- Poland

- /

- Food and Staples Retail

- /

- WSE:DNP

3 European Stocks Estimated To Be Up To 39.5% Below Intrinsic Value

Reviewed by Simply Wall St

The European market has recently experienced a downturn, with the pan-European STOXX Europe 600 Index falling by 1.23% amid concerns over U.S. trade tariffs and monetary policy uncertainties. Despite these challenges, opportunities may exist for investors in undervalued stocks that are trading below their intrinsic value, offering potential for growth as economic conditions stabilize and market sentiments improve.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.36 | SEK164.66 | 49.4% |

| Fondia Oyj (HLSE:FONDIA) | €5.45 | €10.63 | 48.7% |

| JOST Werke (XTRA:JST) | €50.00 | €98.51 | 49.2% |

| Storytel (OM:STORY B) | SEK92.70 | SEK180.62 | 48.7% |

| dormakaba Holding (SWX:DOKA) | CHF680.00 | CHF1358.27 | 49.9% |

| Star7 (BIT:STAR7) | €6.20 | €12.36 | 49.8% |

| Cint Group (OM:CINT) | SEK6.40 | SEK12.79 | 49.9% |

| Neosperience (BIT:NSP) | €0.53 | €1.06 | 49.9% |

| Cavotec (OM:CCC) | SEK17.35 | SEK34.07 | 49.1% |

| Fodelia Oyj (HLSE:FODELIA) | €7.12 | €13.91 | 48.8% |

Here we highlight a subset of our preferred stocks from the screener.

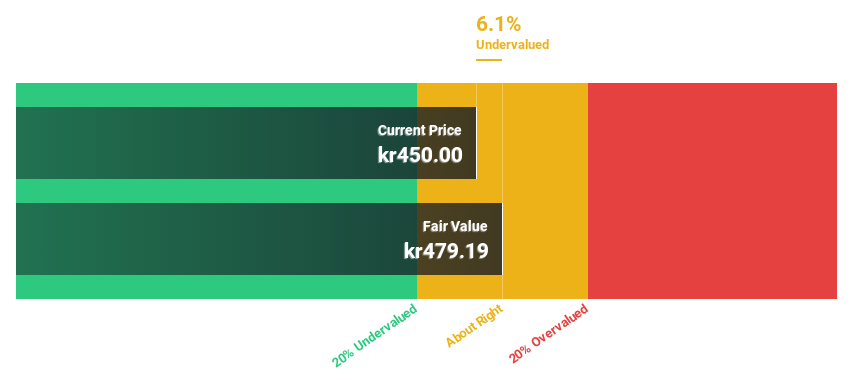

Mycronic (OM:MYCR)

Overview: Mycronic AB (publ) is a company that develops, manufactures, and sells production equipment for the electronics industry across Sweden, Europe, the United States, other Americas, China, South Korea, and internationally with a market cap of SEK42.94 billion.

Operations: The company's revenue is primarily derived from its Pattern Generators segment at SEK2.99 billion, followed by High Flex at SEK1.49 billion, High Volume at SEK1.43 billion, and Global Technologies at SEK1.14 billion.

Estimated Discount To Fair Value: 17.8%

Mycronic is trading at SEK 440, below its estimated fair value of SEK 535.55, suggesting it may be undervalued based on cash flows. The company has demonstrated strong earnings growth of 68.6% over the past year and is expected to grow revenue faster than the Swedish market at 8.4% annually. Recent orders for advanced metrology systems highlight continued demand, potentially supporting future cash flow improvements despite a modest decline in recent quarterly net income.

- Upon reviewing our latest growth report, Mycronic's projected financial performance appears quite optimistic.

- Dive into the specifics of Mycronic here with our thorough financial health report.

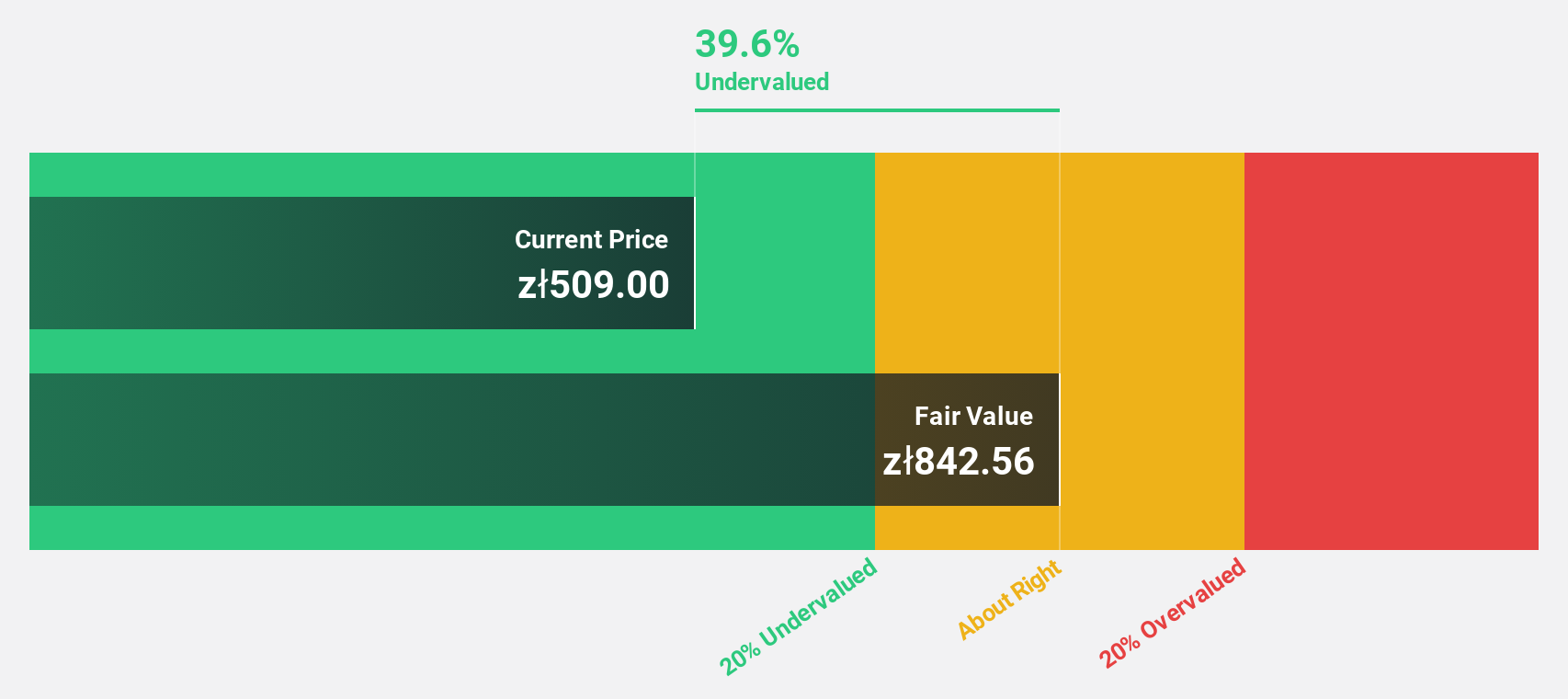

Dino Polska (WSE:DNP)

Overview: Dino Polska S.A. operates a network of mid-sized grocery supermarkets under the Dino brand in Poland, with a market cap of PLN47.35 billion.

Operations: Dino Polska generates revenue primarily from its network of mid-sized grocery supermarkets operating under the Dino brand in Poland.

Estimated Discount To Fair Value: 39.5%

Dino Polska is trading at PLN 483, significantly below its estimated fair value of PLN 798.4, indicating it is undervalued based on cash flows. The company reported robust sales growth to PLN 29.27 billion for 2024 and net income of PLN 1.51 billion, up from the previous year. Earnings are forecast to grow at an annual rate of 16.52%, outpacing the Polish market's growth expectations and highlighting strong future cash flow potential despite moderate revenue growth projections.

- The analysis detailed in our Dino Polska growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Dino Polska's balance sheet health report.

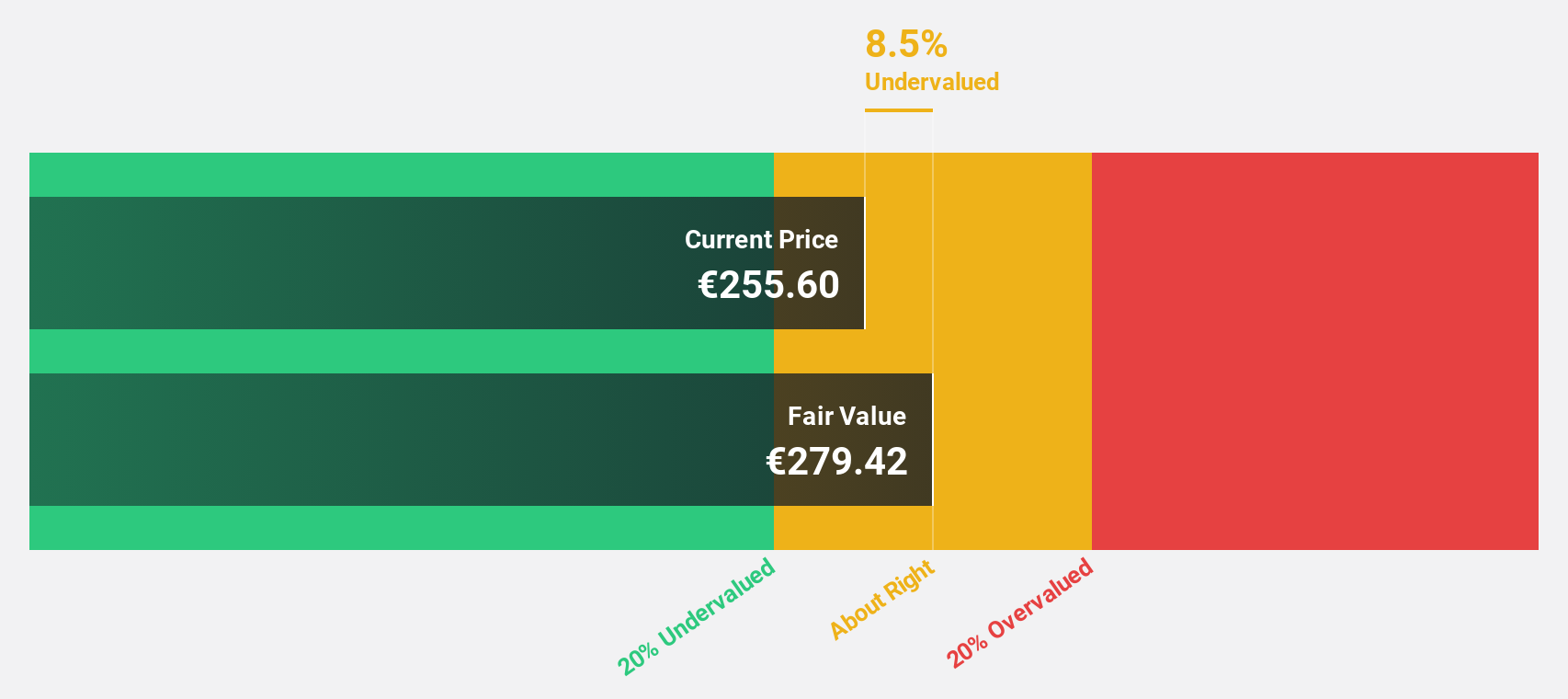

SAP (XTRA:SAP)

Overview: SAP SE, along with its subsidiaries, offers enterprise application and business solutions globally and has a market capitalization of approximately €283.01 billion.

Operations: SAP's revenue primarily comes from its Applications, Technology & Services segment, which generated €34.18 billion.

Estimated Discount To Fair Value: 20.3%

SAP is trading at €242.6, significantly below its estimated fair value of €304.47, suggesting an undervaluation based on cash flows. The company's earnings are forecast to grow 24.1% annually, outpacing the German market's growth expectations and indicating strong future cash flow potential despite large one-off items impacting financial results. Recent strategic alliances, such as with Vonage for AI-driven experiences, further enhance SAP's operational capabilities and customer engagement initiatives across industries.

- Our growth report here indicates SAP may be poised for an improving outlook.

- Get an in-depth perspective on SAP's balance sheet by reading our health report here.

Where To Now?

- Get an in-depth perspective on all 199 Undervalued European Stocks Based On Cash Flows by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:DNP

Dino Polska

Operates a network of mid-sized grocery supermarkets under the Dino brand name in Poland.

Excellent balance sheet with reasonable growth potential.