Brian Protiva became the CEO of ADVA Optical Networking SE ( ETR:ADV ) in 2001, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for ADVA Optical Networking.

Check out our latest analysis for ADVA Optical Networking

How Does Total Compensation For Brian Protiva Compare With Other Companies In The Industry?

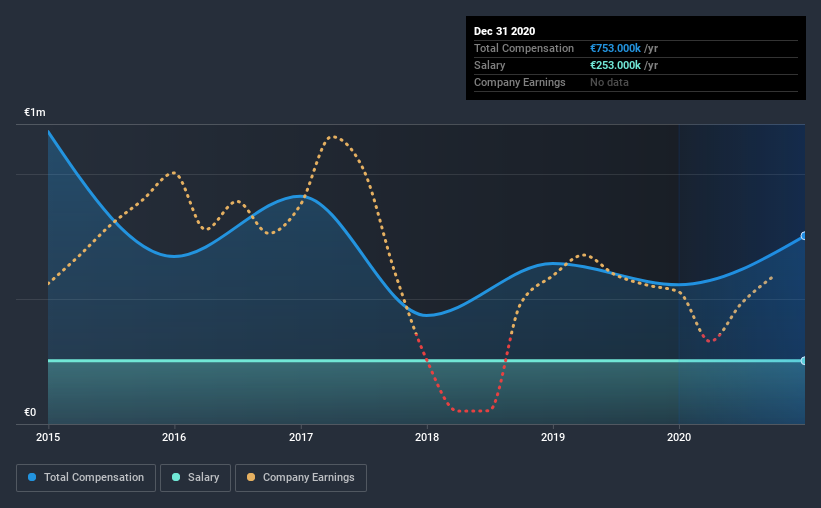

According to our data, ADVA Optical Networking SE has a market capitalization of €461m, and paid its CEO total annual compensation worth €753k over the year to December 2020. That's a notable increase of 35% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at €253k.

On examining similar-sized companies in the industry with market capitalizations between €165m and €661m, we discovered that the median CEO total compensation of that group was €646k. This suggests that ADVA Optical Networking remunerates its CEO largely in line with the industry average. What's more, Brian Protiva holds €3.7m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €253k | €253k | 34% |

| Other | €500k | €304k | 66% |

| Total Compensation | €753k | €557k | 100% |

On an industry level, roughly 77% of total compensation represents salary and 23% is other remuneration. ADVA Optical Networking sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at ADVA Optical Networking SE's Growth Numbers

Over the last four years, ADVA Optical Networking SE has shrunk its earnings per share by 2.9% per year. In the last year, its revenue is up 7.1%.

A lack of EPS improvement is not good to see. The fairly low revenue growth fails to impress given that the EPS is down. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings. .

Has ADVA Optical Networking SE Been A Good Investment?

Most shareholders would probably be pleased with ADVA Optical Networking SE for providing a total return of 57% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

As we touched on above, ADVA Optical Networking SE is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. This doesn't look good when you see that EPS growth over the last four years has been negative. On the flip side, shareholder returns have been strong over the same time, which is certainly a positive sign. We're not saying CEO compensation is too generous, but shrinking EPS is undoubtedly an issue that will have to be addressed.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 2 warning signs for ADVA Optical Networking that investors should look into moving forward.

Switching gears from ADVA Optical Networking, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

When trading ADVA Optical Networking or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers . You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

* Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:ADV

Adtran Networks

Engages in the development, manufacture, and sale of optical and Ethernet-based networking solutions for telecommunications carriers and enterprises to deliver data, storage, voice, and video services.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)