- Norway

- /

- Oil and Gas

- /

- OB:BNOR

European Value Stocks: 3 Companies Trading Below Estimated Worth

Reviewed by Simply Wall St

The European stock market recently faced a downturn, with the pan-European STOXX Europe 600 Index ending lower after five weeks of gains, influenced by new tariff threats from the U.S. and unexpected contractions in business activity. In this environment, investors might look for value opportunities in stocks trading below their estimated worth, as these can offer potential resilience and growth despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK49.60 | SEK96.51 | 48.6% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €52.35 | €104.47 | 49.9% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.88 | €3.70 | 49.2% |

| adidas (XTRA:ADS) | €220.50 | €433.62 | 49.1% |

| Clemondo Group (OM:CLEM) | SEK10.80 | SEK21.24 | 49.2% |

| Absolent Air Care Group (OM:ABSO) | SEK215.00 | SEK416.92 | 48.4% |

| Lectra (ENXTPA:LSS) | €24.75 | €47.27 | 47.6% |

| dormakaba Holding (SWX:DOKA) | CHF733.00 | CHF1399.64 | 47.6% |

| Fodelia Oyj (HLSE:FODELIA) | €7.00 | €13.31 | 47.4% |

| Claranova (ENXTPA:CLA) | €2.805 | €5.45 | 48.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

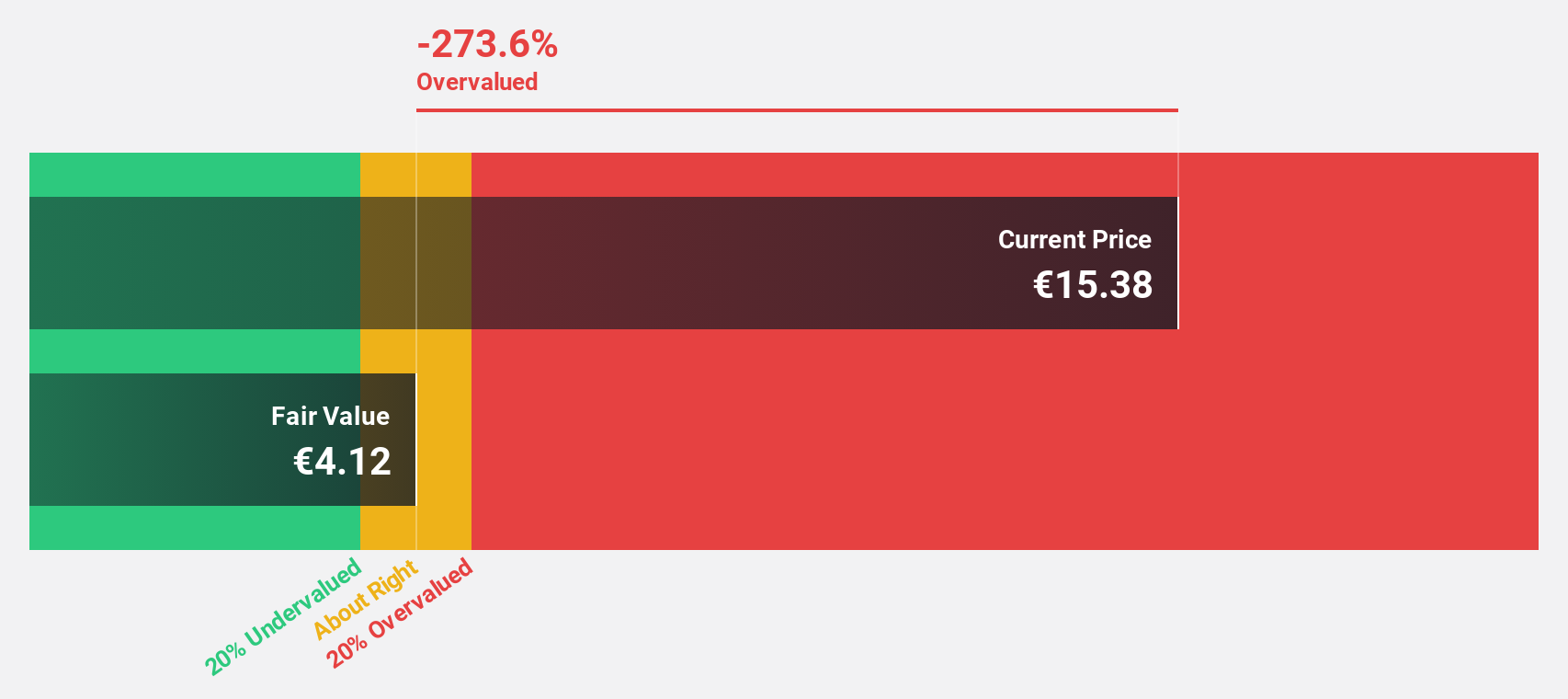

REVO Insurance (BIT:REVO)

Overview: REVO Insurance S.p.A. is an Italian insurance company with a market cap of €378.54 million.

Operations: The company's revenue primarily comes from its Damage Management segment, which generated €317.62 million.

Estimated Discount To Fair Value: 27.6%

REVO Insurance is trading at a significant discount, approximately €14.96 compared to its estimated fair value of €20.65, suggesting undervaluation based on discounted cash flow analysis. The company reported a substantial net income increase to €18.58 million for 2024 and forecasts strong earnings growth of 24.3% annually over the next three years, outpacing the Italian market's average growth rate, despite having a forecasted low return on equity of 14.4%.

- Upon reviewing our latest growth report, REVO Insurance's projected financial performance appears quite optimistic.

- Dive into the specifics of REVO Insurance here with our thorough financial health report.

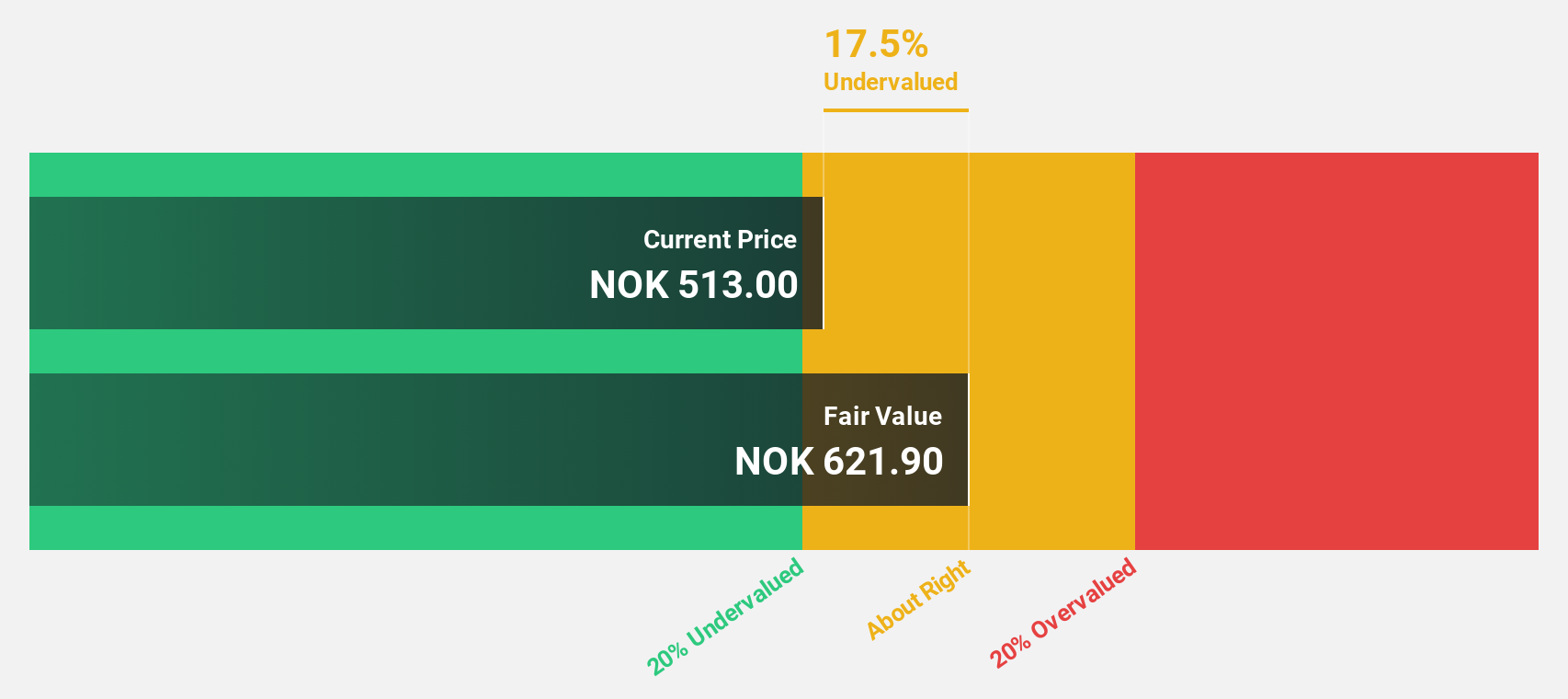

BlueNord (OB:BNOR)

Overview: BlueNord ASA is an oil and gas company engaged in the exploration, development, and production of hydrocarbon resources across Norway, Denmark, the Netherlands, and the United Kingdom with a market cap of NOK15.42 billion.

Operations: The company's revenue from its oil and gas exploration and production activities amounts to $704.90 million.

Estimated Discount To Fair Value: 31.1%

BlueNord is trading at NOK582, significantly below its estimated fair value of NOK844.91, indicating potential undervaluation based on discounted cash flow analysis. Recent earnings show a turnaround with net income rising to US$18.6 million from a loss last year, and revenue reaching US$171.1 million for Q1 2025. Despite interest payments not well covered by earnings, production ramp-up at Tyra II supports future profitability expectations above market growth rates in Norway.

- The growth report we've compiled suggests that BlueNord's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of BlueNord.

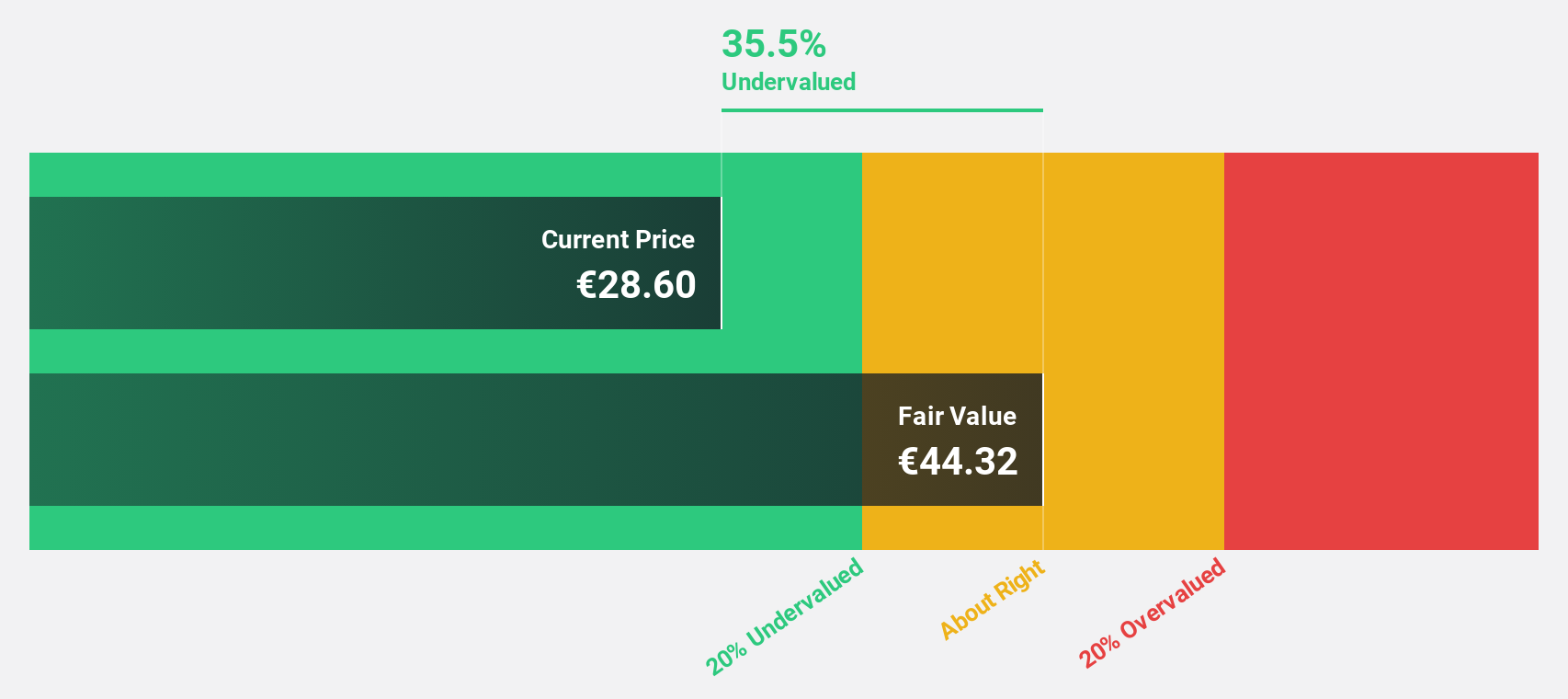

PSI Software (XTRA:PSAN)

Overview: PSI Software SE develops and integrates software solutions to optimize energy and materials flow for utilities and industry globally, with a market cap of €461.54 million.

Operations: The company's revenue is primarily derived from Process Industries & Metals (€72.15 million), Logistics (€33.77 million), and Discrete Manufacturing (€31.70 million).

Estimated Discount To Fair Value: 33.6%

PSI Software is trading at €29.8, well below its estimated fair value of €44.87, highlighting potential undervaluation based on discounted cash flow analysis. The company reported a significant improvement in Q1 2025 earnings with sales rising to €67.9 million and net income turning positive at €0.271 million from a substantial loss last year. With expected revenue growth outpacing the German market and a strategic partnership with Google Cloud, PSI is positioned for enhanced operational efficiency and profitability over the next three years.

- Insights from our recent growth report point to a promising forecast for PSI Software's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of PSI Software.

Seize The Opportunity

- Click here to access our complete index of 181 Undervalued European Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlueNord might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BNOR

BlueNord

An oil and gas company, engages in the production and development of resources that support the energy transition towards net zero in Norway, Denmark, the Netherlands, and the United Kingdom.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives