Market Might Still Lack Some Conviction On INTERSHOP Communications Aktiengesellschaft (ETR:ISHA) Even After 26% Share Price Boost

The INTERSHOP Communications Aktiengesellschaft (ETR:ISHA) share price has done very well over the last month, posting an excellent gain of 26%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 24% in the last twelve months.

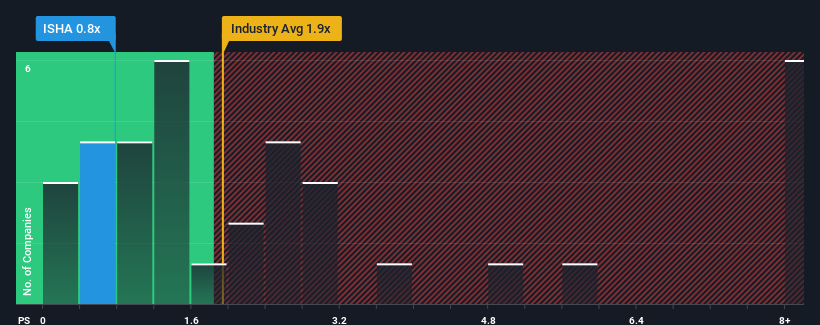

Although its price has surged higher, INTERSHOP Communications may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.8x, since almost half of all companies in the Software industry in Germany have P/S ratios greater than 1.9x and even P/S higher than 5x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for INTERSHOP Communications

How Has INTERSHOP Communications Performed Recently?

INTERSHOP Communications could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on INTERSHOP Communications will help you uncover what's on the horizon.How Is INTERSHOP Communications' Revenue Growth Trending?

In order to justify its P/S ratio, INTERSHOP Communications would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Regardless, revenue has managed to lift by a handy 16% in aggregate from three years ago, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 7.0% each year during the coming three years according to the two analysts following the company. That's shaping up to be similar to the 7.9% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that INTERSHOP Communications' P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does INTERSHOP Communications' P/S Mean For Investors?

INTERSHOP Communications' stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that INTERSHOP Communications currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

And what about other risks? Every company has them, and we've spotted 3 warning signs for INTERSHOP Communications you should know about.

If you're unsure about the strength of INTERSHOP Communications' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:ISHA

INTERSHOP Communications

Offers B2B ecommerce solutions in Germany and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives