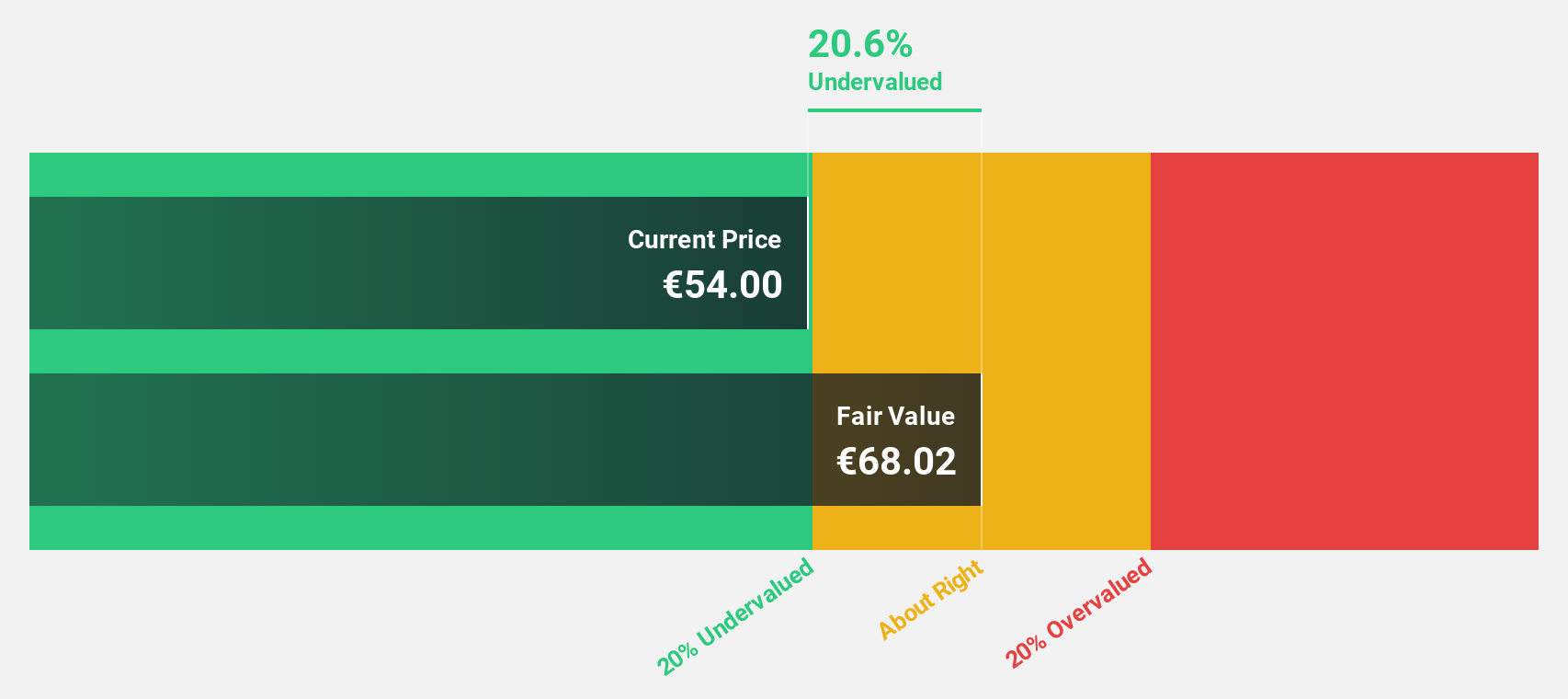

Estimated Discount To Fair Value: 34.5%

Basler Aktiengesellschaft is trading significantly below its estimated fair value, with a share price of €8.2 compared to a fair value estimate of €12.52, indicating potential undervaluation based on cash flows. Despite recent financial challenges, including a net loss of €3.37 million for H1 2024 and volatile share prices, Basler's revenue is projected to grow faster than the German market average and earnings are expected to increase by 97.6% annually over the next three years.

- Insights from our recent growth report point to a promising forecast for Basler's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Basler.

Stemmer Imaging (XTRA:S9I)

Overview: Stemmer Imaging AG offers machine vision technology for both industrial and non-industrial applications globally, with a market capitalization of €313.95 million.

Operations: The company's revenue is derived entirely from its machine vision technology segment, totaling €126.23 million.

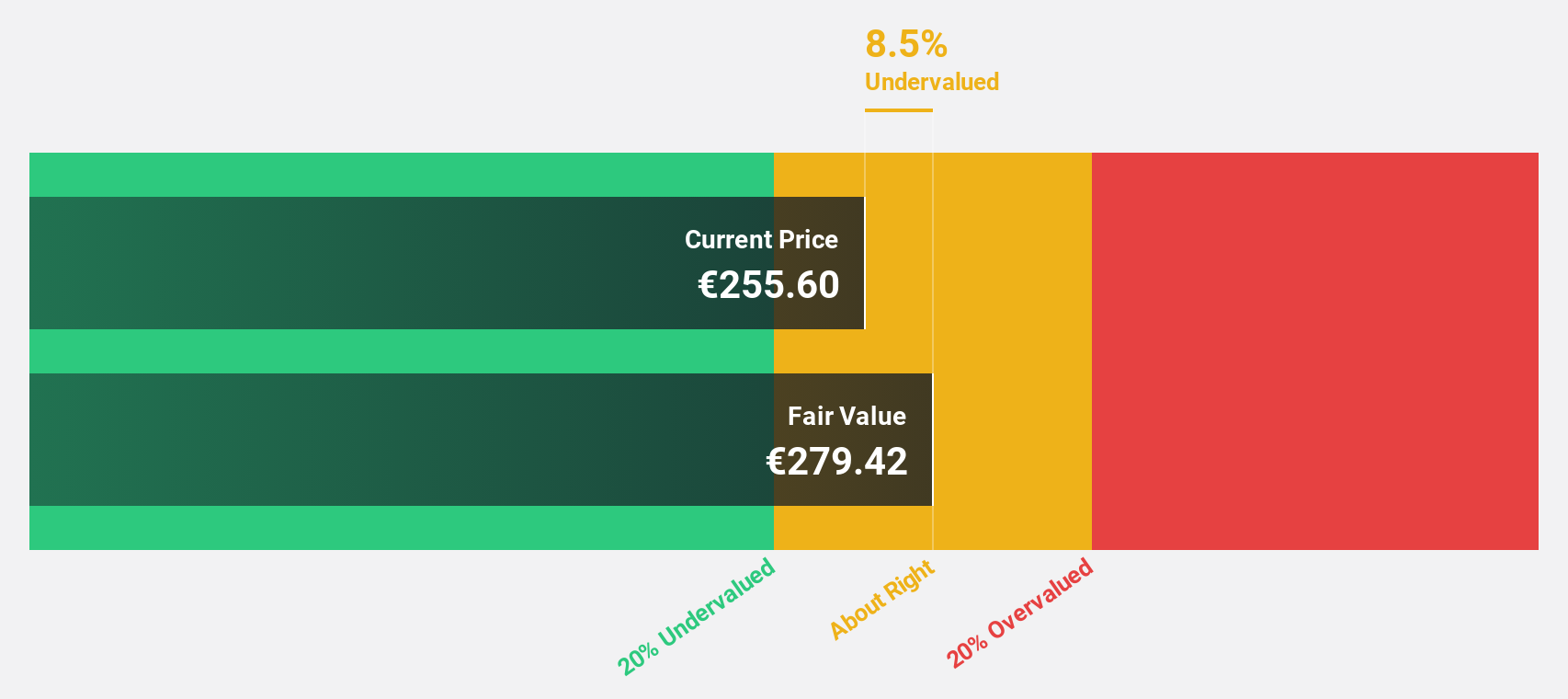

Estimated Discount To Fair Value: 18.2%

Stemmer Imaging is trading at €48.3, below its estimated fair value of €59.08, suggesting potential undervaluation based on cash flows despite recent earnings declines. The company's earnings are forecast to grow significantly at 23.2% annually over the next three years, outpacing the German market's average growth rate of 19.8%. However, Stemmer faces a volatile share price and an unstable dividend track record amidst a takeover offer by MiddleGround Capital aiming for privatization.

- Upon reviewing our latest growth report, Stemmer Imaging's projected financial performance appears quite optimistic.

- Dive into the specifics of Stemmer Imaging here with our thorough financial health report.

SAP (XTRA:SAP)

Overview: SAP SE, along with its subsidiaries, offers applications, technology, and services on a global scale and has a market cap of approximately €247.62 billion.

Operations: SAP's revenue is primarily derived from its Applications, Technology & Services segment, which generated €32.54 billion.

Estimated Discount To Fair Value: 22.6%

SAP is trading at €212.85, below its estimated fair value of €274.87, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow significantly at 37.9% annually over the next three years, surpassing the German market's average growth rate of 19.8%. Recent partnerships and AI innovations enhance SAP's offerings, potentially driving operational efficiency and enterprise-wide transformation despite a low forecasted return on equity of 16.4%.

- Our expertly prepared growth report on SAP implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of SAP.

Taking Advantage

- Access the full spectrum of 20 Undervalued German Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Basler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BSL

Basler

Engages in the development, manufacture, and sale of digital cameras for professional users in Germany and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives